Get the free Supplement to Military Pay Worksheet - ucdmc ucdavis

Show details

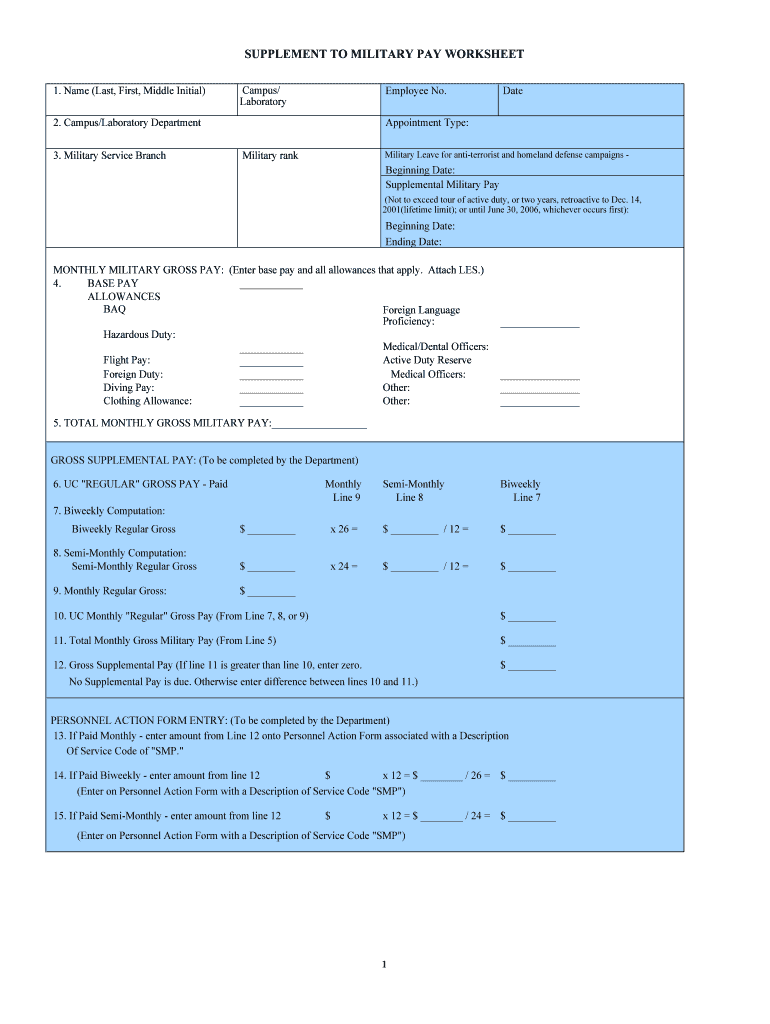

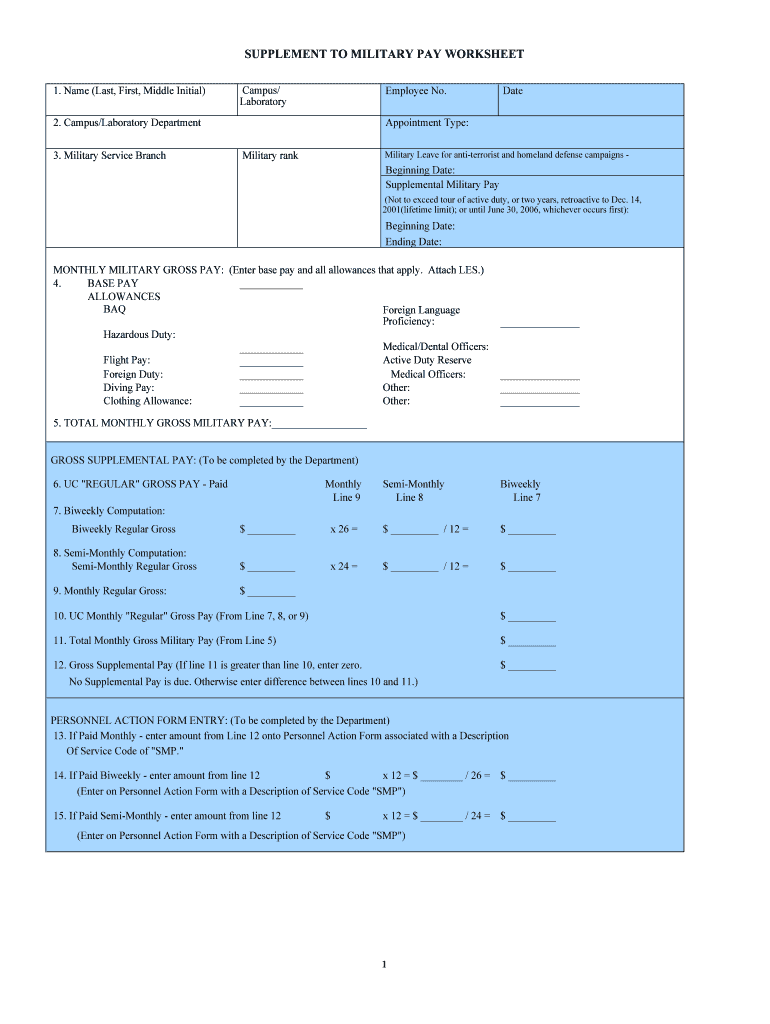

Este formulario se utiliza para documentar y calcular el pago militar suplementario que un empleado de la Universidad de California puede recibir durante el servicio militar. El formulario recopila

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign supplement to military pay

Edit your supplement to military pay form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your supplement to military pay form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing supplement to military pay online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit supplement to military pay. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out supplement to military pay

How to fill out Supplement to Military Pay Worksheet

01

Gather all necessary financial documentation, including pay stubs and military orders.

02

Obtain a copy of the Supplement to Military Pay Worksheet form.

03

Fill in personal information at the top of the worksheet, including name, rank, and service number.

04

List your current base pay and any additional pay received by filling in the respective sections.

05

Include any allowances, reimbursements, or other income in the designated fields.

06

Double-check the entered amounts for accuracy against your financial documents.

07

Sign and date the form at the bottom to certify the information is true and correct.

08

Submit the completed worksheet to the designated finance office or authority.

Who needs Supplement to Military Pay Worksheet?

01

Active duty service members who receive military pay and need to report changes or receive supplemental pay.

02

Reservists who are activated and require adjustments to their pay.

03

Veterans who may need to document their income for benefit calculations.

Fill

form

: Try Risk Free

People Also Ask about

Is social security taken out of military pay?

A Payments you receive as a member of a military service generally are taxed as wages except for retirement pay, which is taxed as a pension. If your retirement pay is based on age or length of service, it is taxable and must be included in your income as a pension on lines 5a and 5b of Form 1040 or Form 1040-SR.

What is deducted from military pay?

What comes out of your military pay. Everyone has deductions for taxes, including Social Security and Medicare. You probably have a federal tax deduction, and you may have a state tax deduction, depending on your state of legal residence.

How much of military pay is taxed?

While all pays are taxable, most allowances are tax-exempt. The primary allowances for most individuals are BAS and BAH, which are tax-exempt. Conus COLA is one allowance that is taxable.

What is a supplement to military pay?

Supplement to Military Pay: Compensation paid to a University employee who has been called to active military duty in support of an ongoing overseas military mobilization campaign. The Supplement to Military Pay is the difference between an employee's University pay and active military duty pay.

What is taken out of military pay?

Here are other deductions you may notice: Social Security deductions are 6.2% of your taxable military pays. Medicare taxes are 1.45% of your taxable military pays. The Servicemembers' Group Life Insurance program provides low-cost life insurance to military members.

What is military pay and allowances?

Allowances are the second most important element of military pay. Allowances are moneys provided for specific needs, such as food or housing. Monetary allowances are provided when the government does not provide for that specific need.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Supplement to Military Pay Worksheet?

The Supplement to Military Pay Worksheet is a form used by military personnel to report additional income or allowances that are not included in their standard military pay.

Who is required to file Supplement to Military Pay Worksheet?

Military personnel who receive additional income or allowances outside their regular pay, such as bonuses, special duty pay, or other types of compensation, are required to file this worksheet.

How to fill out Supplement to Military Pay Worksheet?

To fill out the Supplement to Military Pay Worksheet, one must provide accurate details of all additional income, including the source, amount, and relevant dates, while ensuring that the information matches official documentation.

What is the purpose of Supplement to Military Pay Worksheet?

The purpose of the Supplement to Military Pay Worksheet is to ensure that all sources of income are accurately reported for taxation and military pay calculations, facilitating transparency and compliance.

What information must be reported on Supplement to Military Pay Worksheet?

The information that must be reported includes all additional income sources, amounts of each type of income, time periods for which the income was received, and any relevant supporting documentation.

Fill out your supplement to military pay online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Supplement To Military Pay is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.