Get the free Form LLC-1

Show details

Este documento proporciona instrucciones detalladas para completar el Formulario LLC-1, el cual es necesario para la formación de una compañía de responsabilidad limitada en New Hampshire. Incluye

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form llc-1

Edit your form llc-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form llc-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form llc-1 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form llc-1. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

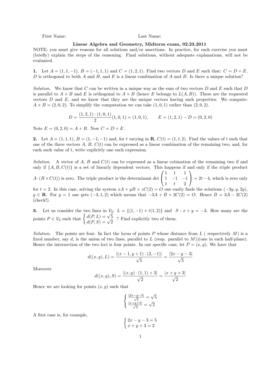

How to fill out form llc-1

How to fill out Form LLC-1

01

Obtain Form LLC-1 from the appropriate state agency website or office.

02

Fill in the name of the LLC you wish to register.

03

Provide the principal office address of the LLC.

04

List the name and address of the initial agent for service of process.

05

Indicate whether the LLC will be managed by members or managers.

06

Include the date of formation and any other required details.

07

Review the completed form for accuracy.

08

Submit the form along with any required filing fees to the appropriate state agency.

Who needs Form LLC-1?

01

Individuals or groups looking to establish a Limited Liability Company (LLC) in their state.

02

Entrepreneurs who want to separate personal liability from business liabilities.

03

Business owners seeking to formalize their business structure for legal recognition.

Fill

form

: Try Risk Free

People Also Ask about

What is LLC in English?

State-by-state filing fees StateDomestic LLCForeign LLC California $70 $70 Colorado $50 $100 Connecticut $120 $120 Delaware $110 $20049 more rows • Jan 18, 2025

Is an LLC good or bad?

LLC members, who are considered owners of the business, can't be on the regular payroll like regular employees. Instead, they receive their income in two main ways: by getting a share of the company's profits (known as taking a "draw") or by receiving a guaranteed payment for the services they provide to the LLC.

What is the $800 fee for LLC in California?

Limited liability company (LLC)

What exactly does LLC stand for?

Key takeaways. LLC stands for limited liability company, which means its members are not personally liable for the company's debts. LLCs are taxed on a “pass-through” basis — all profits and losses are filed through the member's personal tax return.

What is an LLC 1?

Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form LLC-1?

Form LLC-1 is the legal document required to register a Limited Liability Company (LLC) in certain jurisdictions, such as California.

Who is required to file Form LLC-1?

Individuals or entities wishing to establish an LLC in the respective jurisdiction must file Form LLC-1.

How to fill out Form LLC-1?

To fill out Form LLC-1, you need to provide details such as the LLC's name, the address of the principal office, and the names of the members or managers.

What is the purpose of Form LLC-1?

The purpose of Form LLC-1 is to officially create and register the LLC, allowing it to operate as a distinct legal entity.

What information must be reported on Form LLC-1?

Form LLC-1 generally requires information including the LLC's name, address, the names of the members or managers, and the registered agent's contact information.

Fill out your form llc-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Llc-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.