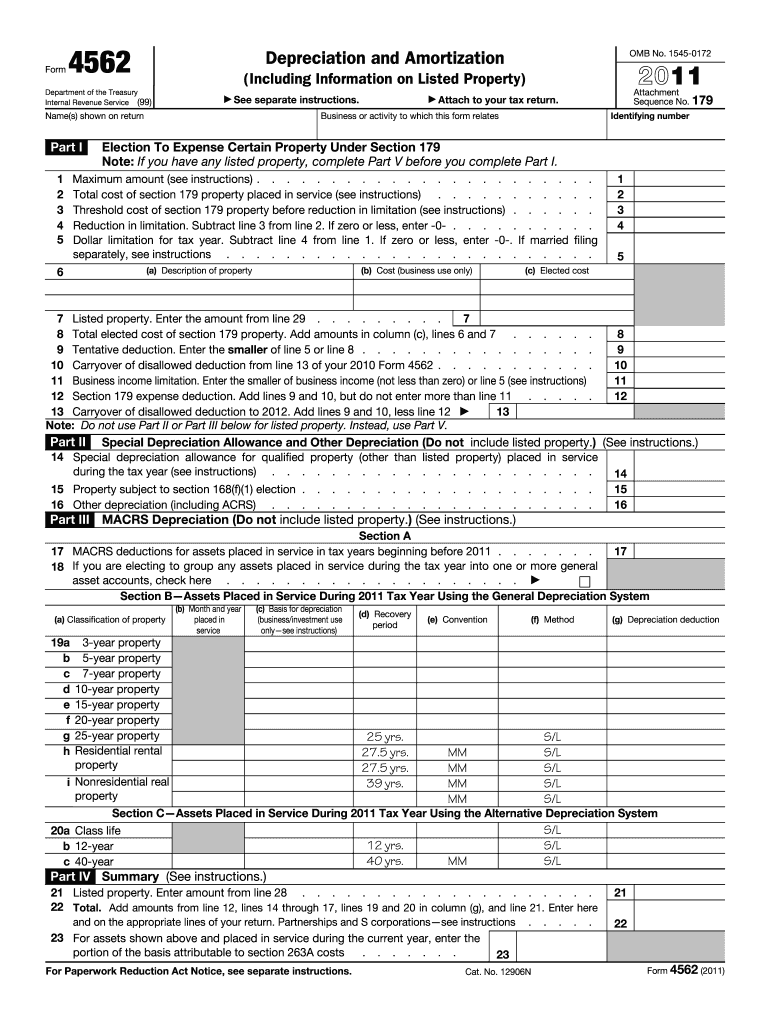

IRS 4562 2011 free printable template

Instructions and Help about IRS 4562

How to edit IRS 4562

How to fill out IRS 4562

About IRS 4 previous version

What is IRS 4562?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 4562

What should I do if I made a mistake on my IRS 4562?

If you made an error on your IRS 4562, you can file an amended return using Form 1040-X, which allows you to correct mistakes on previous filings. Ensure that you include a corrected IRS 4562 with the amended return. It's essential to keep records of your original and amended documents for your records.

How can I verify the status of my submitted IRS 4562?

To verify the status of your IRS 4562, you can use the IRS's online tool for checking the status of your e-filed return. You may also receive confirmation via email if you e-filed. Additionally, keep an eye out for any notices sent by the IRS regarding your filing status.

Can I file IRS 4562 on behalf of someone else?

Yes, you can file IRS 4562 on behalf of someone else if you have obtained a Power of Attorney (POA) from them. This document authorizes you to act on their behalf for tax purposes and is necessary to ensure compliance with IRS regulations when filing forms for others.

What are the common errors that people make when filing IRS 4562 and how can I avoid them?

Common errors when filing IRS 4562 include incorrect asset descriptions, overstating or understating depreciation amounts, and failing to include necessary attachments. To avoid these pitfalls, double-check all entries for accuracy, ensure that you use the correct asset classification, and review IRS guidelines to ensure compliance.

What should I do if I receive a notice from the IRS regarding my IRS 4562?

Receiving a notice from the IRS related to your IRS 4562 should prompt you to review the document and the IRS communication carefully. Respond promptly with any necessary documentation or clarification, and consider consulting a tax professional if the notice pertains to significant discrepancies or potential penalties.

See what our users say