Get the free Bankruptcy Resolution - nuhs

Show details

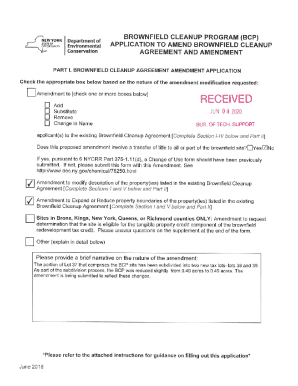

This form is required for students with student loans and/or grant overpayments in active bankruptcy status. It includes questions regarding the status and dischargeability of Title IV debts, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bankruptcy resolution - nuhs

Edit your bankruptcy resolution - nuhs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bankruptcy resolution - nuhs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bankruptcy resolution - nuhs online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit bankruptcy resolution - nuhs. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bankruptcy resolution - nuhs

How to fill out Bankruptcy Resolution

01

Gather necessary financial documents, including income statements, debt statements, and asset valuations.

02

Complete the Bankruptcy Resolution form, ensuring all personal information is accurate and up to date.

03

List all creditors and the amounts owed, being thorough and precise to avoid complications.

04

Provide a detailed account of your financial situation, including income, expenses, and liabilities.

05

Review the completed form for accuracy and completeness before submission.

06

Submit the Bankruptcy Resolution form to the appropriate court or agency as per local regulations.

07

Attend any required hearings or meetings related to your bankruptcy case.

Who needs Bankruptcy Resolution?

01

Individuals experiencing overwhelming debt that they cannot manage.

02

Businesses facing insolvency and unable to meet financial obligations.

03

People seeking a fresh start financially through the legal process of bankruptcy.

04

Those whose assets are at risk and need protection from creditors.

Fill

form

: Try Risk Free

People Also Ask about

What is the resolution in Chapter 13?

Chapter 13 is a form of bankruptcy that allows debtors to restructure their debts and pay them off over a period of three to five years under court supervision. Filing for Chapter 13 bankruptcy can stop foreclosure proceedings that would have led to the seizure of the debtor's home.

Can a bankruptcy be rescinded?

Your bankruptcy discharge wipes out your liability for qualifying debts, such as medical bills, credit card balances, and personal loans. But if you're not completely honest in your bankruptcy papers or fail to follow all the rules, the court can revoke your discharge even after closing your case.

What can you lose in bankruptcies?

Special debts like child support, alimony and student loans, will not be eliminated when filing for bankruptcy. Not all debts are treated the same. The law takes some debts very seriously and these cannot be wiped out by filing for bankruptcy.

Can a bankruptcy be rescinded?

Your bankruptcy discharge wipes out your liability for qualifying debts, such as medical bills, credit card balances, and personal loans. But if you're not completely honest in your bankruptcy papers or fail to follow all the rules, the court can revoke your discharge even after closing your case.

What cannot be wiped out by bankruptcies?

By eliminating burdensome debts, Chapter 7 bankruptcy enables individuals to break free from the cycle of financial stress and start anew. This can be particularly beneficial for those who have faced unforeseen circumstances such as job loss, medical emergencies, or other setbacks.

What debt will bankruptcy get rid of?

Debts you can discharge in bankruptcy Many unsecured debts can be discharged in bankruptcy: Credit card debt and medical bills are common types of unsecured debt discharged during bankruptcy. Unsecured personal and payday loans are often dischargeable. This includes personal lines of credit or installment loans.

What is the resolution date of bankruptcy?

Bankruptcy Resolution Date means the date on which a Final Order of the Bankruptcy Court has been entered dismissing, closing or otherwise terminating the Chapter 11 Cases.

What does bankruptcy resolve?

Bankruptcy is a legal process to help people who owe money, or debtors, get relief from debts they cannot pay and, at the same time, help people who are owed money, or creditors, get paid from assets property the debtor has.

What is resolution in bankruptcy?

Under the Insolvency Bankruptcy Code 2016, when a company fails to make payments to creditors, the National Company Law Tribunal (NCLT) takes charge of the Insolvency Resolution Process (IRP). An operational creditor, financial creditor, or the company itself can apply for IRP.

What is a resolution of authority?

Resolutions of Authority name an individual that is authorized to act on behalf of a Corporation, Partnership, or Company. Complete ONLY the Resolution which matches the structure of the business. Sole Proprietorship/Single Membership.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Bankruptcy Resolution?

Bankruptcy Resolution is a legal process through which an individual or business that is unable to meet their financial obligations can seek relief from some or all of their debts. It's a way to reorganize or eliminate debts, typically under the protection of the bankruptcy court.

Who is required to file Bankruptcy Resolution?

Individuals, sole proprietors, or businesses that are unable to pay their debts as they come due are required to file for Bankruptcy Resolution. The requirement may vary based on the type of bankruptcy being sought, such as Chapter 7 or Chapter 13 in the United States.

How to fill out Bankruptcy Resolution?

To fill out a Bankruptcy Resolution, individuals or businesses need to complete the appropriate bankruptcy petition forms, which detail their financial situation, including assets, liabilities, income, and expenses. It's often advisable to consult with a bankruptcy attorney for assistance in accurately completing these forms.

What is the purpose of Bankruptcy Resolution?

The purpose of Bankruptcy Resolution is to provide a structured way for individuals or businesses facing insurmountable debt to obtain relief from creditors, discharge certain debts, and allow for a fresh financial start while following legal guidelines.

What information must be reported on Bankruptcy Resolution?

On a Bankruptcy Resolution, individuals must report comprehensive financial information including but not limited to assets, liabilities, income sources, monthly expenses, and any previous bankruptcy filings. This detailed disclosure helps the court determine the appropriate course of action for the resolution.

Fill out your bankruptcy resolution - nuhs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bankruptcy Resolution - Nuhs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.