Get the free Tennessee Consolidated Retirement System Employer Manual - images pcmac

Show details

Este manual del empleador ha sido desarrollado para administrar de manera eficiente el Sistema de Jubilación Consolidado de Tennessee (TCRS) a nivel local. Incluye toda la información necesaria

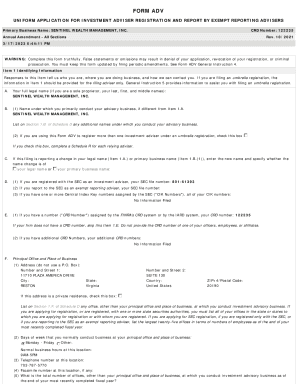

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tennessee consolidated retirement system

Edit your tennessee consolidated retirement system form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tennessee consolidated retirement system form via URL. You can also download, print, or export forms to your preferred cloud storage service.

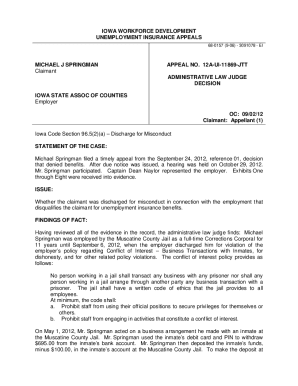

Editing tennessee consolidated retirement system online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tennessee consolidated retirement system. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tennessee consolidated retirement system

How to fill out Tennessee Consolidated Retirement System Employer Manual

01

Obtain the Tennessee Consolidated Retirement System Employer Manual from the official TCRS website or your HR department.

02

Review the manual's table of contents to understand its structure and key sections.

03

Carefully read each section, focusing on the guidelines for employer responsibilities, contributions, and reporting requirements.

04

Gather the necessary documents and data required for completing forms and calculations mentioned in the manual.

05

Follow the step-by-step instructions provided in the manual for filling out each relevant form, ensuring all required fields are accurately completed.

06

Double-check all entries for accuracy and compliance with TCRS regulations.

07

Submit the completed forms and any additional documentation as instructed in the manual, keeping copies for your records.

Who needs Tennessee Consolidated Retirement System Employer Manual?

01

Employers participating in the Tennessee Consolidated Retirement System.

02

Human resources personnel responsible for payroll and retirement benefits administration.

03

Financial officers and benefits administrators who need to ensure compliance with state retirement policies.

04

Newly appointed administrators who require guidelines for managing retirement benefits.

05

Any stakeholder involved in the retirement process for employees covered under TCRS.

Fill

form

: Try Risk Free

People Also Ask about

How many years to be vested in the Tennessee retirement system?

After a five-year vesting period, an employee becomes eligible to receive a monthly benefit at retirement once the age requirement is met. The benefit is calculated by the employee's years of service and salary. The benefit provided by TCRS is a solid foundation for building a retirement future.

How many years to be vested in the Tennessee retirement system?

Full-time state employees are automatically a member of the Tennessee Consolidated Retirement System (TCRS). However, you must accrue five years of creditable state service before you are vested (guaranteed retirement benefits when age requirements are met).

How does Tennessee consolidated retirement system work?

Tennessee Consolidated Retirement System (TCRS) Benefits are determined using the member's highest five-year average salary and years of service. TCRS Hybrid has a defined benefit portion and a defined contribution portion (employer contribution to the 401k).

What is the formula for consolidated retirement in Tennessee?

Vested and either 30 years of TCRS service or age 60. There are provisions for early retirement at a reduced level of benefits. For instance, an individual who has 10 years of service at age 55 or 25 years of service can retire at a benefit level of 76% of the full retirement.

Can you retire with 25 years with TCRS?

After a five-year vesting period, an employee becomes eligible to receive a monthly benefit at retirement once the age requirement is met. The benefit is calculated by the employee's years of service and salary. The benefit provided by TCRS is a solid foundation for building a retirement future.

What is the retirement finance formula?

The Simple Math to Retirement Equation With your annual expenses in hand, you can calculate how much you'll need in investments and be able to safely withdraw 4% per year. To do that, it's simply your annual expenses multiplied by 25. Why 25? It's the inverse of the 4% Rule.

What is the formula for TCRS in Tennessee?

DEFINED BENEFIT (TCRS) EXPLAINED Benefits are determined by a set formula: Accrual Factor (1%) x AFC (average highest consecutive five year salaries) x Years of Service = Monthly Benefit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

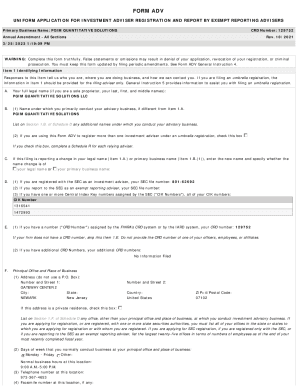

What is Tennessee Consolidated Retirement System Employer Manual?

The Tennessee Consolidated Retirement System Employer Manual is a comprehensive guide that provides instructions and guidelines for employers participating in the Tennessee Consolidated Retirement System (TCRS). It outlines the procedures, policies, and responsibilities of employers in relation to retirement benefits for public employees.

Who is required to file Tennessee Consolidated Retirement System Employer Manual?

All employers that participate in the Tennessee Consolidated Retirement System, including state agencies, municipalities, and other public entities in Tennessee, are required to file and comply with the guidelines set forth in the Tennessee Consolidated Retirement System Employer Manual.

How to fill out Tennessee Consolidated Retirement System Employer Manual?

To fill out the Tennessee Consolidated Retirement System Employer Manual, employers should carefully read the instructions provided within the manual. They must provide accurate data regarding employee contributions, payroll information, and any other required details, ensuring that all sections are completed as per the guidelines.

What is the purpose of Tennessee Consolidated Retirement System Employer Manual?

The purpose of the Tennessee Consolidated Retirement System Employer Manual is to ensure that all participating employers understand their roles and responsibilities in administering retirement benefits, maintaining compliance with state regulations, and accurately reporting necessary information to the TCRS.

What information must be reported on Tennessee Consolidated Retirement System Employer Manual?

Employers must report information such as employee contributions, salaries, employment dates, and other payroll data relevant to the retirement benefits. This includes accurate records of the number of hours worked and any changes in employee status that may affect their retirement eligibility or benefits.

Fill out your tennessee consolidated retirement system online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tennessee Consolidated Retirement System is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.