Get the free Tax Year 2012 Software Developer Information Sheet - Oklahoma

Show details

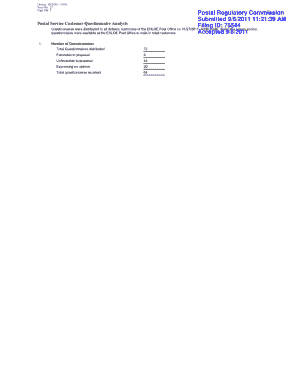

Oklahoma Tax Commission Tax Year 2012 Individual Income Tax Software Developer Information Sheet Form D-101 Revised 8-2011 Complete One Sheet per Product Being Tested Firm Information Firm Name: Product

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax year 2012 software

Edit your tax year 2012 software form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax year 2012 software form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax year 2012 software online

To use the services of a skilled PDF editor, follow these steps below:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax year 2012 software. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax year 2012 software

Step-by-Step Guide to Filling Out Tax Year 2012 Software:

01

Start by gathering all the necessary documents for filing your taxes for the year 2012. This may include your W-2 forms, 1099 forms, receipts for deductions, and any other relevant financial documents.

02

Once you have all your documents ready, install the tax year 2012 software on your computer. Follow the instructions provided by the software provider to complete the installation process.

03

Launch the software and create a new tax return for the year 2012. The software will usually guide you through this process, asking for your personal information, such as your name, Social Security number, and address.

04

Enter your income information into the software. This includes any wages, salaries, tips, or self-employment income you earned during the tax year 2012. The software may prompt you to fill in specific boxes or fields with the relevant information from your W-2 or 1099 forms.

05

After entering your income, proceed to report any deductions and credits that you are eligible for in the tax year 2012. This may include deductions for mortgage interest, student loan interest, medical expenses, and education-related expenses. The software will guide you through these sections, prompting you to fill in the necessary information.

06

Review your tax return for accuracy. Carefully go through each section to ensure that you have entered all the information correctly. Double-check your calculations to avoid any mistakes or discrepancies.

07

Once you are confident that all the information is accurate, the software will generate your tax return. Review the final version of your return and verify that all the numbers and details are correct.

08

If you owe taxes for the tax year 2012, the software will provide you with options to make the payment. Follow the provided instructions to pay the amount due to the relevant taxing authority.

09

Conversely, if you are eligible for a tax refund, the software will guide you through the process of entering your banking information for direct deposit or printing a paper check.

Who Needs Tax Year 2012 Software?

Individuals or businesses who did not file their taxes for the year 2012 and are required to or desire to do so at a later time may need tax year 2012 software. This software is designed to help users accurately complete their tax returns for the specific tax year and to ensure compliance with tax laws and regulations in effect during that period.

Some reasons why individuals or businesses may require tax year 2012 software include:

01

Late Filing: If you missed the original deadline to file your tax return for the year 2012, you may need tax year 2012 software to catch up and file your taxes belatedly.

02

Amended Returns: If you discovered errors or omissions on your previously filed tax returns for the year 2012, you may need tax year 2012 software to prepare and file an amended return to correct those mistakes.

03

Audit or Examination: If you are currently undergoing an audit or examination by the tax authorities for the tax year 2012, you may need tax year 2012 software to help prepare the requested documentation and address any issues raised during the audit process.

It is important to note that tax year 2012 software may not be readily available from all tax preparation software providers, as most software companies prioritize the latest tax year's software. However, some providers may still offer access to the tax year 2012 software for download or purchase, ensuring that individuals or businesses can fulfill their filing obligations and accurately report their 2012 tax information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute tax year 2012 software online?

pdfFiller has made it simple to fill out and eSign tax year 2012 software. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit tax year 2012 software straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing tax year 2012 software.

How do I fill out the tax year 2012 software form on my smartphone?

Use the pdfFiller mobile app to complete and sign tax year 2012 software on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is tax year software developer?

Tax year software developer is a software designed for developers to calculate and manage their taxes for a specific financial year.

Who is required to file tax year software developer?

Any software developer who earns income from their work is required to file their taxes using tax year software developer.

How to fill out tax year software developer?

To fill out tax year software developer, developers need to input information about their income, expenses, deductions, and any other relevant financial information.

What is the purpose of tax year software developer?

The purpose of tax year software developer is to help software developers accurately calculate their taxes, ensure compliance with tax laws, and maximize deductions.

What information must be reported on tax year software developer?

Developers must report all sources of income, expenses related to their work, deductions they are eligible for, and any other financial information required for tax purposes.

Fill out your tax year 2012 software online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Year 2012 Software is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.