Get the free Estate or Trust - Nebraska Department of Revenue - Nebraska.gov

Show details

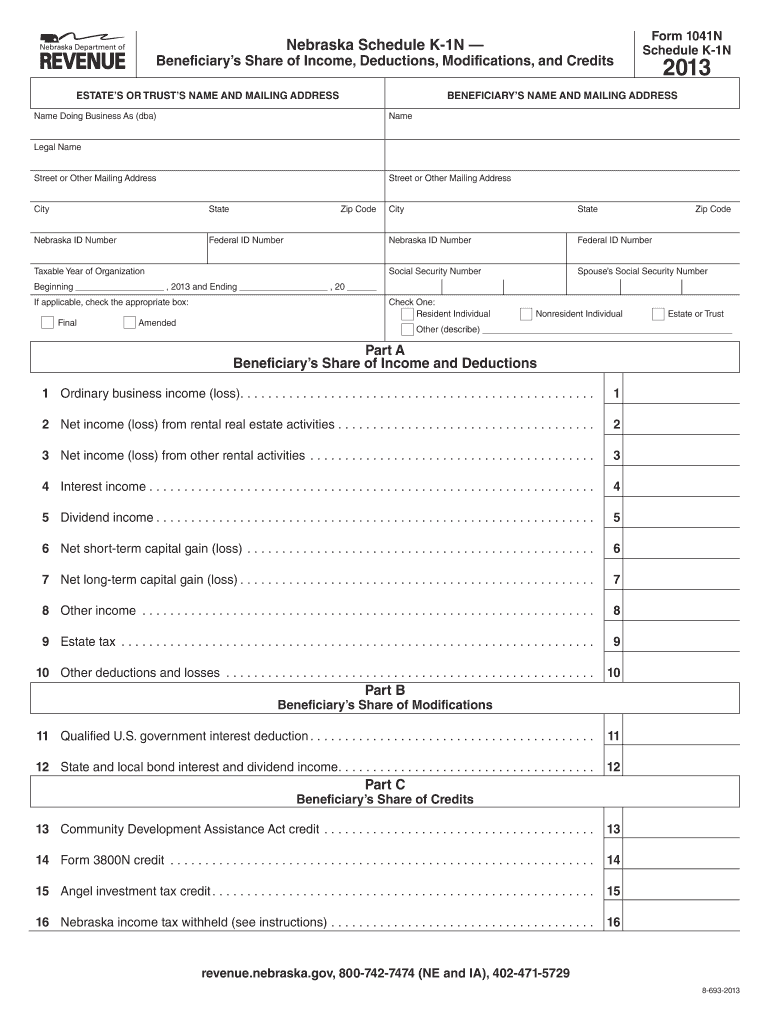

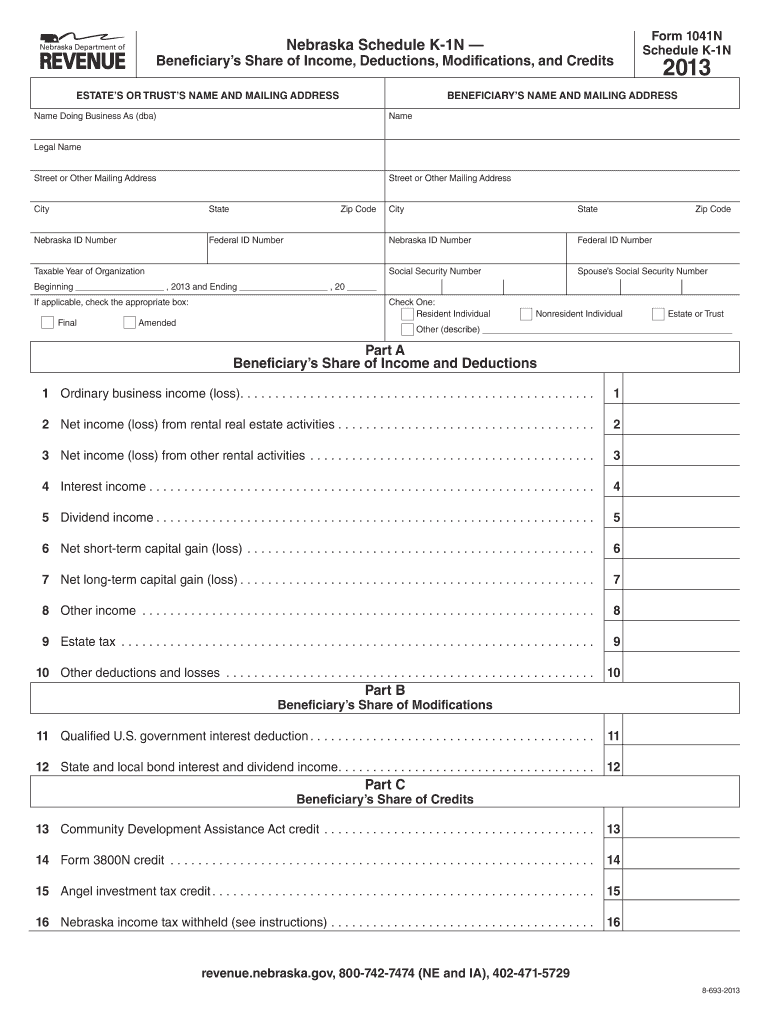

PRINT RESET Nebraska Schedule K-1 N Beneficiary s Share of Income, Deductions, Modifications, and Credits ESTATE S OR TRUST S NAME AND MAILING ADDRESS Form 1041 N Schedule K1 IN 2013 BENEFICIARY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign estate or trust

Edit your estate or trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your estate or trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit estate or trust online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit estate or trust. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out estate or trust

How to fill out estate or trust?

01

Determine the type of estate or trust: The first step is to understand the type of estate or trust you are dealing with. Whether it is a living trust, testamentary trust, or estate, each may have different requirements and legal implications.

02

Gather necessary documents: Next, gather all the necessary documents related to the estate or trust. This may include the will, trust documents, financial statements, beneficiary information, and any other relevant paperwork.

03

Identify and value assets: Identify all the assets held by the estate or trust. This may include real estate, bank accounts, investments, business interests, and personal property. Assign a value to each asset, either by obtaining appraisals or through reliable market assessments.

04

Inventory outstanding debts and liabilities: Determine the outstanding debts and liabilities associated with the estate or trust. This may include mortgages, loans, taxes, credit card debts, and any other financial obligations. Make sure to document and address these liabilities appropriately.

05

Appoint an executor or trustee: If one has not already been designated, select an executor or trustee to oversee the administration of the estate or trust. This person should be trustworthy, capable, and willing to fulfill their duties according to the law.

06

Complete necessary legal forms: Prepare and complete any legal forms or documents required for the estate or trust administration. This may involve filing court forms, obtaining necessary licenses, and adhering to local regulations.

07

Distribute assets and fulfill obligations: Once all the necessary legal and administrative steps have been taken, distribute the assets of the estate or trust according to the terms outlined in the will or trust agreement. Additionally, make sure all outstanding financial obligations and tax requirements are met.

Who needs estate or trust?

01

Individuals with substantial assets: People who have significant wealth or assets may choose to set up an estate or trust to ensure the smooth transfer of their assets to their beneficiaries after their passing. This allows for greater control over how their assets are distributed and reduces the burden on their loved ones.

02

Families with minor children: Parents who have minor children may use an estate or trust to prepare for their children's future. By appointing a trustee and outlining specific instructions for the use of funds, parents can ensure the financial security of their children until they reach adulthood.

03

Individuals with complex financial situations: For individuals with complicated financial situations, such as business owners, shareholders, or individuals with multiple properties, creating an estate or trust can help simplify and streamline the management of their assets.

In summary, filling out an estate or trust involves understanding the type of estate or trust, gathering relevant documents, identifying and valuing assets, inventorying liabilities, appointing an executor or trustee, completing legal forms, and distributing assets. Estate or trust plans are suitable for individuals with substantial assets, families with minor children, and individuals with complex financial situations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my estate or trust directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign estate or trust and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send estate or trust to be eSigned by others?

When you're ready to share your estate or trust, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I execute estate or trust online?

Easy online estate or trust completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

What is estate or trust?

Estate or trust is a legal entity created to hold assets on behalf of beneficiaries.

Who is required to file estate or trust?

The executor or trustee of the estate or trust is required to file.

How to fill out estate or trust?

To fill out estate or trust, you will need to gather all relevant financial information and complete the necessary tax forms.

What is the purpose of estate or trust?

The purpose of estate or trust is to manage and distribute assets according to the wishes of the deceased or grantor.

What information must be reported on estate or trust?

Information such as income, deductions, distributions, and taxes paid must be reported on estate or trust.

Fill out your estate or trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Estate Or Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.