Get the free Last Three Years - Income & Expense Analysis

Show details

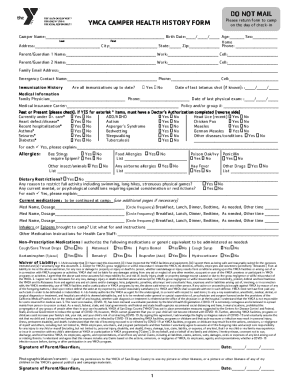

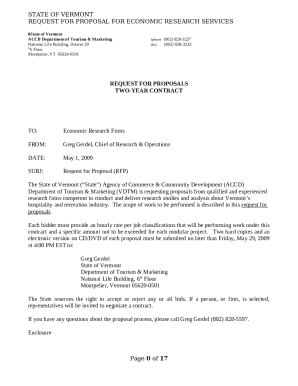

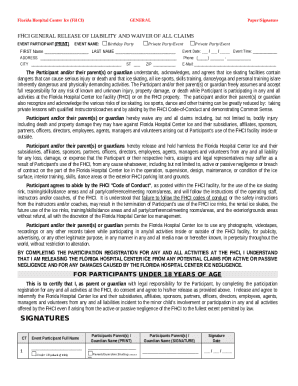

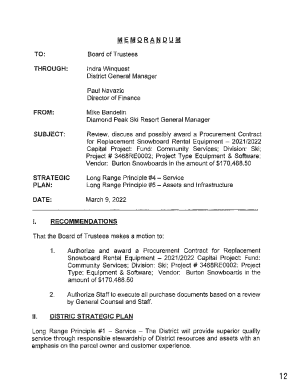

This form is to analyze the income and expenses related to a specific property for tax purposes, including reporting requirements for the Federal Income Tax return.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign last three years

Edit your last three years form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your last three years form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit last three years online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit last three years. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out last three years

How to fill out Last Three Years - Income & Expense Analysis

01

Gather all income statements from the last three years.

02

List all sources of income (e.g., salary, investments, rental income) for each year.

03

Compile all expenses for each year, categorizing them (e.g., fixed, variable, discretionary).

04

Total the income and total the expenses for each year.

05

Calculate the net income by subtracting total expenses from total income for each year.

06

Review and analyze trends in income and expenses to identify patterns or areas for improvement.

07

Document any unusual expenses or income sources that require further explanation.

Who needs Last Three Years - Income & Expense Analysis?

01

Individuals preparing for personal financial planning.

02

Small business owners evaluating company performance.

03

Financial advisors assisting clients with budgeting.

04

Banks or lenders assessing loan applications.

05

Investors analyzing potential investments.

Fill

form

: Try Risk Free

People Also Ask about

How to analyse an income and expenditure statement?

Reviewing and Analyzing an Income Statement Find the bottom line (Should be easy—it's at the bottom) Look at the sources of income. Look at the expense categories. Now look at the amounts: What are the biggest expenses? Compare year-over-year numbers. Compare to the budget and forecast.

How to analyze a P&L statement?

The income summary account is a temporary account that consolidates revenues and expenses for closing and transfers net results to retained earnings. If revenue exceeds expenses, the income summary shows a credit balance for net profit; if expenses exceed revenue, it shows a debit balance for a net loss.

How do you read an income and expenditure statement?

Sales start at the top, expenses and other costs are subtracted as you go down the column and "the bottom line" tells you how much money your practice earned or lost at the end of the reporting period.

How can you properly interpret an income statement?

The income expenditure model is one popular method that helps companies, business managers, financial analysts and production specialists understand a market's health and flexibility. Understanding this model and its formula could allow you to plan a company's production and service models.

What is the income and expense analysis?

Income and expense analysis involves reviewing your financial statements—the income statement, expense reports, and other financial data—to track where your money goes. The goal is to understand your actual expenses, identify inefficiencies, and find ways to reduce variable costs without compromising.

How do you Analyse income and expenditure statements?

Reviewing and Analyzing an Income Statement Find the bottom line (Should be easy—it's at the bottom) Look at the sources of income. Look at the expense categories. Now look at the amounts: What are the biggest expenses? Compare year-over-year numbers. Compare to the budget and forecast.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Last Three Years - Income & Expense Analysis?

The Last Three Years - Income & Expense Analysis is a financial document that summarizes and compares the income and expenses over the past three years to assess financial performance and trends.

Who is required to file Last Three Years - Income & Expense Analysis?

Typically, individuals or businesses seeking loans, grants, or financial assistance are required to file the Last Three Years - Income & Expense Analysis to demonstrate their financial history and stability.

How to fill out Last Three Years - Income & Expense Analysis?

To fill out the analysis, gather income and expense records for the past three years, categorize them, and ensure accuracy. Then, complete the sections of the analysis form, detailing income sources and expense categories for each year.

What is the purpose of Last Three Years - Income & Expense Analysis?

The purpose of the analysis is to provide a clear picture of financial health, help identify trends, and support decision-making in financial planning, lending applications, and potential investments.

What information must be reported on Last Three Years - Income & Expense Analysis?

The analysis must report total income, total expenses, and subtotals for relevant categories such as operational expenses, salaries, and other financial obligations for each of the last three years.

Fill out your last three years online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Last Three Years is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.