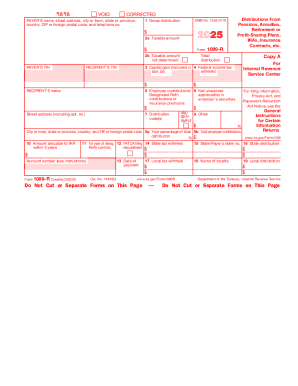

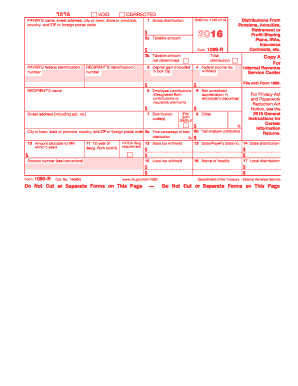

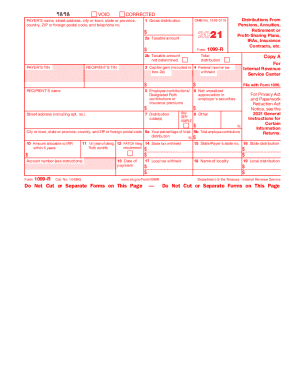

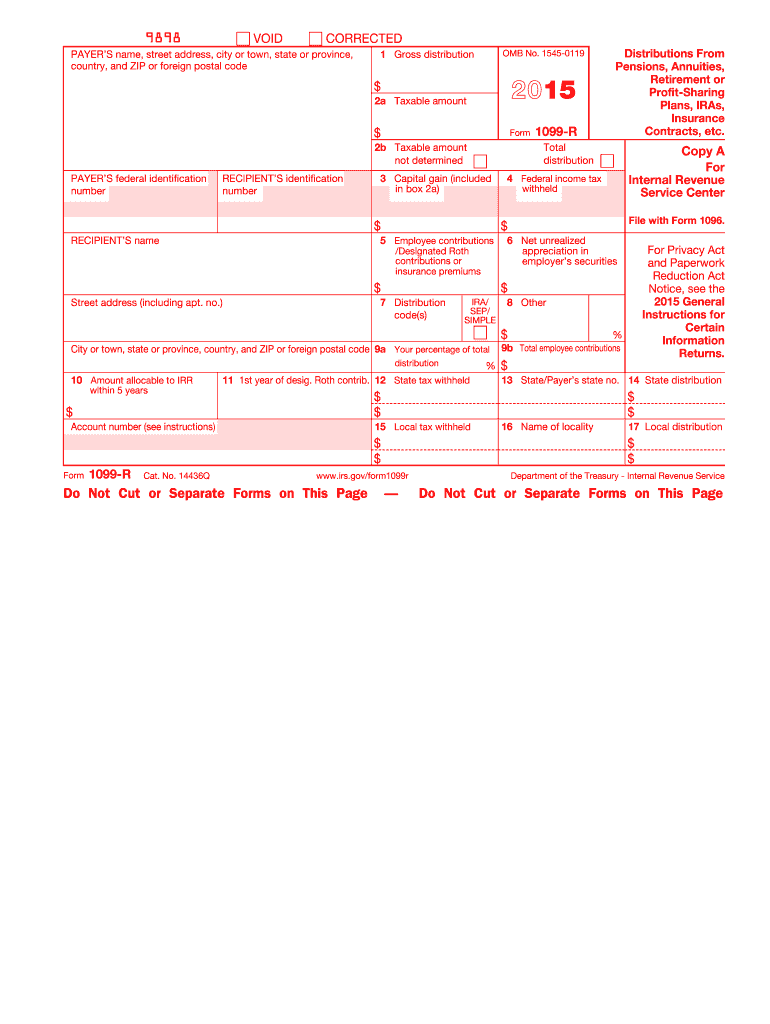

IRS 1099-R 2015 free printable template

Instructions and Help about IRS 1099-R

How to edit IRS 1099-R

How to fill out IRS 1099-R

About IRS 1099-R 2015 previous version

What is IRS 1099-R?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1099-R

What should I do if I realize I made an error on my IRS 1099-R after filing?

If you discover a mistake on your IRS 1099-R after submission, you should file a corrected form. This involves completing another IRS 1099-R with the correct information and marking it as 'Corrected.' Make sure to also provide supporting documentation if necessary to explain the corrections.

How can I track the status of my filed IRS 1099-R?

To track your filed IRS 1099-R, you can use the IRS's e-services for tax professionals or the IRS Online Account if you are an individual taxpayer. Keep in mind that e-filed forms may show updates sooner, and you should be aware of common rejection codes to troubleshoot issues effectively.

What are the privacy and data security considerations for handling IRS 1099-R?

When handling IRS 1099-R forms, it is crucial to maintain the confidentiality of sensitive information. Ensure that all electronic submissions are conducted through secure channels, and retain physical copies in locked files. Also, remember to follow the IRS guidelines on record retention periods for tax documents.

Are there special filing criteria for non-resident payees on IRS 1099-R?

Yes, non-resident payees have specific criteria when filing IRS 1099-R. Payments made to them may be subject to different tax rules, including withholding requirements. It’s essential to determine the correct tax rate and possibly issue a Form 1042-S for these types of payments to avoid issues with compliance.

What common errors should I look out for to avoid issues with my IRS 1099-R filing?

Common errors in filing IRS 1099-R include incorrect taxpayer identification numbers (TINs), reporting the wrong amount distributions, or failing to check the correct boxes for certain payments. Reviewing the submitted information thoroughly before filing can help avoid these pitfalls.

See what our users say