Get the free Top-Heavy Plans

Show details

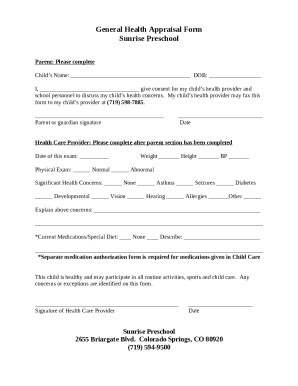

Department of the Treasury Internal Revenue Service 8397 Employee Plan Deficiency Check sheet Attachment #7 Top-Heavy Plans Form (Rev. March 2006) For IRS Use 707 II.a. 710, 711 II.b.(i)(a) and (b)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign top-heavy plans

Edit your top-heavy plans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your top-heavy plans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit top-heavy plans online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit top-heavy plans. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out top-heavy plans

How to fill out top-heavy plans:

01

Determine if your company's retirement plan qualifies as a top-heavy plan. A top-heavy plan is one where the total value of the accounts held by key employees exceeds 60% of the total value of all accounts in the plan.

02

Identify key employees in your plan. Key employees are typically defined as company owners, officers, and highly compensated employees. These individuals are often the ones who have the highest account balances.

03

Calculate the top-heavy minimum contribution. The top-heavy minimum contribution is the amount that must be contributed to the plan to ensure that non-key employees receive a minimum benefit. This is typically either 3% of compensation for each non-key employee or a lesser percentage that maintains the ratio between the key employees' account balances and the non-key employees' account balances.

04

Communicate the top-heavy status to all plan participants. Provide employees with a clear explanation of what it means for the plan to be top-heavy and how it may impact their retirement benefits.

05

Adjust contributions as necessary. If the plan is top-heavy, additional contributions may need to be made on behalf of non-key employees to meet the minimum requirements. Ensure that these contributions are made in a timely manner and in accordance with the plan's rules and regulations.

06

Monitor the plan on an ongoing basis. It's important to regularly review the plan's status to ensure compliance with top-heavy requirements. This may involve annual testing and adjustments to contribution levels as necessary.

Who needs top-heavy plans:

01

Companies with a significant number of key employees. Top-heavy plans are most commonly found in companies where a small group of individuals holds a majority of the plan's assets.

02

Companies that want to attract and retain key employees. Offering a top-heavy plan can be an attractive benefit for highly compensated employees and may help incentivize them to stay with the company.

03

Companies that want to meet certain legal requirements. Depending on the type of retirement plan being offered, there may be legal requirements for the plan to not be top-heavy. In such cases, it becomes necessary for the company to actively manage and address the top-heavy status of the plan.

Overall, understanding how to fill out top-heavy plans and identifying who needs them is crucial for companies to navigate the complexities of retirement planning and ensure compliance with applicable regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify top-heavy plans without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your top-heavy plans into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit top-heavy plans in Chrome?

Install the pdfFiller Google Chrome Extension to edit top-heavy plans and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How can I fill out top-heavy plans on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your top-heavy plans. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is top-heavy plans?

Top-heavy plans are retirement plans where the total value of the accounts for key employees make up more than 60% of the total value of all accounts in the plan.

Who is required to file top-heavy plans?

Plan administrators of retirement plans are required to file top-heavy plans if the plan is deemed to be top-heavy.

How to fill out top-heavy plans?

Top-heavy plans must be filled out accurately with information about key employees, non-key employees, account balances, and contributions.

What is the purpose of top-heavy plans?

The purpose of top-heavy plans is to ensure that retirement plans do not excessively favor key employees over non-key employees.

What information must be reported on top-heavy plans?

Top-heavy plans must report information on key employees, non-key employees, account balances, contributions, and any corrective actions taken.

Fill out your top-heavy plans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Top-Heavy Plans is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.