Get the free Report of Independent Contractor(s) - Employment Development ... - edd ca

Show details

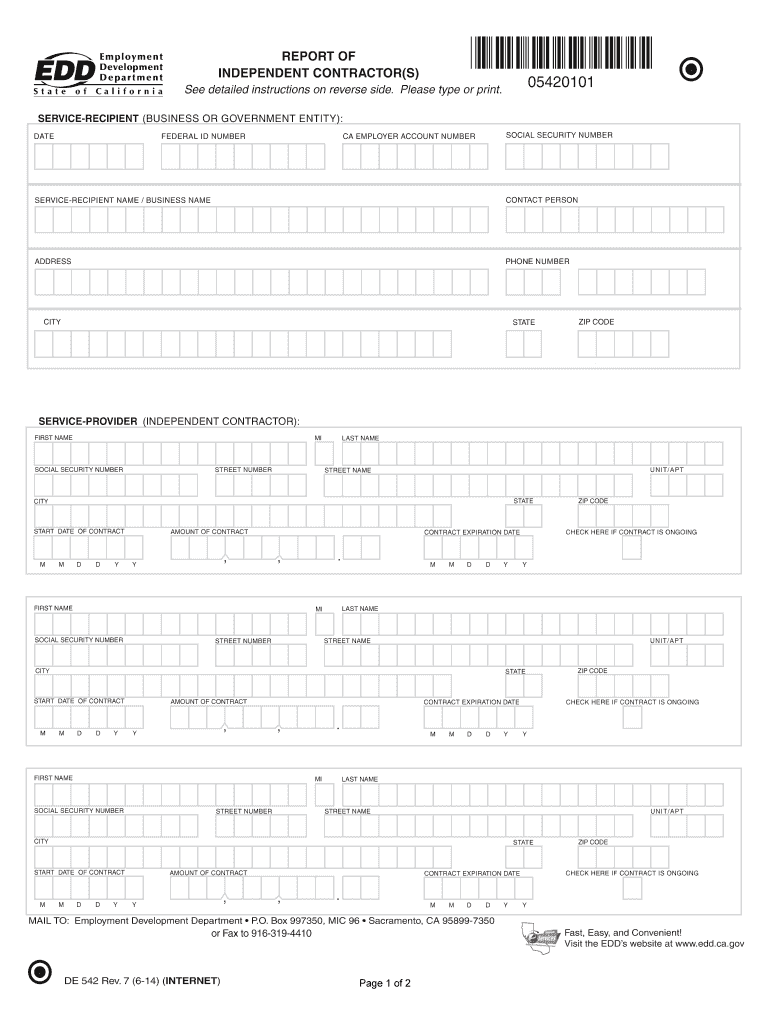

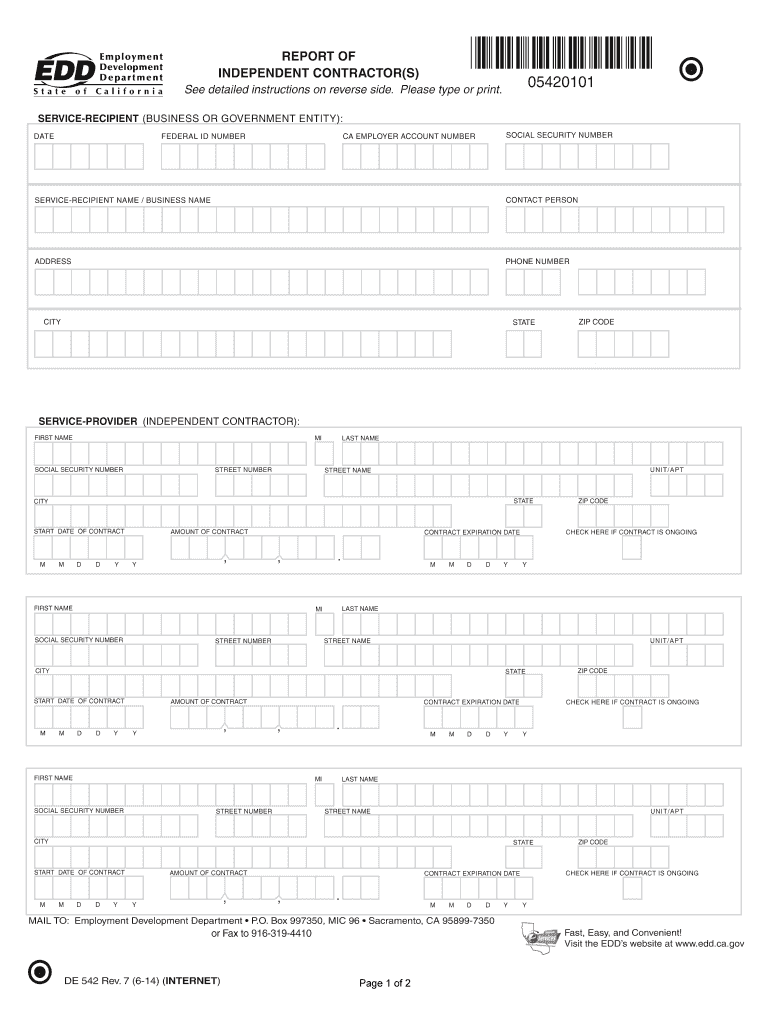

Entering into a contract for $600 or more with an independent contractor in any calendar year, ... Visit the EDD website at www.edd.ca.gov/Forms/. ... To file a DE 542 form, complete the information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign report of independent contractors

Edit your report of independent contractors form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your report of independent contractors form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing report of independent contractors online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit report of independent contractors. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out report of independent contractors

01

Start by gathering all necessary information about the independent contractors you have worked with. This may include their names, addresses, social security numbers or tax identification numbers, and the dates they provided services for your company.

02

Determine the specific requirements for the report of independent contractors based on your legal obligations and the guidelines provided by your country's tax or labor authorities. This may involve including details about the amount paid to each contractor, the nature of their services, and any applicable tax withholding information.

03

Organize the information in a clear and organized manner. You can use spreadsheet software or specialized accounting tools to input the necessary data. Create columns for each relevant detail, such as the contractor's name, tax ID, payment amount, and any tax deductions made.

04

Calculate or summarize the total payments made to each contractor during the reporting period. Ensure that all calculations are accurate to avoid any errors or discrepancies.

05

Depending on the requirements, you may need to include additional information, such as a contractor agreement or contract details, in the report. Attach any supporting documents that may be required or relevant to substantiate the information provided.

06

Review the completed report for accuracy, ensuring that all data is correctly entered and accounted for. It's important to double-check the information to minimize any potential errors or issues.

07

Submit the report to the appropriate authorities as required by law. This may involve sending it electronically through an online platform or mailing a hard copy to the designated office. Be aware of any specific deadlines or filing requirements in order to avoid penalties or fines.

Who needs a report of independent contractors?

01

Employers or companies who have engaged independent contractors for their services need a report of independent contractors.

02

Tax authorities and government agencies may require such a report to ensure proper tax compliance and to monitor the use of independent contractors in the workforce.

03

Audit or compliance departments within an organization may also require the report to maintain accurate records and ensure legal and regulatory compliance.

04

In some cases, insurance companies or legal entities may request a report of independent contractors to assess potential liabilities or risks associated with engaging independent contractors.

Overall, the report of independent contractors serves as a vital document to track and report the engagement of independent contractors, assisting in conducting proper taxation, maintaining records, and complying with legal obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify report of independent contractors without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your report of independent contractors into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit report of independent contractors in Chrome?

report of independent contractors can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I edit report of independent contractors on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing report of independent contractors.

Fill out your report of independent contractors online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Report Of Independent Contractors is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.