Get the free Fundamentals of pension accounting and funding

Show details

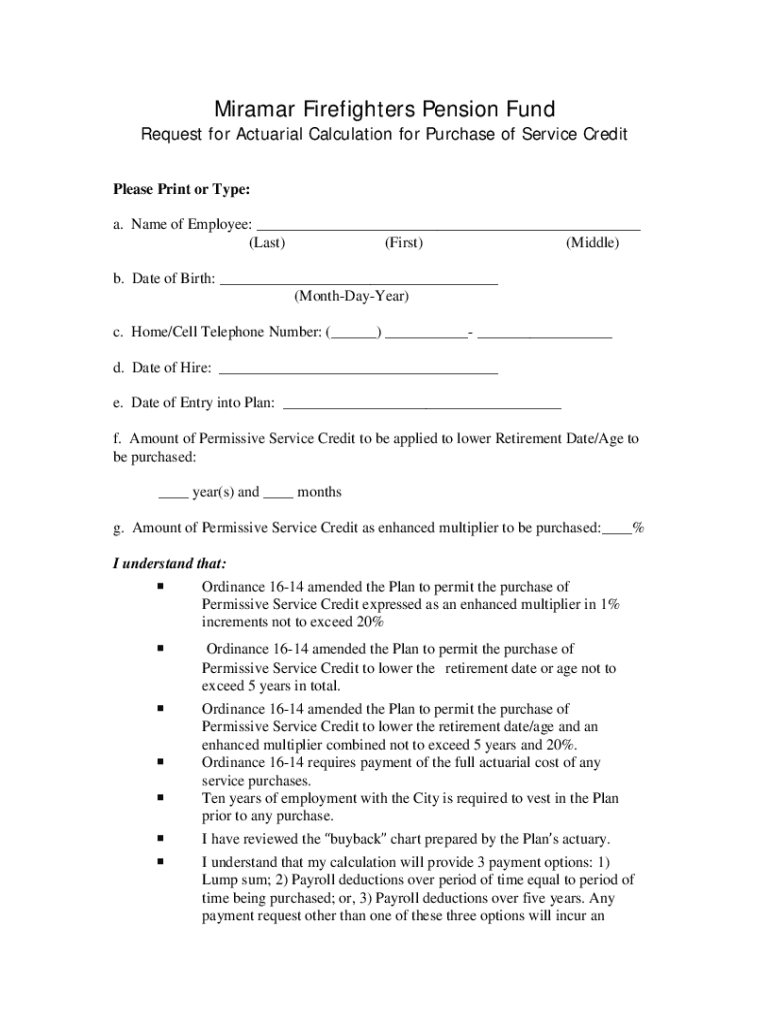

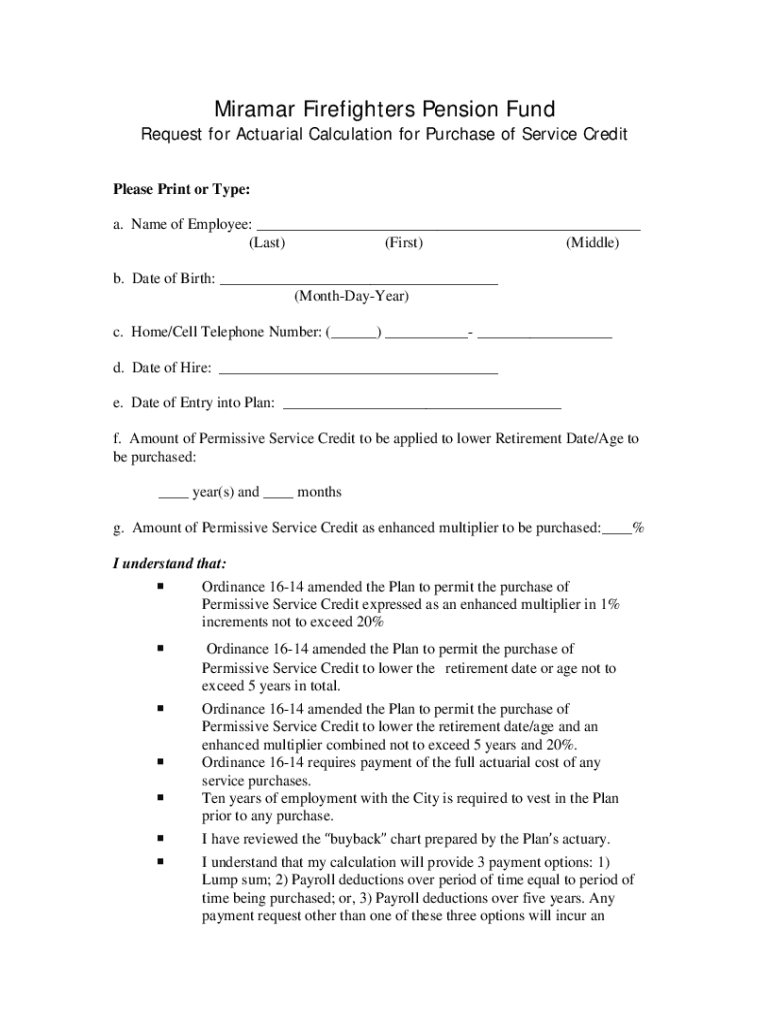

Miramar Firefighters Pension FundRequest for Actuarial Calculation for Purchase of Service Credit

Please Print or Type:

a. Name of Employee: ___

(Last)

(First)

(Middle)

b. Date of Birth: ___

(MonthDayYear)

c.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fundamentals of pension accounting

Edit your fundamentals of pension accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fundamentals of pension accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fundamentals of pension accounting online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit fundamentals of pension accounting. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fundamentals of pension accounting

How to fill out fundamentals of pension accounting

01

Gather information on the company's pension plan, including details on employee benefits, contributions, and investment returns.

02

Identify the key assumptions and estimates used in pension accounting, such as the discount rate, salary growth rate, and mortality estimates.

03

Calculate the funded status of the pension plan by comparing the fair value of plan assets to the projected benefit obligation.

04

Record pension expense and any gains or losses in the income statement, and disclose relevant information in the financial statements.

05

Prepare the required disclosures in the footnotes to the financial statements, including details on pension assets, liabilities, and costs.

06

Review the pension accounting disclosures with management, auditors, and stakeholders to ensure compliance with relevant accounting standards.

Who needs fundamentals of pension accounting?

01

Accounting professionals who work for companies with employee pension plans.

02

Financial analysts who analyze the financial statements of companies with pension obligations.

03

Investors and creditors who need to understand the impact of pension accounting on a company's financial position and performance.

04

Regulators and standard setters who monitor compliance with accounting standards related to pension accounting.

05

Employees who participate in or are affected by their company's pension plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit fundamentals of pension accounting online?

With pdfFiller, the editing process is straightforward. Open your fundamentals of pension accounting in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my fundamentals of pension accounting in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your fundamentals of pension accounting directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Can I edit fundamentals of pension accounting on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as fundamentals of pension accounting. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is fundamentals of pension accounting?

Fundamentals of pension accounting encompass the principles and guidelines for recording and reporting pension-related transactions and obligations.

Who is required to file fundamentals of pension accounting?

Organizations that offer pension plans to their employees are required to file fundamentals of pension accounting.

How to fill out fundamentals of pension accounting?

Fundamentals of pension accounting are typically filled out by accounting professionals who are knowledgeable in pension regulations and accounting standards.

What is the purpose of fundamentals of pension accounting?

The purpose of fundamentals of pension accounting is to ensure accurate and transparent reporting of pension-related transactions and obligations.

What information must be reported on fundamentals of pension accounting?

Fundamentals of pension accounting typically include information on pension contributions, investment earnings, benefit payments, and actuarial assumptions.

Fill out your fundamentals of pension accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fundamentals Of Pension Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.