NYS PER-1 2008-2025 free printable template

Show details

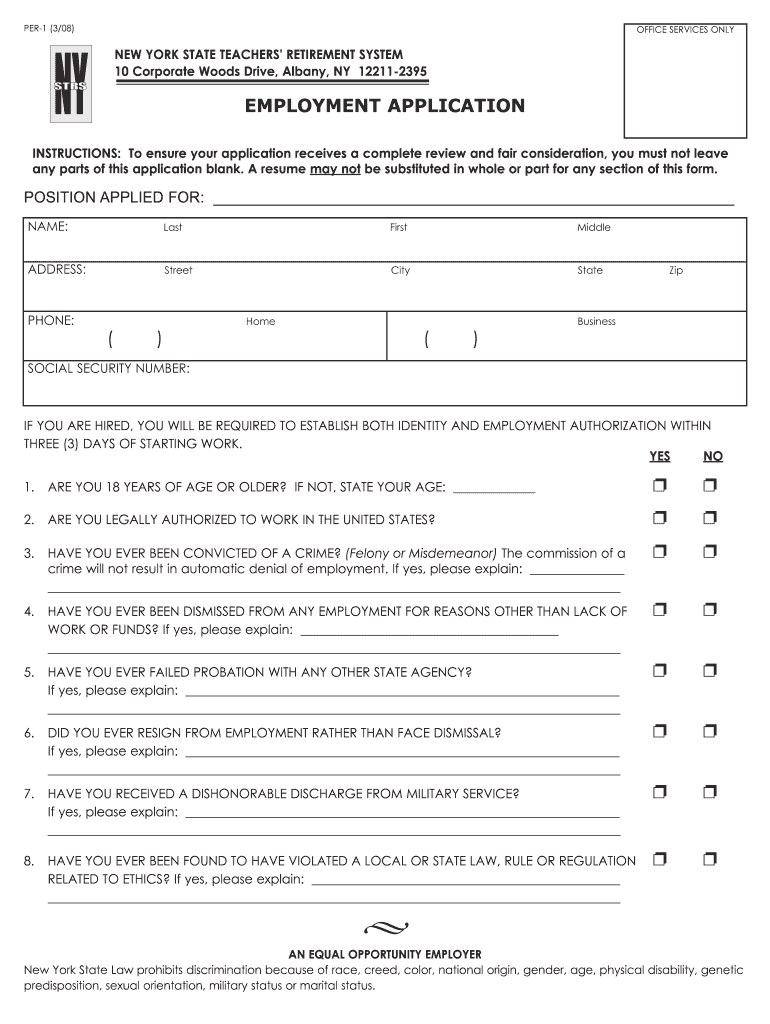

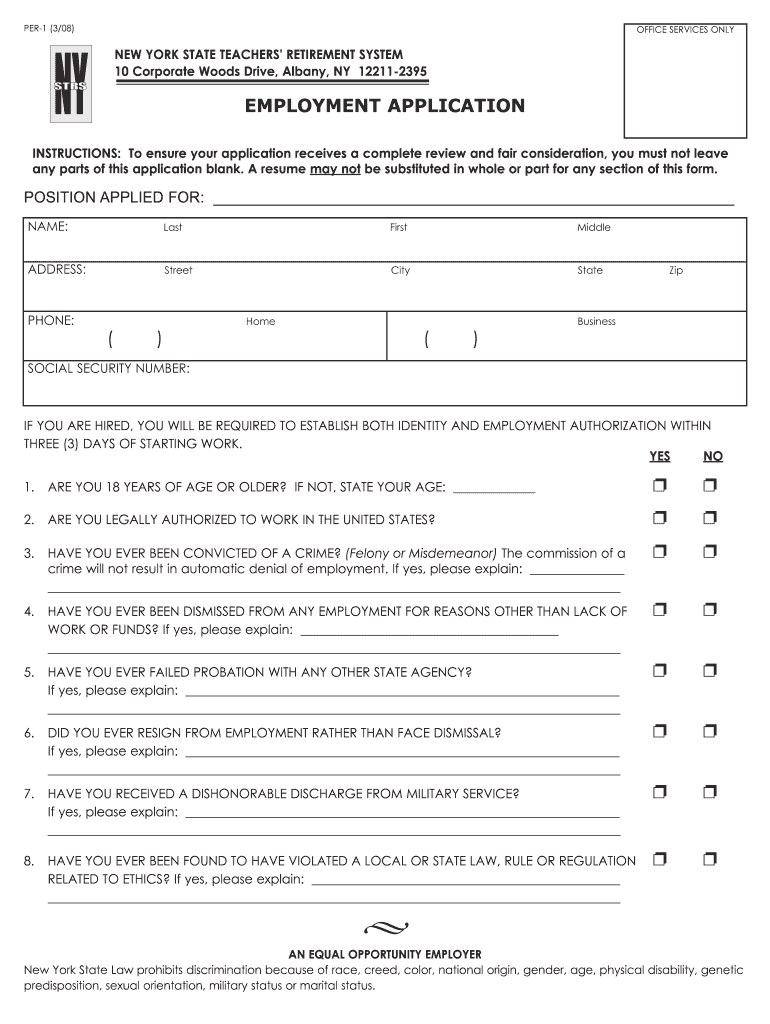

PER-1 (3/08) STARS POSITION APPLIED FOR: NAME: Last First Middle State INSTRUCTIONS: To ensure your application receives a complete review and fair consideration, you must not leave any parts of this

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nys per 1 employment application form

Edit your nys system per 1 employment application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your system per 1 employment application fillable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit retirement system per1 employment fillable online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit nys per1 employment print form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out system per 1 employment application edit form

How to fill out NYS PER-1

01

Obtain a blank copy of the NYS PER-1 form from the New York State Department of Taxation and Finance website.

02

Fill in the taxpayer's name and address in the appropriate fields at the top of the form.

03

Provide the taxpayer identification number (TIN) or Social Security number (SSN).

04

Indicate the type of entity (individual, partnership, corporation) by checking the appropriate box.

05

Complete the income section by entering total income and applicable deductions.

06

Fill out the tax computation section to determine the tax owed or the refund due.

07

Add any necessary schedules or additional forms that pertain to your specific tax situation.

08

Sign and date the form at the bottom, certifying that the information provided is accurate.

09

Review the form carefully for completeness and accuracy before submission.

10

Mail the completed form to the address indicated in the instructions.

Who needs NYS PER-1?

01

Any individual or business taxpayer in New York State who is required to report income, pay taxes, or apply for tax credits should complete the NYS PER-1 form.

02

It is often used by those seeking a refund or verifying tax payments for the tax year.

Video instructions and help with filling out and completing nys per1 employment blank

Instructions and Help about nys per 1 employment application edit

Fill

nys retirement system per1 blank form

: Try Risk Free

People Also Ask about nys system per1 employment

What should be included in an employment application?

How to structure an effective job application form Name of applicant. Contact information, including phone and email. Education history. Work experience. Professional references (optional) Availability (e.g., weekends, night shift) Applicant signature and date.

How many hours is considered full time NY?

Generally, Employers define full-time Employees as those who work at least 35-40 hours during a seven-day workweek. Employers may choose to provide benefits, such as paid time off, only to full time Employees.

What would you include in the application?

Follow these steps to compose a compelling application letter: Research the company and job opening. Use a professional format. State the position you're applying for. Explain why you're the best fit for the job. Summarize your qualifications. Mention why you want the job. Include a professional closing.

What paperwork is required for new hire in NY?

New York employers should provide each new employee with a New York State Form IT-2104, Employee's Withholding Allowance Certificate, as well as a federal Form W-4. See Employee Withholding Forms. Employers in certain industries must obtain statements from new hires. See Employee Statements.

What should not be on an employment application?

An employment application should not include any questions that will produce a response that would indicate an applicant's protected class such as age, race, national origin, disability, etc.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my nys retirement system per1 fill in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your new york state retirement per1 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Where do I find nys teachers retirement per1 fill?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the nys retirement per1 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make edits in nys teachers per1 application download without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your teachers retirement per1 employment, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is NYS PER-1?

NYS PER-1 is a form used in New York State that pertains to the reporting of payroll expenses for public employers, primarily for the purposes of maintaining compliance with state regulations.

Who is required to file NYS PER-1?

Public employers in New York State, including state agencies, municipalities, and certain other government entities, are required to file NYS PER-1.

How to fill out NYS PER-1?

To fill out NYS PER-1, employers must gather necessary payroll data, complete the form with accurate financial figures, ensure all required sections are filled out, and submit it to the appropriate government agency.

What is the purpose of NYS PER-1?

The purpose of NYS PER-1 is to provide a standardized method for public employers to report payroll expenses, ensuring transparency and compliance with state economic and labor regulations.

What information must be reported on NYS PER-1?

Information that must be reported on NYS PER-1 includes total payroll expenses, employee classifications, wages paid, hours worked, and any relevant deductions or contributions made by the employer.

Fill out your NYS PER-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nys per1 Employment Printable is not the form you're looking for?Search for another form here.

Keywords relevant to nys per1 employment application pdf

Related to nys teachers system per 1 application

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.