Get the free A reference for tax year 2012 - Michigan Legislature - State of ... - legislature mi

Show details

Jan 1, 2013 ... the Michigan Department of Treasury in the income tax instruction .... the preparation of this publication. ... All property taxes collected by local units of government, other than

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign a reference for tax

Edit your a reference for tax form online

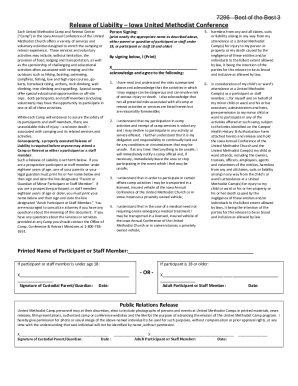

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your a reference for tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit a reference for tax online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit a reference for tax. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out a reference for tax

How to fill out a reference for tax:

01

Gather all necessary information: Before filling out the reference for tax, make sure you have all the required information at hand. This includes the taxpayer's full name, address, social security number, and any other relevant personal details.

02

Identify the purpose of the reference: Determine the reason for filling out the reference. This could be for claiming deductions, verifying income, or any other specific tax-related requirement. Understanding the purpose will help you include the necessary details in the reference.

03

Research tax reference formats: Different tax authorities or institutions may have specific formats or templates for references. Research and familiarize yourself with the appropriate format to ensure compliance with the guidelines and avoid any errors.

04

Provide accurate financial information: One of the key aspects of a tax reference is providing accurate financial information. This includes stating the taxpayer's income, expenses, assets, and liabilities. It is important to double-check all the figures and ensure their accuracy.

05

Include necessary supporting documents: Along with the reference, it may be required to attach supporting documents such as pay stubs, bank statements, or other financial records. Make sure to include these documents as required, as they provide evidence or backup for the information provided in the reference.

06

Use a professional and concise language: When filling out the reference, it is crucial to maintain a professional tone and use clear and concise language. Avoid any ambiguous statements or unnecessary details. Focus on providing accurate and relevant information.

Who needs a reference for tax?

01

Individuals filing tax returns: Individuals who are required to file tax returns usually need to provide references for tax. These references are used by tax authorities to verify the information provided and ensure compliance with tax regulations.

02

Self-employed individuals: Self-employed individuals, such as freelancers or business owners, often need references for tax to substantiate their income and expenses. These references help calculate their taxable income accurately and provide evidence for any deductions claimed.

03

Loan or mortgage applicants: When applying for loans or mortgages, financial institutions may require tax references. These references assist in verifying an individual's income, which helps lenders assess their creditworthiness and determine loan eligibility.

04

Job applicants: Certain employers may request tax references from job applicants during the hiring process. These references can provide insights into an individual's financial situation, income stability, and overall credibility.

05

Insurance policyholders: Some insurance providers ask for tax references to ascertain an individual's financial position when offering policies. This helps determine the appropriate premium amount and coverage based on the policyholder's income and assets.

Note: The requirements for tax references and who needs them may vary depending on the country, tax laws, or specific circumstances. It is always advisable to consult with a tax professional or refer to the relevant tax authority for accurate and up-to-date information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is a reference for tax?

A reference for tax is a document used to report income, deductions, and other financial information to the tax authorities.

Who is required to file a reference for tax?

Individuals, businesses, and other entities that have taxable income are required to file a reference for tax.

How to fill out a reference for tax?

A reference for tax can be filled out manually or electronically online using the necessary forms provided by the tax authorities.

What is the purpose of a reference for tax?

The purpose of a reference for tax is to accurately report income, deductions, and other financial information to determine tax liability.

What information must be reported on a reference for tax?

Income, deductions, credits, and other financial information must be reported on a reference for tax.

Where do I find a reference for tax?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the a reference for tax in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an eSignature for the a reference for tax in Gmail?

Create your eSignature using pdfFiller and then eSign your a reference for tax immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I complete a reference for tax on an Android device?

Use the pdfFiller Android app to finish your a reference for tax and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your a reference for tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

A Reference For Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.