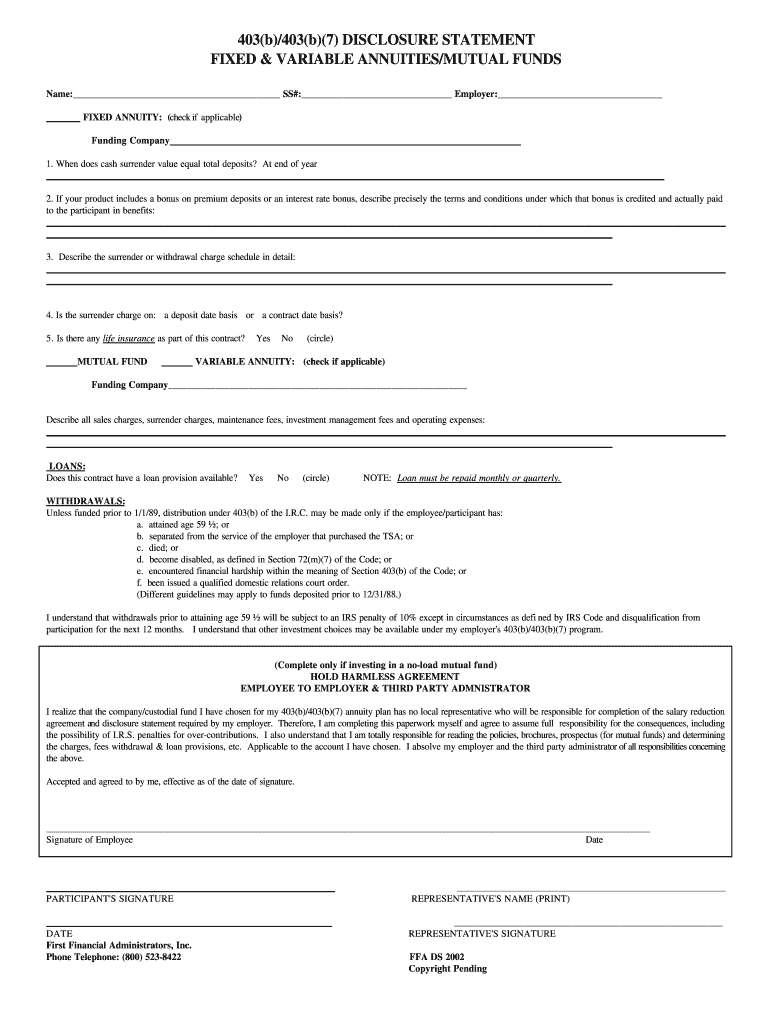

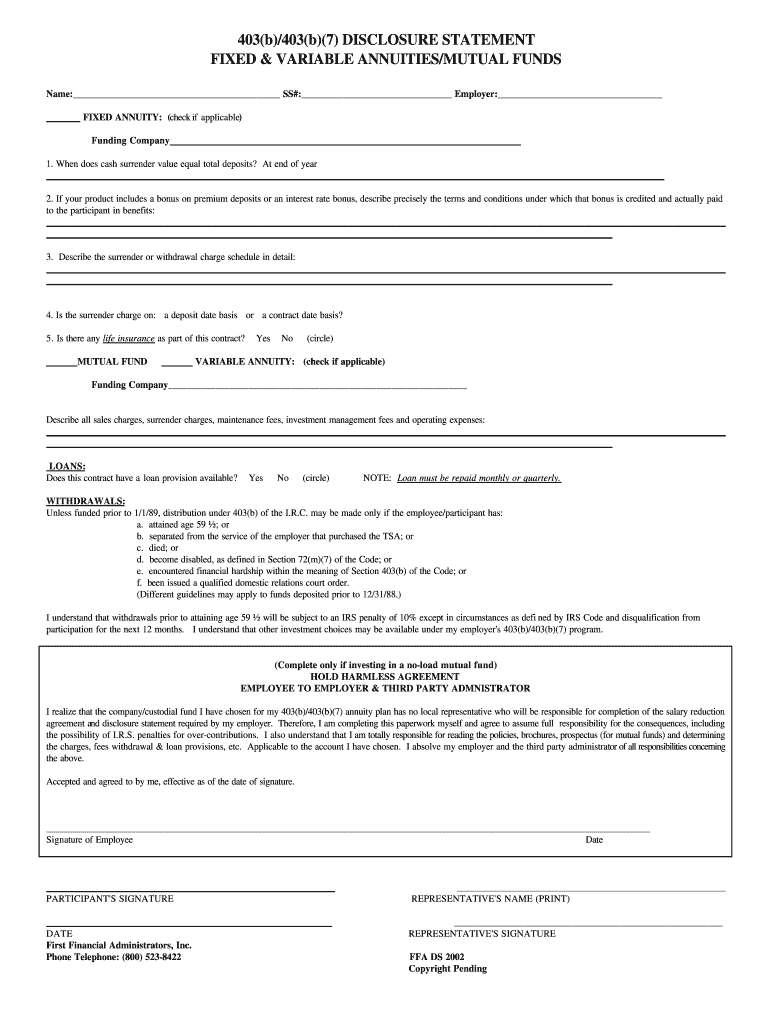

Get the free 403(b)/403(b)(7) DISCLOSURE STATEMENT

Show details

This document provides essential information regarding fixed and variable annuities and mutual funds under the 403(b) retirement plan. It outlines cash surrender value, withdrawal charges, loan provisions,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 403b403b7 disclosure statement

Edit your 403b403b7 disclosure statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 403b403b7 disclosure statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 403b403b7 disclosure statement online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 403b403b7 disclosure statement. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 403b403b7 disclosure statement

How to fill out 403(b)/403(b)(7) DISCLOSURE STATEMENT

01

Obtain the 403(b)/403(b)(7) DISCLOSURE STATEMENT from your employer or the plan administrator.

02

Carefully read through the disclosure statement to understand the plan details.

03

Fill out your personal information, including your name, address, and Social Security number.

04

Review the investment options available within the plan and select your preferences.

05

Understand the fees associated with the plan and record any that may apply to your investments.

06

Sign and date the disclosure statement to acknowledge receipt and understanding.

07

Submit the completed disclosure statement to your employer or plan administrator as instructed.

Who needs 403(b)/403(b)(7) DISCLOSURE STATEMENT?

01

Employees of educational institutions, non-profit organizations, or certain government entities who are eligible for a 403(b) or 403(b)(7) retirement plan.

02

Individuals seeking information about the retirement plan they are enrolled in or considering enrolling in.

03

Employers providing 403(b)/403(b)(7) plans to employees to inform them of plan details and obligations.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between 403b and 403b 7?

Sub section 403(b)(1) describes annuity contracts that may be made available to employees under a Section 403(b) plan. Sub section 403(b)(7) describes custodial accounts (mutual funds) that may be made available to employees under a Section 403(b) plan.

What is a 403 B )( 7 custodial account?

A 403(b)(7) custodial account allows you, as an eligible employee, to save and invest for your own retirement on a tax-deferred basis. You decide how much money you want deducted from your paycheck and deposited to the account.

What is 403 B )( 7 )( A?

Under IRC 403(b)(7)(A)(ii), a distribution from a custodial account may not be paid or made available to a distributee before the employee attains age 59-1/2, separates from service, dies, becomes disabled, or, in the case of salary reduction contributions, encounters financial hardship.

What is the difference between a 403 B and a 403 B )( 7?

But beware: While a terrific savings vehicle, 403(b)s have some drawbacks. 403(b)s have a narrower range of investments than 401(k)s, and many plans over-emphasize, or even prioritize, annuities as the primary investment option.

What are the different types of 403b plans?

An annuity contract, which is a contract provided through an insurance company; A custodial account, which is an account invested in mutual funds; or. A retirement income account set up for church employees that can be invested in either annuities or mutual funds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 403(b)/403(b)(7) DISCLOSURE STATEMENT?

The 403(b)/403(b)(7) DISCLOSURE STATEMENT is a document provided to participants of a 403(b) retirement plan, detailing plan features, investment options, fees, and any other important information to facilitate informed decision-making about their retirement savings.

Who is required to file 403(b)/403(b)(7) DISCLOSURE STATEMENT?

Plan sponsors, typically organizations that offer 403(b) plans, are required to provide the 403(b)/403(b)(7) DISCLOSURE STATEMENT to the participants of the plan.

How to fill out 403(b)/403(b)(7) DISCLOSURE STATEMENT?

To fill out the 403(b)/403(b)(7) DISCLOSURE STATEMENT, plan sponsors should provide accurate and complete information regarding the plan’s features, investment selections, associated fees, and any relevant financial details that affect the participants' retirement savings.

What is the purpose of 403(b)/403(b)(7) DISCLOSURE STATEMENT?

The purpose of the 403(b)/403(b)(7) DISCLOSURE STATEMENT is to ensure transparency and inform participants about the specifics of the retirement plan, enabling them to make educated choices regarding their investments and retirement planning.

What information must be reported on 403(b)/403(b)(7) DISCLOSURE STATEMENT?

The 403(b)/403(b)(7) DISCLOSURE STATEMENT must report information such as plan features, eligibility criteria, contribution limits, investment options, fees, and any potential risks associated with the investments.

Fill out your 403b403b7 disclosure statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

403B403B7 Disclosure Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.