Get the free Payroll Overpayments Worksheet - busfin uga

Show details

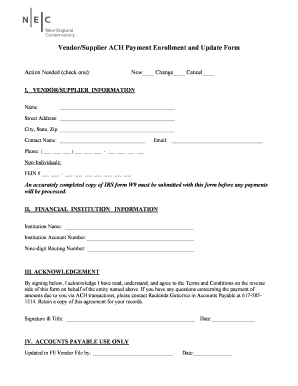

This form is used to gather information necessary for calculating payroll errors related to overpayments. Users are required to fill in various details regarding pay type, actual and corrected figures,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payroll overpayments worksheet

Edit your payroll overpayments worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll overpayments worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payroll overpayments worksheet online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit payroll overpayments worksheet. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payroll overpayments worksheet

How to fill out Payroll Overpayments Worksheet

01

Obtain a copy of the Payroll Overpayments Worksheet from the relevant authority or your HR department.

02

Fill in your employee details, including your name, employee ID, and department.

03

List the payroll periods where overpayments occurred.

04

For each payroll period, specify the gross amount that was overpaid.

05

Indicate the deductions that were initially taken from those overpayments, if applicable.

06

Calculate the total overpayment amount for each period listed.

07

Review your entries for accuracy before submission.

08

Submit the completed worksheet to the payroll department for processing.

Who needs Payroll Overpayments Worksheet?

01

Employees who have been overpaid in their payroll due to errors or any other discrepancies.

02

Human resources or payroll departments that need to track and rectify payroll overpayments.

03

Financial departments responsible for maintaining accurate payroll records.

Fill

form

: Try Risk Free

People Also Ask about

Do I pay back net or gross on an overpayment?

Check/Money Order repayment: If this employee would repay by check/money order, they would repay the net amount (70% of the gross overpayment amount). For example, if this gross overpayment was $562.50, the employee would repay $393.75.

How to handle overpayments in payroll?

In most situations, it's best to notify your employee of the payroll overpayment in writing. In some states like Michigan, it's required by law to deliver notice in writing. Other states, like Washington, require that your notification must also include terms of adjustment and repayment.

Can employers deduct overpayment due to payroll?

In California, the Division of Labor Standards Enforcement (DLSE) views deductions from wages to recover overpayments to an employee as unlawful deductions under the law.

How do you write an overpayment?

Tips for Writing Overpayment Emails Include Specific Details: Mention the exact amount overpaid, the date of the transaction, and any relevant invoice or reference numbers. This helps avoid confusion.

How to calculate overpayment of wages?

Determine the exact amount of the overpayment by comparing the employee's correct pay with the amount they received. Make sure to account for any applicable taxes and deductions.

How do you calculate payroll overpayments?

To verify the amount is correct, subtract the gross amount listed in the “Paid Gross” from the dollar amount listed in the “Should Have Been Paid Gross”. The result represents the overpaid gross salary.

How do you account for overpayments?

Options for handling overpayments are to either refund the amount or establish a credit for it. The receiver cannot keep an overpayment, as it is neither revenue nor income. Account credits caused by customer overpayment are recorded as liabilities or contra-assets on the balance sheet until applied against an invoice.

How to process an overpayment in payroll?

How To Correct a Payroll Overpayment Step 1: Gather Data. Before taking any action to correct overpaid wages, you'll need to get your facts straight. Step 2: Check State Laws and Company Policies. Step 3: Notify the Employee. Step 4: Discuss Repayment Options with the Employee. Step 5: Adjust your payroll.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Payroll Overpayments Worksheet?

The Payroll Overpayments Worksheet is a document used to calculate and report any overpayments made to employees in a payroll period.

Who is required to file Payroll Overpayments Worksheet?

Employers who have made payroll overpayments to their employees are required to file the Payroll Overpayments Worksheet.

How to fill out Payroll Overpayments Worksheet?

To fill out the Payroll Overpayments Worksheet, employers must enter details such as the employee's name, the amount overpaid, the pay period, and any deductions or adjustments that apply.

What is the purpose of Payroll Overpayments Worksheet?

The purpose of the Payroll Overpayments Worksheet is to ensure the accurate reporting and recovery of overpaid wages, maintaining proper accounting and compliance with employment laws.

What information must be reported on Payroll Overpayments Worksheet?

The information that must be reported includes the employee's name, Social Security number, the amount of overpayment, the pay period in question, and any adjustments made or to be made.

Fill out your payroll overpayments worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payroll Overpayments Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.