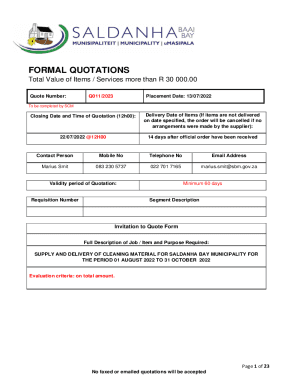

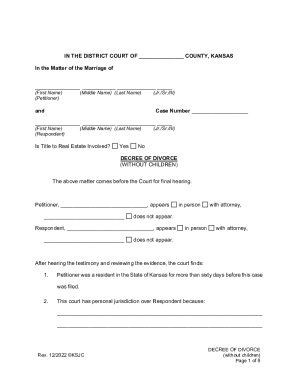

Get the free Cuyahoga River Community Reinvestment Area Tax Exemption Application

Show details

Este formulario está diseñado para que los propietarios residenciales en la Ciudad de Cuyahoga Falls puedan solicitar una exención de impuestos por la construcción o remodelación de sus viviendas,

We are not affiliated with any brand or entity on this form

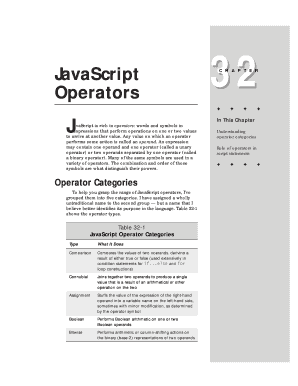

Get, Create, Make and Sign cuyahoga river community reinvestment

Edit your cuyahoga river community reinvestment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cuyahoga river community reinvestment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cuyahoga river community reinvestment online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit cuyahoga river community reinvestment. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cuyahoga river community reinvestment

How to fill out Cuyahoga River Community Reinvestment Area Tax Exemption Application

01

Obtain the Cuyahoga River Community Reinvestment Area Tax Exemption Application form from the appropriate local government website or office.

02

Read the application instructions carefully to understand the eligibility requirements and necessary documentation.

03

Fill in your personal information, including name, address, and contact details.

04

Provide detailed information about the property for which the tax exemption is being requested, including address, parcel number, and current use of the property.

05

Describe the proposed improvements or redevelopment plans for the property, including estimated costs and timelines.

06

Attach any required supporting documents, such as project plans, financial statements, or commitments from financing sources.

07

Review your application for completeness, ensuring all sections are filled out accurately.

08

Submit the application to the designated local government office, either in person or through mail, by the specified deadline.

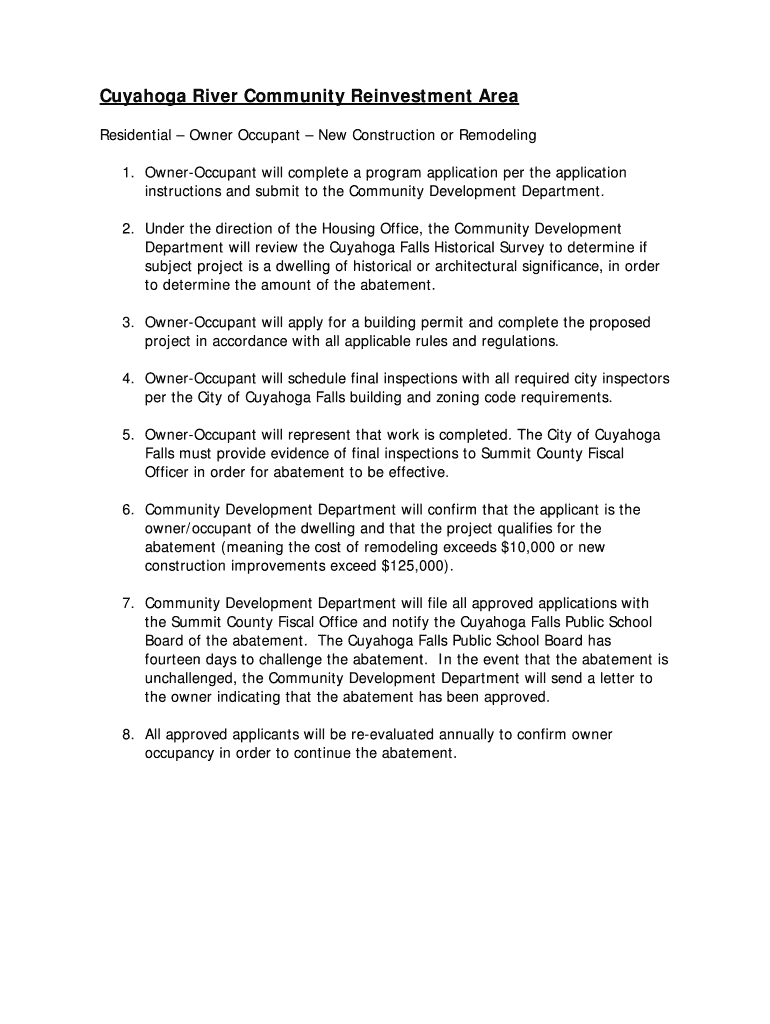

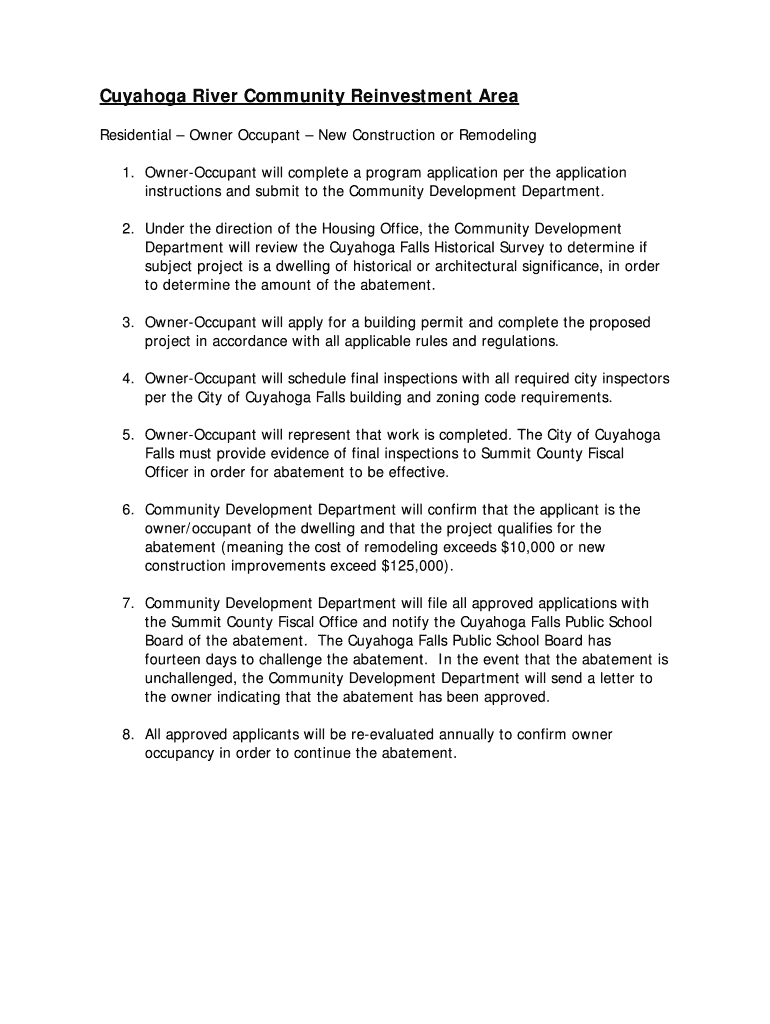

Who needs Cuyahoga River Community Reinvestment Area Tax Exemption Application?

01

Property owners and developers who are planning to invest in improvements or redevelopment within the Cuyahoga River Community Reinvestment Area.

02

Individuals or businesses seeking tax incentives to promote economic growth and revitalization in the area.

Fill

form

: Try Risk Free

People Also Ask about

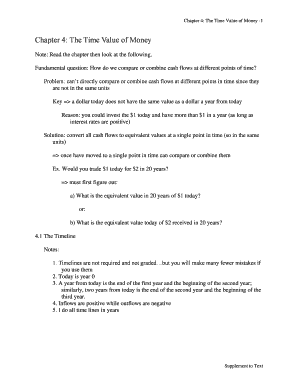

How does tax abatement work in Ohio?

Tax abatement is the City exempting a property owner from paying property taxes due to an investment of over $125,000 in new construction. Tax abatement is only granted for the increased value of a property – tax abated properties continue to pay property tax on the value of the land.

How does tax abatement work in Ohio?

Tax abatement is the City exempting a property owner from paying property taxes due to an investment of over $125,000 in new construction. Tax abatement is only granted for the increased value of a property – tax abated properties continue to pay property tax on the value of the land.

At what age do you stop paying property tax in Ohio?

Who is eligible for the Homestead Exemption program? Those eligible must be 65 years of age or older or be permanently or totally disabled, meet annual state set income requirements, and own the home where they live as of January 1st or the year in which they apply.

What does a 15 year tax abatement mean?

By freezing real estate tax assessments at the pre-improvement level over a designated period (generally five to fifteen years), tax abatements can make completing the necessary repairs financially feasible.

What is the 15 year tax abatement in Ohio?

The abatement allows owners to pay taxes on the pre-improvement assessed value of their residential property for 15 years after improvements are completed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

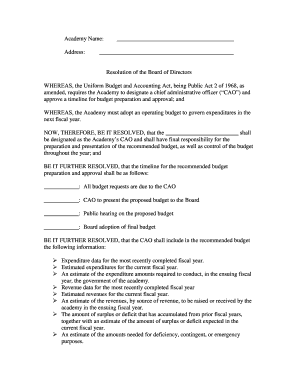

What is Cuyahoga River Community Reinvestment Area Tax Exemption Application?

The Cuyahoga River Community Reinvestment Area Tax Exemption Application is a formal request submitted by property owners seeking tax exemptions for improvements made to properties located within designated community reinvestment areas along the Cuyahoga River.

Who is required to file Cuyahoga River Community Reinvestment Area Tax Exemption Application?

Property owners who are planning to make substantial improvements to their properties in the designated Cuyahoga River Community Reinvestment Area are required to file this application.

How to fill out Cuyahoga River Community Reinvestment Area Tax Exemption Application?

To fill out the application, property owners need to provide detailed information about their property, the planned improvements, associated costs, and any other documentation required by the local municipality overseeing the reinvestment area.

What is the purpose of Cuyahoga River Community Reinvestment Area Tax Exemption Application?

The purpose of the application is to encourage investment in the Cuyahoga River area by providing tax incentives that help offset the costs of property improvements, thereby stimulating economic development in the community.

What information must be reported on Cuyahoga River Community Reinvestment Area Tax Exemption Application?

The application must report information such as the property owner's details, property address, type of improvements planned, estimated costs, timeline for the project, and any previous tax exemption applications filed.

Fill out your cuyahoga river community reinvestment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cuyahoga River Community Reinvestment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.