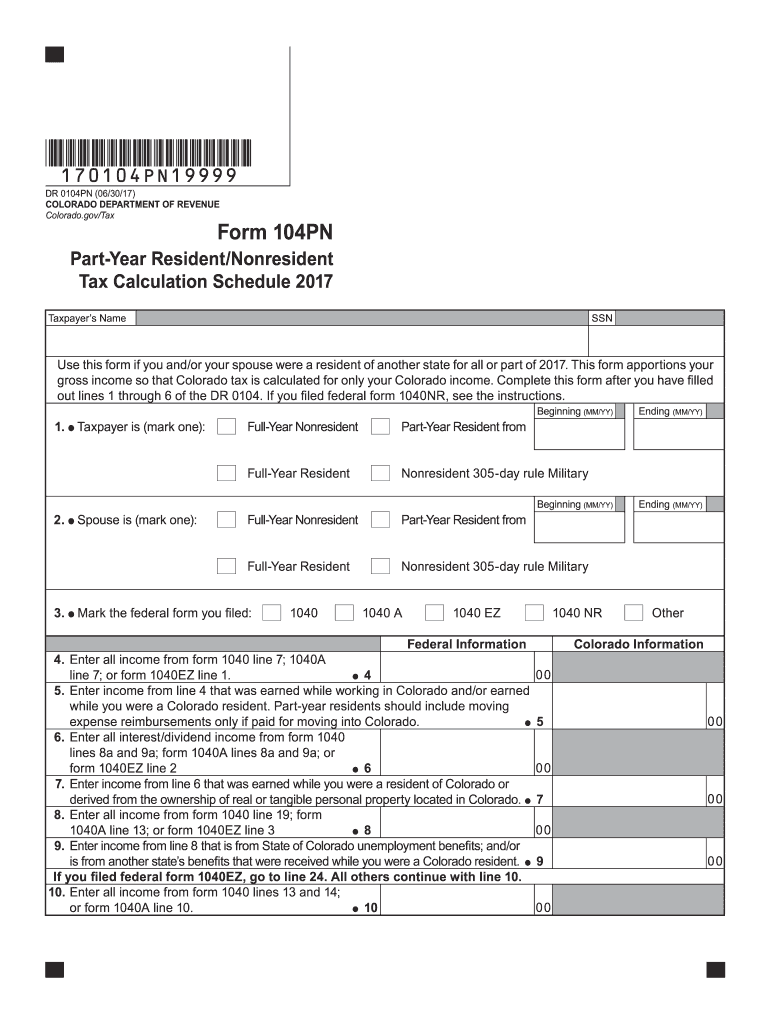

CO DoR 104PN 2014 free printable template

Instructions and Help about CO DoR 104PN

How to edit CO DoR 104PN

How to fill out CO DoR 104PN

About CO DoR 104PN 2014 previous version

What is CO DoR 104PN?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about CO DoR 104PN

What should I do if I need to correct mistakes on a submitted CO DoR 104PN?

If you discover errors after filing the CO DoR 104PN, you can submit an amended version. Ensure to clearly indicate that the new form is a correction, and provide any necessary documentation to support the changes.

How can I track the status of my CO DoR 104PN submission?

To verify the receipt and processing of your CO DoR 104PN, you can check your filing portal or contact the relevant department directly. Be prepared to provide identifying details related to your submission for faster assistance.

Are there legal considerations for e-signatures when filing the CO DoR 104PN?

Yes, e-signatures are generally accepted for the CO DoR 104PN, but it's important to ensure that your e-signature complies with legal standards. Confirm with the filing agency for any specific requirements pertaining to electronic signatures.

What common errors should I be aware of when filing the CO DoR 104PN?

Common mistakes when submitting the CO DoR 104PN include incorrect taxpayer identification numbers and misreported amounts. Double-check all entries against supporting documentation before submission to minimize errors.

What steps should I take if I receive an audit notice regarding my CO DoR 104PN?

If you receive an audit notice related to your CO DoR 104PN, review the notice carefully and gather all relevant documentation. Respond promptly and clearly address any concerns raised by the auditor, supplying additional information as needed.

See what our users say