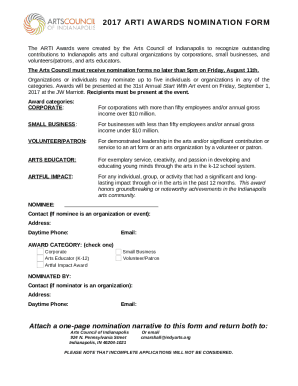

Get the free Home-Based Local Business Tax Receipt Application

Show details

This application is for residents of Sarasota wishing to operate a home-based business. It includes requirements for business address, identification numbers, floor plans, and compliance with local

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign home-based local business tax

Edit your home-based local business tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home-based local business tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit home-based local business tax online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit home-based local business tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out home-based local business tax

How to fill out Home-Based Local Business Tax Receipt Application

01

Obtain the Home-Based Local Business Tax Receipt Application form from your local government or its website.

02

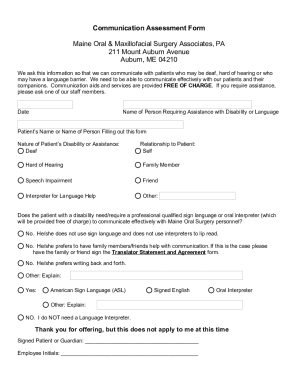

Fill in your personal information, including your name, address, and contact details.

03

Provide details about your home-based business, such as the type of business, description of services or products offered, and business hours.

04

Include any necessary documentation, such as proof of residency or zoning approval.

05

Calculate any applicable fees for the application and include payment if required or instructed.

06

Review the application for completeness and correctness before submission.

07

Submit the completed application form, along with any supporting documents and payment, to the designated authority, either in person or online as specified.

Who needs Home-Based Local Business Tax Receipt Application?

01

Individuals operating a business from their home.

02

Entrepreneurs seeking to comply with local business regulations.

03

Home-based service providers, such as consultants or freelancers.

04

Anyone selling products from their residence.

Fill

form

: Try Risk Free

People Also Ask about

What is a tax receipt for a business?

Tax receipts serve as proof of payment for business expenses that may be deductible on your tax return. Understanding what tax receipts are, why they are important, and how to properly manage them can help you avoid potential tax issues and ensure that you are taking full advantage of all available deductions.

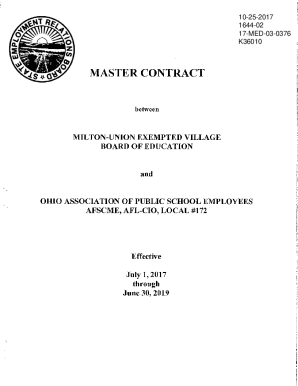

What is a business tax receipt application?

Some local governments demand business tax receipts to demonstrate that a business tax payment was paid and/or that a business is authorized to operate in a specific city or county. For business tax receipts, an application must be submitted together with a charge of between $25 and $500.

What is the purpose of local taxes?

Local taxes are used by municipal and state governments to pay for public services and the people who deliver them. Local taxes pay the salaries of police and fire personnel and other public employees.

What is a Florida local business tax receipt?

A business tax receipt is a tax levied upon all businesses within the municipal boundaries. Payment of the tax receipt does not certify or imply the competence of the licensee. Within Florida, most cities and counties have a business tax receipt program.

What is LBT in business?

(formerly known as occupational licenses) Any entity conducting business within a municipality is required to obtain both a City BTR and a County Local Business Tax ( LBT ) Receipt.

Can you file business taxes without a business license?

If you're running a business operation and earning income from it, the IRS considers you self-employed for tax purposes – even if you don't have a business license or entity. As a rule of thumb, the IRS requires you to file an income tax return if your net earnings from your self-employment are $400 or more.

What is the purpose of a local business tax receipt?

A Local Business Tax Receipt is issued by the Tax Collector for the privilege of operating any business, profession, or occupation within the county notwithstanding the classification of the business.

What is the purpose of a receipt in business?

Receipts are one of the basic units of corporate accounting. Businesses and individuals use receipts as proof of payment, to claim deductions on their taxes, and to document expenditures on their income statements as well as to substantiate the existence of the assets on their balance sheets.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Home-Based Local Business Tax Receipt Application?

The Home-Based Local Business Tax Receipt Application is a form that individuals must fill out to legally operate a business from their residence, ensuring compliance with local regulations.

Who is required to file Home-Based Local Business Tax Receipt Application?

Individuals who intend to start or operate a home-based business within the local jurisdiction are required to file the Home-Based Local Business Tax Receipt Application.

How to fill out Home-Based Local Business Tax Receipt Application?

To fill out the Home-Based Local Business Tax Receipt Application, applicants should provide their personal information, business details, and information pertaining to the type of business being conducted, and submit the completed form to the local government office.

What is the purpose of Home-Based Local Business Tax Receipt Application?

The purpose of the Home-Based Local Business Tax Receipt Application is to ensure that home-based businesses are operating legally, meeting zoning requirements, and contributing to local tax revenues.

What information must be reported on Home-Based Local Business Tax Receipt Application?

The information that must be reported on the Home-Based Local Business Tax Receipt Application includes the applicant's name and address, business name, description of business activities, and any necessary permits or licenses required for operation.

Fill out your home-based local business tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home-Based Local Business Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.