Get the free Checking Line of Credit Application

Show details

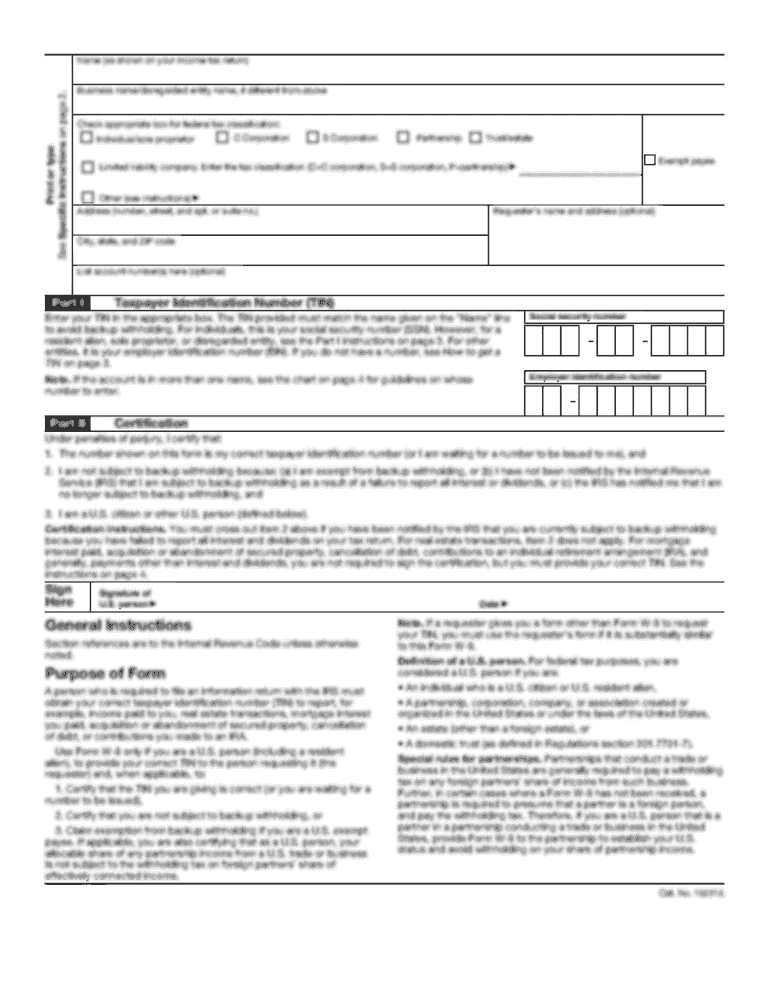

This document is an application form for a line of credit provided by Interra Credit Union, requiring personal and financial information from both the applicant and co-applicant, if applicable.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign checking line of credit

Edit your checking line of credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your checking line of credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

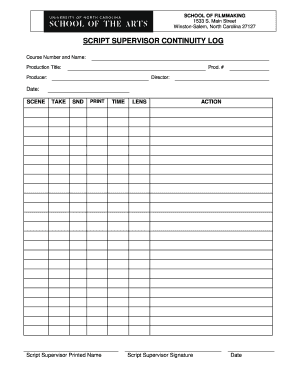

Editing checking line of credit online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit checking line of credit. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out checking line of credit

How to fill out Checking Line of Credit Application

01

Gather your personal information including your name, address, Social Security number, and contact details.

02

Review your financial history and ensure all necessary documents, such as bank statements and income proof, are ready.

03

Visit your bank's website or the physical branch to obtain the Checking Line of Credit Application form.

04

Start filling out the application by providing required personal details accurately.

05

Indicate your income sources and amounts for the bank to assess your creditworthiness.

06

Specify your desired credit limit in the appropriate section.

07

Review the terms and conditions of the line of credit, and make sure you understand any fees involved.

08

Double-check all the provided information for accuracy and completeness.

09

Submit the application either online or in person at the bank.

Who needs Checking Line of Credit Application?

01

Individuals who frequently use their checking account and want a safety net for accidental overdrafts.

02

Consumers who may have irregular income and need financial flexibility.

03

Those who want to avoid high overdraft fees associated with insufficient funds.

04

Customers looking for a way to manage short-term cash flow issues.

Fill

form

: Try Risk Free

People Also Ask about

What is a checking line of credit for?

A checking line of credit is a revolving credit line that is attached to your checking account. It protects you from overdrafts and from having transactions denied for non-sufficient funds.

What is better, a loan or a line of credit?

A loan is based on the borrower's specific need, such as the purchase of a car or a home. Credit lines can be used for any purpose. On average, closing costs (if any) are higher for loans than for lines of credit. Credit lines tend to have higher interest rates than loans.

What is the disadvantage of a line of credit?

Cons of getting a line of credit Easy access to money can be tempting. Ensure your spending doesn't get out of control by borrowing only what you need. Lines of credit come with variable interest rates, meaning your monthly bill could balloon if interest rates rise.

What is a line of credit in English?

A line of credit is a type of loan that lets you borrow money up to a pre-set limit. You don't need to use the funds for a specific purpose. You may use as little or as much of the funds as you like, up to a specified maximum. You may pay back the money you owe at any time.

Should I accept a line of credit offer?

Accepting and using a line of credit will affect your credit score. However, using your LOC responsibly can help to improve your score over time. Lenders run hard credit checks when individuals accept a line of credit offered to them. This commonly leads to a drop in credit score.

What is a line of credit in simple terms?

A line of credit (LOC) is a preset borrowing limit offered by banks and financial institutions to their personal and business customers. Lines of credit can be used at any time until the limit is reached. The limit is set by the issuer based on the borrower's creditworthiness.

Can you write checks off a line of credit?

Key takeaways You can write checks against a line of credit with credit card convenience checks. Convenience checks are often processed as a cash advance, which can be expensive.

What is checking line of credit navy federal?

0:12 3:38 Sign into your online banking account or use the opt-in. Form once you're logged in Go to theMoreSign into your online banking account or use the opt-in. Form once you're logged in Go to the account services section select checking and savings. And then choose the checking line of credit. Option.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

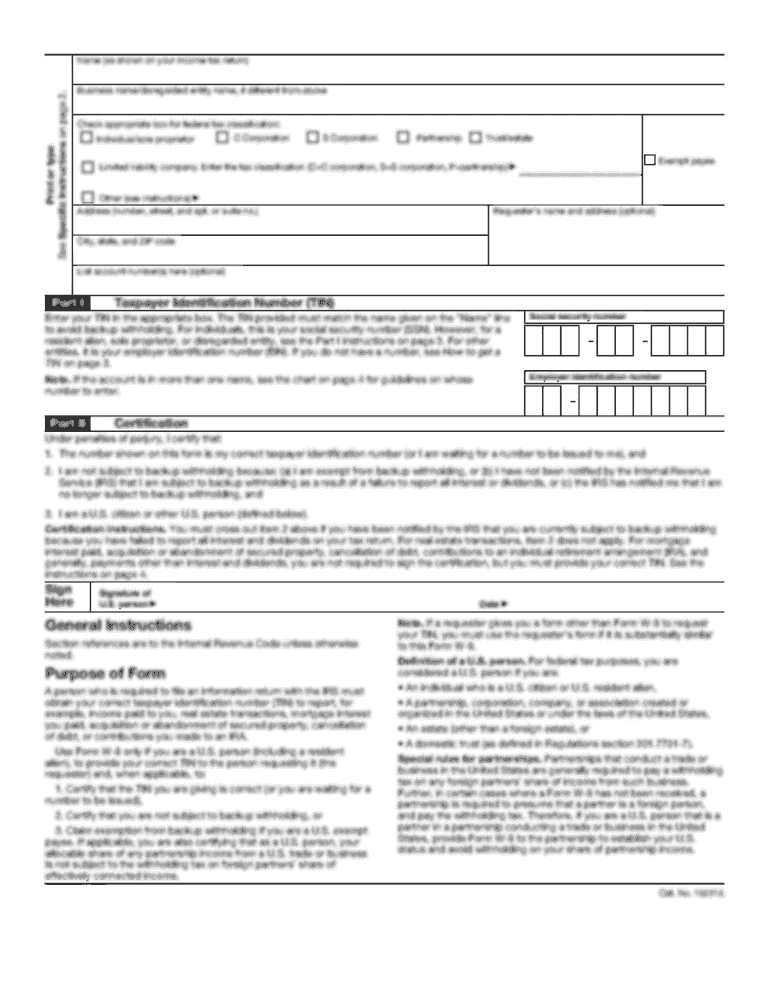

What is Checking Line of Credit Application?

The Checking Line of Credit Application is a form used by individuals or businesses to apply for a line of credit linked to their checking account, allowing them to borrow funds up to a certain limit for overdrafts and short-term financial needs.

Who is required to file Checking Line of Credit Application?

Individuals or businesses seeking to establish a line of credit for their checking account must file a Checking Line of Credit Application.

How to fill out Checking Line of Credit Application?

To fill out a Checking Line of Credit Application, provide personal or business information, including name, address, social security number or tax ID, income details, and desired credit limit, and sign the form to authorize a credit check.

What is the purpose of Checking Line of Credit Application?

The purpose of the Checking Line of Credit Application is to allow applicants to access additional funds when needed, helping to manage cash flow and prevent overdrafts in their checking accounts.

What information must be reported on Checking Line of Credit Application?

The application typically requires personal or business identification information, financial information such as income and expenses, requested credit limit, and authorization for credit checks.

Fill out your checking line of credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Checking Line Of Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.