Get the free Residential Property Disclosure Exemption Form - The Athens Real ...

Show details

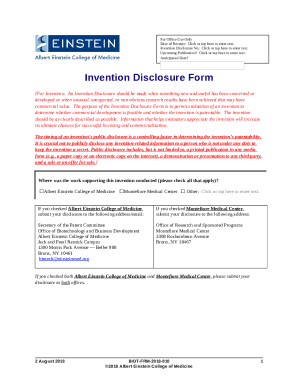

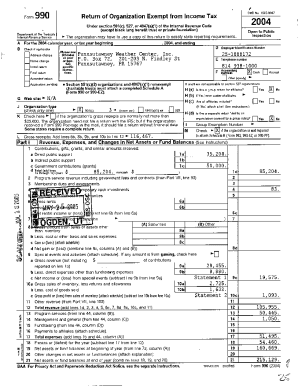

Dot loop signature verification: www.dotloop.com/my/verification/DL-102405874-4-T301 Residential Property Disclosure Exemption Form Address: 0 Shelby Rd, Athens, OH 45701 Owner s Name(s): David P

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign residential property disclosure exemption

Edit your residential property disclosure exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your residential property disclosure exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit residential property disclosure exemption online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit residential property disclosure exemption. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out residential property disclosure exemption

How to fill out residential property disclosure exemption:

01

First, gather all the necessary documents related to the property. This may include the deed, title information, and any relevant building permits or inspections.

02

Review the specific requirements for your jurisdiction. Each area may have different criteria for when a property disclosure exemption can be claimed. Check with your local real estate or housing authority for clear guidelines.

03

Determine if you meet any of the qualifying conditions for the exemption. Common reasons for exemption may include transfers between family members, foreclosures, or court orders. Make sure you have a valid and documented reason for claiming the exemption.

04

Obtain the appropriate exemption form from your local authority or real estate professional. This form will typically require you to provide information about the property, the exemption reason, and any supporting documentation.

05

Fill out the form accurately and thoroughly. Be sure to include all required information and double-check for any errors or missing details. Take your time to ensure the form is completed correctly.

06

Attach any supporting documents as required. This may include copies of relevant court orders, death certificates, or other legal documentation that supports your exemption claim. Make sure to provide copies, not original documents.

07

Submit the completed exemption form and supporting documents to the appropriate authority. This may be a local real estate board, housing authority, or government agency. Follow any specific instructions for submission, such as mailing or hand-delivering the documents.

Who needs residential property disclosure exemption:

01

Homeowners who are transferring the property to a family member without a sale involved may be eligible for a residential property disclosure exemption. This could include parents transferring a property to their children, or grandparents transferring to grandchildren.

02

Properties that have gone through foreclosure may be eligible for an exemption. This is because the foreclosing party may not have complete knowledge of the property's history or condition.

03

Court-ordered transfers or property transfers resulting from divorce or legal separation may also be eligible for an exemption. These situations often involve special circumstances that prevent the full disclosure of the property's condition.

It is important to note that the specific eligibility criteria and requirements for a residential property disclosure exemption may vary depending on your jurisdiction. It is recommended to consult with a real estate professional or legal expert familiar with the laws and regulations in your area.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is residential property disclosure exemption?

Residential property disclosure exemption allows certain sellers to avoid disclosing specific information about their property to potential buyers.

Who is required to file residential property disclosure exemption?

Individuals who meet the criteria set by their local real estate laws and regulations are required to file for residential property disclosure exemption.

How to fill out residential property disclosure exemption?

To fill out residential property disclosure exemption, sellers must provide the required information on the designated form provided by the local real estate authorities.

What is the purpose of residential property disclosure exemption?

The purpose of residential property disclosure exemption is to protect sellers from disclosing sensitive information about their property while still ensuring transparency in the real estate transaction process.

What information must be reported on residential property disclosure exemption?

The specific information that must be reported on a residential property disclosure exemption form varies depending on the local real estate laws, but commonly includes information about property defects, legal issues, and other relevant details.

How do I make changes in residential property disclosure exemption?

The editing procedure is simple with pdfFiller. Open your residential property disclosure exemption in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I sign the residential property disclosure exemption electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your residential property disclosure exemption and you'll be done in minutes.

How do I edit residential property disclosure exemption straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing residential property disclosure exemption, you need to install and log in to the app.

Fill out your residential property disclosure exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Residential Property Disclosure Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.