Get the free 2010 schedule c ez form - irsvideos

Instructions and Help about IRS 1040 - Schedule C-EZ

How to edit IRS 1040 - Schedule C-EZ

How to fill out IRS 1040 - Schedule C-EZ

About IRS 1040 - Schedule C-EZ 2010 previous version

What is IRS 1040 - Schedule C-EZ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about 2010 schedule c ez

How can I manage my [SKS] directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your [SKS] along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Where do I find [SKS]?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific [SKS] and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I sign the [SKS] electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your [SKS] in seconds.

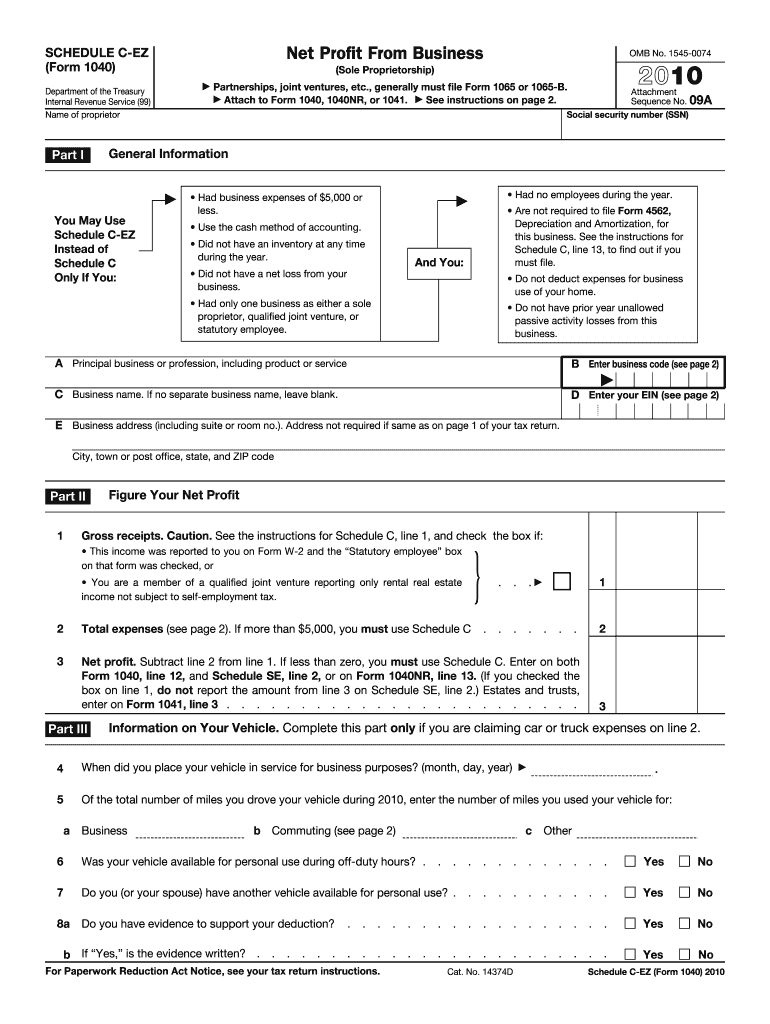

What is IRS 1040 - Schedule C-EZ?

IRS 1040 - Schedule C-EZ is a simplified version of Schedule C, used to report income or loss from a sole proprietorship. It's designed for small businesses with uncomplicated income and expenses.

Who is required to file IRS 1040 - Schedule C-EZ?

Taxpayers with a business that meets certain criteria, including having no inventory, having expenses that do not exceed $5,000, and operating as a sole proprietorship can file Schedule C-EZ.

How to fill out IRS 1040 - Schedule C-EZ?

To fill out Schedule C-EZ, taxpayers must report their business income and certain expenses, including the total income, expenses, and net profit or loss. Only simple and straightforward information is required.

What is the purpose of IRS 1040 - Schedule C-EZ?

The purpose of Schedule C-EZ is to simplify the process of reporting business income and expenses for small businesses, making it easier for sole proprietors to comply with tax regulations.

What information must be reported on IRS 1040 - Schedule C-EZ?

Taxpayers must report their business name, income from business, expenses, and the net profit or loss. They need to ensure the expenses do not exceed $5,000 and adhere to eligibility requirements.