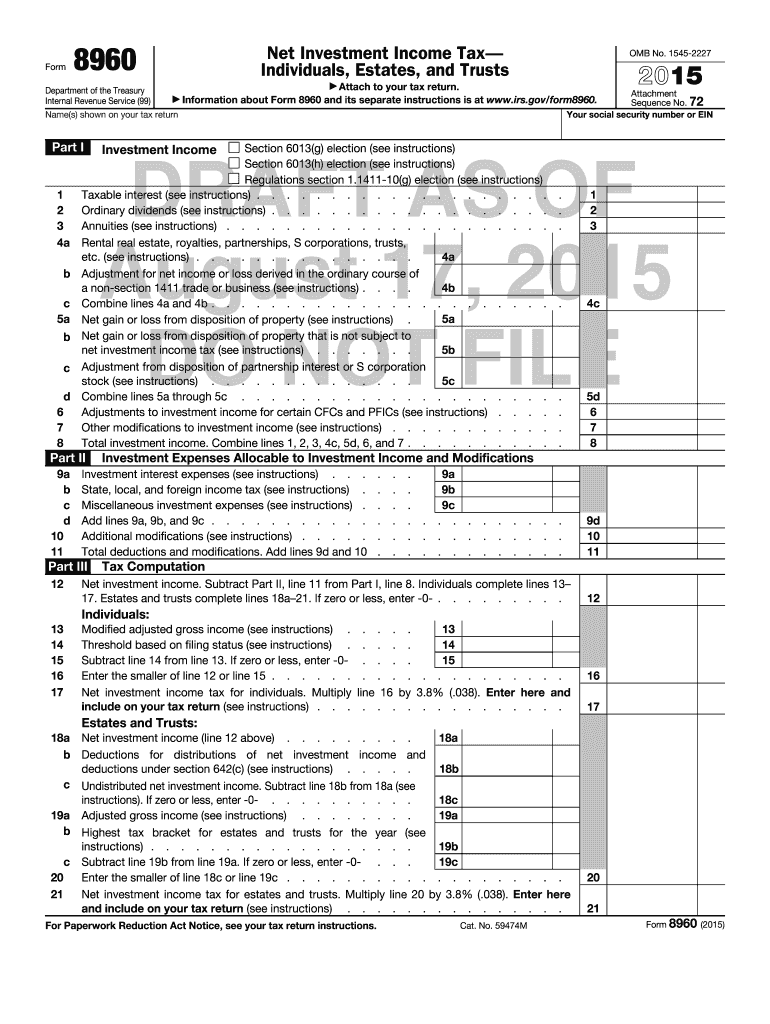

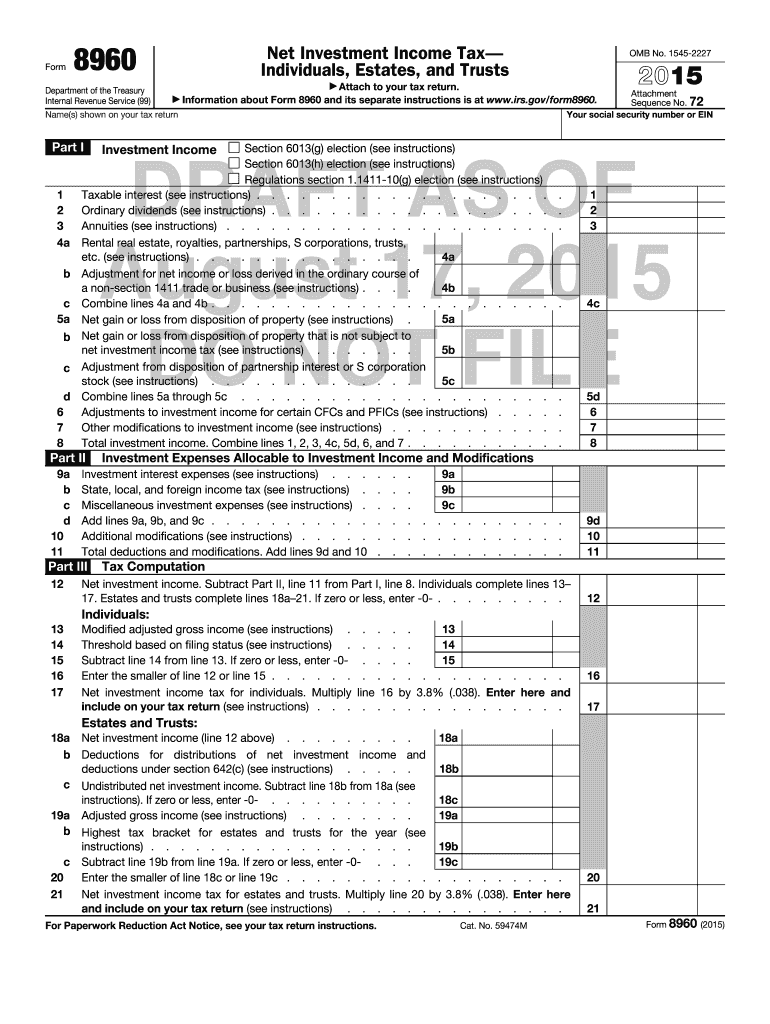

Get the free 1411-10(g) election (see instructions) - eitc irs

Show details

25 Sep 2013 ... o Determining the EIC phaseout by multiplying the .... http://www.irs.gov/pub/irs- DFT/f8960--dft.pdf.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1411-10g election see instructions

Edit your 1411-10g election see instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1411-10g election see instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 1411-10g election see instructions online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 1411-10g election see instructions. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1411-10g election see instructions

How to Fill Out 1411-10g Election (See Instructions):

01

Obtain the form: The 1411-10g election form can typically be found on the official website of the relevant tax authority or obtained from a tax professional.

02

Review the instructions: Before filling out the form, it is crucial to carefully read and understand the instructions provided. These instructions will guide you through the process and explain the necessary information.

03

Provide personal information: Begin by filling out the required personal information, such as your name, address, and taxpayer identification number (TIN).

04

Identify the election being made: Clearly specify the election you are making by referencing the appropriate section and paragraph numbers from the tax code or regulations. Ensure you accurately state the purpose of the election and any relevant details.

05

Attach supporting documents if required: Depending on the specific circumstances related to the election, you may need to include supporting documents. These documents should be securely attached to the form, providing evidence or additional information supporting your election.

06

Review and verify: After completing the form, carefully review each section to ensure accuracy and completeness. Confirm that all necessary information has been provided and that there are no errors or omissions.

07

Submit the form: Once you are confident that the form is accurately filled out, sign it and submit it according to the instructions provided. This may involve mailing it to the appropriate tax authority or utilizing an electronic filing system.

Who Needs 1411-10g Election (See Instructions)?

01

Taxpayers with specific circumstances: The 1411-10g election is typically used by taxpayers facing unique situations that require them to make an election or claim a specific tax benefit. These circumstances may include certain business or investment activities, ownership of specific assets, or qualification for specific tax deductions or credits.

02

Individuals seeking tax optimization: Some taxpayers may choose to make the 1411-10g election to optimize their tax situation. By understanding the tax code and regulations thoroughly and utilizing the election option, individuals may be able to reduce their tax liability or take advantage of beneficial tax provisions.

03

Tax professionals: Tax professionals, such as accountants or tax attorneys, commonly assist clients who may need to make the 1411-10g election. They have the expertise to navigate complex tax regulations and ensure that the election is made correctly to maximize benefits for their clients.

Fill

form

: Try Risk Free

People Also Ask about

What is a Section 1411 trade or business?

1411 Trade or Business: This line is used to enter the net positive or net negative amount for certain items included in line 4a that are not included in determining net investment income (NII); for instance, net income or loss from a section 162 trade or business that is not a passive activity and is not engaged in a

What is excessive investment income for EIC?

To be eligible for the EITC, a taxpayer must have earnings but cannot have investment income in excess of a specified level. For 2022, the maximum level of investment income was set at $10,300, increasing to $11,000 in 2023. Age, relationship, and residency requirements also apply with respect to qualifying dependents.

What is excess investment income for EIC purposes?

To be eligible for the EITC, a taxpayer must have earnings but cannot have investment income in excess of a specified level. For 2022, the maximum level of investment income was set at $10,300, increasing to $11,000 in 2023. Age, relationship, and residency requirements also apply with respect to qualifying dependents.

Is investment income part of earned income?

Investment income is usually taxed as capital gains, which tend to face a lower tax rate than earned income.

What is an IRS Section 1411 adjustment?

The Net Investment Income Tax is imposed by section 1411 of the Internal Revenue Code. The NIIT applies at a rate of 3.8% to certain net investment income of individuals, estates and trusts that have income above the statutory threshold amounts.

What is the IRS regulation 1.1411 10g?

This section provides rules that apply to an individual, estate, or trust that is a United States shareholder of a controlled foreign corporation (CFC), or that is a United States person that directly or indirectly owns an interest in a passive foreign investment company (PFIC).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit 1411-10g election see instructions on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign 1411-10g election see instructions. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I edit 1411-10g election see instructions on an Android device?

With the pdfFiller Android app, you can edit, sign, and share 1411-10g election see instructions on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

How do I complete 1411-10g election see instructions on an Android device?

Use the pdfFiller app for Android to finish your 1411-10g election see instructions. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your 1411-10g election see instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1411-10g Election See Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.