Get the free Intake Application for Mortgage Payment Plan/Default/Foreclosure

Show details

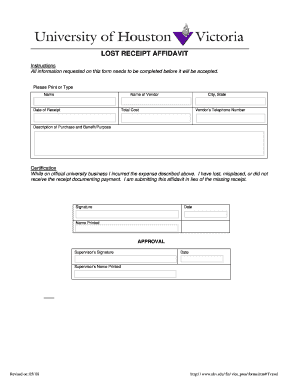

This document is an application for individuals seeking assistance with mortgage payment plans, defaults, or foreclosures. It includes sections for personal information, mortgage details, employment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign intake application for mortgage

Edit your intake application for mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your intake application for mortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit intake application for mortgage online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit intake application for mortgage. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out intake application for mortgage

How to fill out Intake Application for Mortgage Payment Plan/Default/Foreclosure

01

Gather necessary documents, such as income statements, tax returns, and mortgage statements.

02

Download or request the Intake Application form from your mortgage lender.

03

Start filling out your personal information, including your name, address, and contact information.

04

Provide information about your mortgage, including account number, loan type, and current payment status.

05

List your monthly income, including all sources of income.

06

Detail your monthly expenses, including housing, utilities, and other debts.

07

Explain your current financial hardship and why you are unable to make mortgage payments.

08

Review the application for accuracy and completeness.

09

Sign and date the application.

10

Submit the application along with any requested supporting documentation to your lender.

Who needs Intake Application for Mortgage Payment Plan/Default/Foreclosure?

01

Homeowners facing financial hardship due to job loss, medical expenses, or other unforeseen circumstances.

02

Individuals at risk of home foreclosure due to missed mortgage payments.

03

Borrowers seeking to enter a mortgage payment plan or modify their existing loan terms.

Fill

form

: Try Risk Free

People Also Ask about

How long can you default on a mortgage before foreclosure?

How the process of foreclosure works in the state of California. Notice of Default – Foreclosure starts when your lender records a Notice of Default against your property with the Registrar Recorder's office. The Notice of Default tells you the total amount you owe including missed payments and foreclosure fees.

How do you write a letter of foreclosure?

To sum up, I am writing this letter to inform you that I wish to foreclose the loan. Moreover, my loan ID is xx and I opted for (no. of EMIs) EMIs. Therefore, I am willing to pay (Amount)in a single installment and foreclose the loan.

How to write a foreclosure hardship letter?

What to include in a hardship letter The date, your name, address and phone number. The lender/servicer and loan number. The date or approximate time frame when the hardship started. The expected timeframe of hardship — short term (six months or less) or long term. Describe your goal. State the facts, not emotions.

Is notice of default the same as foreclosure?

To sum up, I am writing this letter to inform you that I wish to foreclose the loan. Moreover, my loan ID is xx and I opted for (no. of EMIs) EMIs. Therefore, I am willing to pay (Amount)in a single installment and foreclose the loan.

How to download a foreclosure letter?

How to download a foreclosure letter? To download a foreclosure letter, log into your lender's account portal, navigate to loan services, and request the foreclosure. Once verified and any dues are cleared, you can download the letter in PDF format, typically within a few business days.

How to write a letter for loan closure?

To write a loan closure letter, include your name, address, loan account number, property details, and proof of final payment. Politely request the lender to close the loan, issue a No Objection Certificate (NOC), and return original property documents. Maintain a formal and respectful tone.

How to make a foreclosure letter?

Depending on the mortgage lender, you could be delinquent on your loan for 30 to 90 days before it enters default status. (Some lenders allow even more time.) Once you're in default, more serious actions will be taken, such as collection attempt and starting the foreclosure process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Intake Application for Mortgage Payment Plan/Default/Foreclosure?

The Intake Application for Mortgage Payment Plan/Default/Foreclosure is a form that homeowners must complete when they are seeking assistance to manage their mortgage payments, particularly when they are at risk of defaulting or facing foreclosure. It gathers necessary information to evaluate their financial situation and determine eligibility for various relief options.

Who is required to file Intake Application for Mortgage Payment Plan/Default/Foreclosure?

Homeowners who are struggling to make their mortgage payments, those at risk of default, or facing foreclosure are required to file the Intake Application. This includes individuals or families who are experiencing financial hardships that affect their ability to keep up with mortgage obligations.

How to fill out Intake Application for Mortgage Payment Plan/Default/Foreclosure?

To fill out the Intake Application, homeowners should provide accurate information regarding their financial situation, including income, expenses, outstanding debts, and details about their mortgage. It is essential to follow the instructions provided with the application carefully and to submit all required documentation to support their request for assistance.

What is the purpose of Intake Application for Mortgage Payment Plan/Default/Foreclosure?

The purpose of the Intake Application is to assess the homeowner's financial condition and to determine eligibility for various mortgage assistance programs, including loan modifications, repayment plans, or other options to prevent foreclosure.

What information must be reported on Intake Application for Mortgage Payment Plan/Default/Foreclosure?

The Intake Application must report information such as the homeowner's personal details, income sources, monthly expenses, the current status of the mortgage, reasons for the financial difficulties, and any other relevant financial information that can support the request for a mortgage payment plan or relief from foreclosure.

Fill out your intake application for mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Intake Application For Mortgage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.