Get the free LAT 3 – APPARTMENT – REAL PROPERTY TAX FORM

Show details

Este formulario debe ser presentado al Asesor de la parroquia indicada antes del 1 de abril o dentro de los cuarenta y cinco días posteriores a la recepción, lo que ocurra más tarde, de acuerdo

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lat 3 appartment real

Edit your lat 3 appartment real form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lat 3 appartment real form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing lat 3 appartment real online

Follow the steps below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit lat 3 appartment real. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

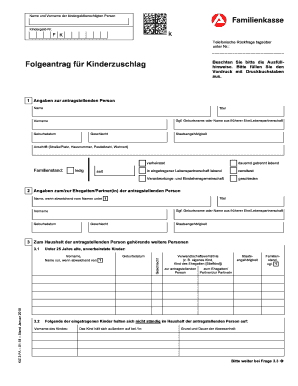

How to fill out lat 3 appartment real

How to fill out LAT 3 – APPARTMENT – REAL PROPERTY TAX FORM

01

Obtain the LAT 3 – APPARTMENT – REAL PROPERTY TAX FORM from the relevant tax authority or website.

02

Fill out your personal information, including name, address, and contact details, in the designated fields.

03

Provide specific details about the apartment, including property identification number, type of property, and address.

04

Indicate the ownership status of the apartment (whether you own it, lease it, etc.).

05

Calculate the assessed value of the apartment and enter this information in the appropriate section.

06

Include any applicable exemptions or deductions, and provide documentation if required.

07

Review all information for accuracy and completeness before signing the form.

08

Submit the completed LAT 3 form to the designated tax office, either in person or via mail, by the required deadline.

Who needs LAT 3 – APPARTMENT – REAL PROPERTY TAX FORM?

01

Property owners who own an apartment and are required to report it for tax assessment purposes.

02

Individuals renting out apartments who need to declare their rental income and associated taxes.

03

Anyone seeking property tax relief or exemptions related to their apartment ownership.

Fill

form

: Try Risk Free

People Also Ask about

At what age do seniors stop paying property taxes in pa?

Age requirements A person aged 65 years or older, A person who lives in the same household with a spouse who is aged 65 years or older, or. A person aged 50 years or older who is a widow of someone who reached the age of 65 before passing away.

What is proof of income for pa property tax rebate?

What documents can I use as proof of income? The Department will accept as proof of income 1099-INT, 1099-R, etc. If the address you provided the Social Security Administration was a PA address, you do not need to submit proof of your Social Security retirement and Supplemental Security benefits.

Do you get a tax form for renting an apartment?

Overview of Landlord Tax Documents Landlords are required by the Internal Revenue Service (IRS) to report their rental income accurately through the proper tax forms, which can vary based on their specific circumstances. These forms may include Form 1099, Form 1040 or 1040-SR, and Form 8825.

How long does it take to get a pa property tax rebate?

April: Automated calls begin to notify applicants that their application was received. June: Automated calls begin to notify applicants that their application was approved. July 1: Rebates will begin to be issued.

Is my apartment subject to property tax?

Renters do not directly receive a property tax bill, but they contribute indirectly through their rent payments. This is because landlords factor in their personal property tax obligations when determining rental rates in the lease agreement.

Where can I get a pa state tax form?

You may call 1-888-PATAXES (1-888-728-2937) to leave a message to have forms mailed to you.

How much does the homestead exemption save you in PA?

The Homestead Exemption reduces the taxable portion of your property's assessed value. With this exemption, the property's assessed value is reduced by $100,000. Most homeowners will save about $1,399 a year on their Real Estate Tax bill starting in 2025.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

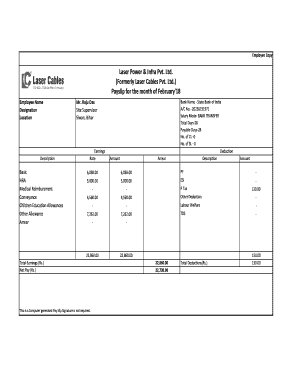

What is LAT 3 – APPARTMENT – REAL PROPERTY TAX FORM?

LAT 3 – APPARTMENT – REAL PROPERTY TAX FORM is a specific form used to report and calculate property taxes for residential apartments. It provides details on the property's value, exemptions, and tax assessments.

Who is required to file LAT 3 – APPARTMENT – REAL PROPERTY TAX FORM?

Property owners of residential apartments or landlords who are responsible for reporting the property taxes for their apartment buildings are required to file the LAT 3 – APPARTMENT – REAL PROPERTY TAX FORM.

How to fill out LAT 3 – APPARTMENT – REAL PROPERTY TAX FORM?

To fill out the LAT 3 form, property owners must provide details about the property, including its value, tax assessment, any applicable exemptions, and supporting documentation. It's essential to review local filing requirements for additional instructions.

What is the purpose of LAT 3 – APPARTMENT – REAL PROPERTY TAX FORM?

The purpose of the LAT 3 form is to ensure accurate reporting of property values for taxation purposes, allowing local authorities to assess property taxes appropriately for residential apartments.

What information must be reported on LAT 3 – APPARTMENT – REAL PROPERTY TAX FORM?

The LAT 3 form must report information such as the property address, owner details, the assessed value of the property, any applicable exemptions, and any previous tax assessments or appeals.

Fill out your lat 3 appartment real online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lat 3 Appartment Real is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.