Get the free Application for Short-Term Major Medical Insurance

Show details

This document is an application form for obtaining Short-Term Major Medical Insurance from Anthem Blue Cross and Blue Shield. It requires personal and family information, program selection, eligibility

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for short-term major

Edit your application for short-term major form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for short-term major form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for short-term major online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for short-term major. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for short-term major

How to fill out Application for Short-Term Major Medical Insurance

01

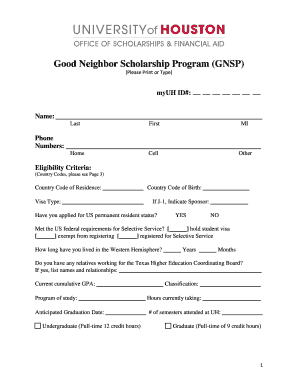

Obtain the Application for Short-Term Major Medical Insurance form from the insurance provider's website or office.

02

Fill in your personal information, including your full name, date of birth, and contact details.

03

Provide your address and any additional information requested in the section.

04

Indicate your preferred coverage start date.

05

Answer any medical history questions honestly, detailing relevant health issues or previous medical conditions.

06

Specify the number of family members you wish to include in the policy, if applicable.

07

Review any premium and payment options outlined in the application.

08

Sign and date the application to certify that the information is accurate.

09

Submit the completed application form via the method specified by the insurance provider.

Who needs Application for Short-Term Major Medical Insurance?

01

Individuals who are between jobs and need temporary coverage.

02

Students needing insurance for a short period.

03

Travelers who require health coverage while traveling.

04

People waiting for other health insurance applications to process.

05

Those who require immediate medical coverage due to unforeseen circumstances.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between medical insurance and major medical insurance?

Major medical insurance is different from other healthcare plans because it is more comprehensive. The terms for this type of health insurance plan are typically longer than a short-term one and provide more extensive coverage than a catastrophic one.

Can short-term insurance deny pre-existing conditions?

Short Term Medical plans are medically underwritten. These Short Term Medical plans do not provide coverage for preexisting conditions nor the mandated coverage necessary to avoid a penalty under the Affordable Care Act.

Can short term disability be denied for pre-existing conditions?

An insurance company will typically (but not always) impose an exclusion for a pre-existing condition, meaning that they will deny your disability claim if you are unable to work due to that pre-existing condition. However, you will still get benefits for any other covered condition.

Can short term health insurance deny pre-existing conditions?

Coverage for pre-existing conditions No insurance plan can reject you, charge you more, or refuse to pay for essential health benefits for any condition you had before your coverage started.

What is the downside to short-term health insurance?

For example, some short-term plans may not cover or may limit your coverage for maternity care, mental health or substance use services, vision care, or dental care—these are costs you'd have to pay yourself for any services you receive.

How much does short-term care insurance cost?

ing to the 2024 Short-Term Care Insurance Price Index, a 65-year-old woman could pay $125 monthly for coverage including both nursing home as well as home care benefits. Identical coverage purchased at age 75 would currently cost $277-per-month.

Can insurance companies deny treatment for pre-existing conditions?

Health insurers can no longer charge more or deny coverage to you or your child because of a pre-existing health condition like asthma, diabetes, or cancer, as well as pregnancy. They cannot limit benefits for that condition either.

What is the downside to short-term health insurance?

For example, some short-term plans may not cover or may limit your coverage for maternity care, mental health or substance use services, vision care, or dental care—these are costs you'd have to pay yourself for any services you receive.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Short-Term Major Medical Insurance?

It is a form used to apply for temporary health insurance coverage designed to provide financial protection for medical expenses incurred over a short period.

Who is required to file Application for Short-Term Major Medical Insurance?

Individuals seeking temporary health coverage, particularly those who are between jobs, recent graduates, or waiting for other health insurance to begin, are required to file this application.

How to fill out Application for Short-Term Major Medical Insurance?

The application is typically filled out by providing personal information, answering health-related questions, and specifying the desired coverage period.

What is the purpose of Application for Short-Term Major Medical Insurance?

The purpose is to secure temporary health insurance that covers unexpected medical costs during gaps in health coverage.

What information must be reported on Application for Short-Term Major Medical Insurance?

Applicants must report personal details such as name, address, date of birth, Social Security number, and medical history.

Fill out your application for short-term major online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Short-Term Major is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.