Get the free Partnership:

Show details

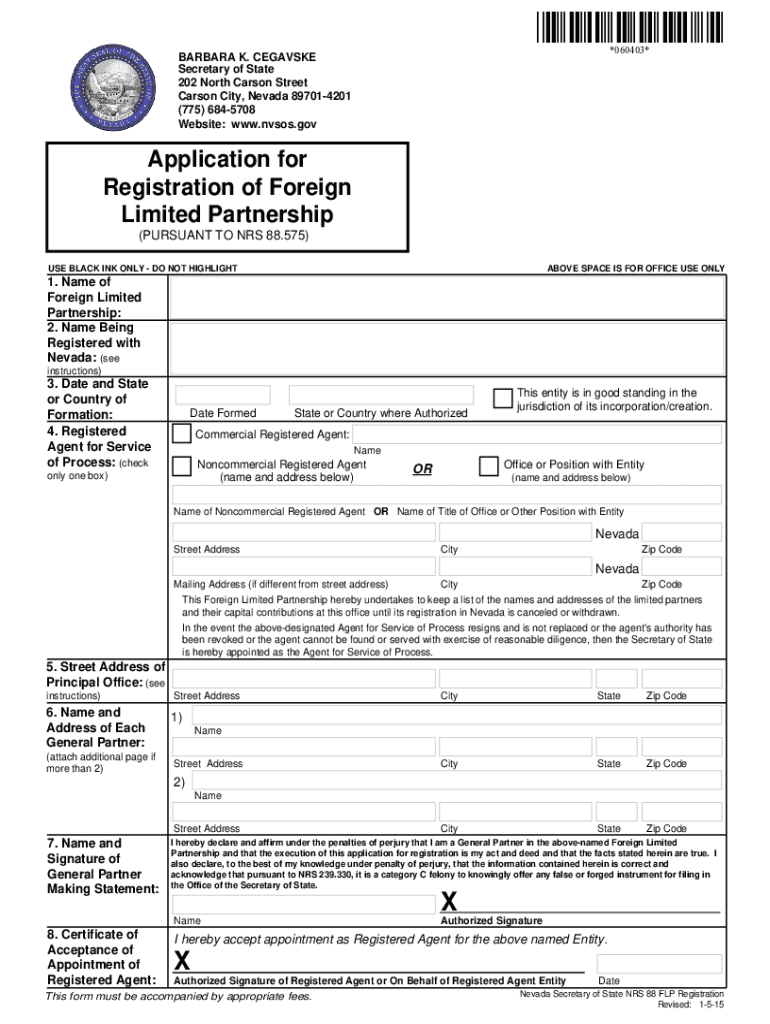

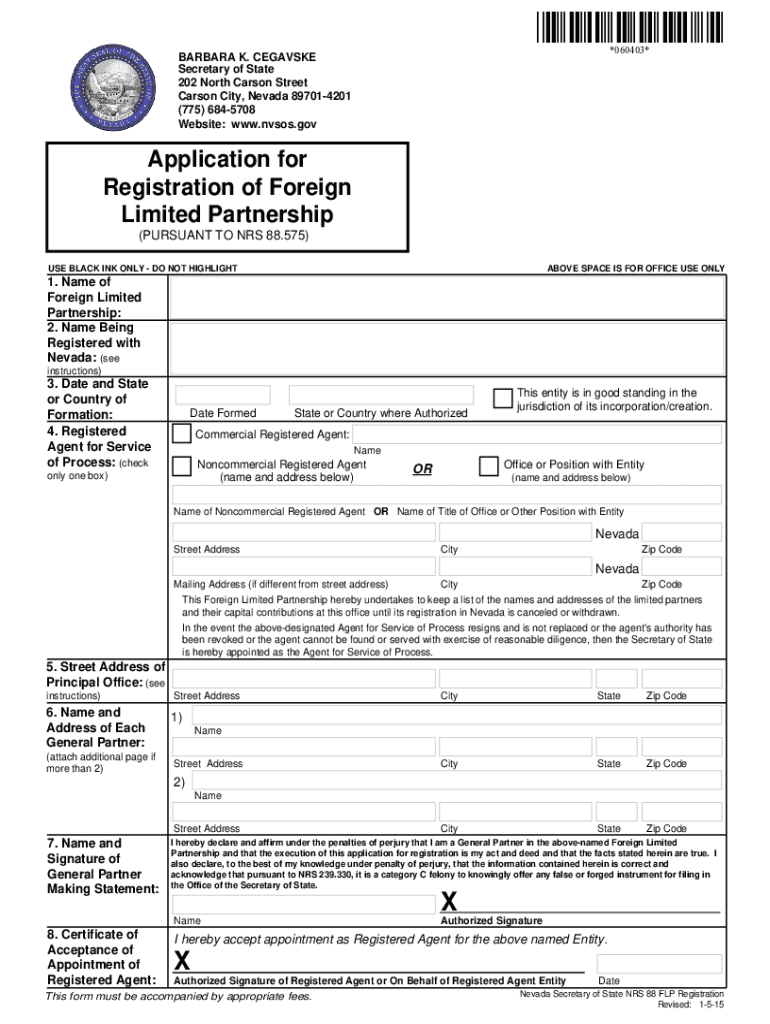

*060403*

*060403×BARBARA K. CEASE

Secretary of State

202 North Carson Street

Carson City, Nevada 897014201

(775) 6845708

Website: www.nvsos.govApplication for

Registration of Foreign

Limited Partnership

(PURSUANT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign partnership

Edit your partnership form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your partnership form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit partnership online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit partnership. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out partnership

How to fill out partnership

01

Identify the partner you want to collaborate with and establish clear communication channels.

02

Clearly define the terms and expectations of the partnership agreement.

03

Outline the roles and responsibilities of each partner in the collaboration.

04

Agree on the financial arrangements and potential benefits of the partnership.

05

Review and finalize the partnership agreement before signing.

Who needs partnership?

01

Businesses looking to expand their reach and capabilities through strategic alliances.

02

Non-profit organizations seeking to pool resources and expertise for common goals.

03

Startups looking to leverage the strengths of other companies to accelerate growth.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send partnership for eSignature?

When your partnership is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I execute partnership online?

pdfFiller makes it easy to finish and sign partnership online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out partnership on an Android device?

Use the pdfFiller mobile app to complete your partnership on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is partnership?

A partnership is a business structure where two or more individuals share ownership and operate a business together, sharing profits, losses, and responsibilities.

Who is required to file partnership?

Partnerships that earn income and are required to report their financial activities must file a partnership tax return. This typically includes general partnerships, limited partnerships, and limited liability partnerships.

How to fill out partnership?

To fill out a partnership tax return, you need to gather financial information such as income, deductions, and credits, fill out IRS Form 1065, and address any state-specific filing requirements. Each partner must also receive a Schedule K-1 detailing their share of income and deductions.

What is the purpose of partnership?

The purpose of a partnership is to allow individuals to collaborate in running a business, pooling resources, sharing risks, and leveraging each partner's expertise to achieve mutual financial goals.

What information must be reported on partnership?

Partnerships must report total income, deductions, credits, and each partner's share of these amounts on their tax return, usually Form 1065, along with individual Form K-1 for each partner.

Fill out your partnership online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Partnership is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.