Get the free fiscal year end (See page 11)

Show details

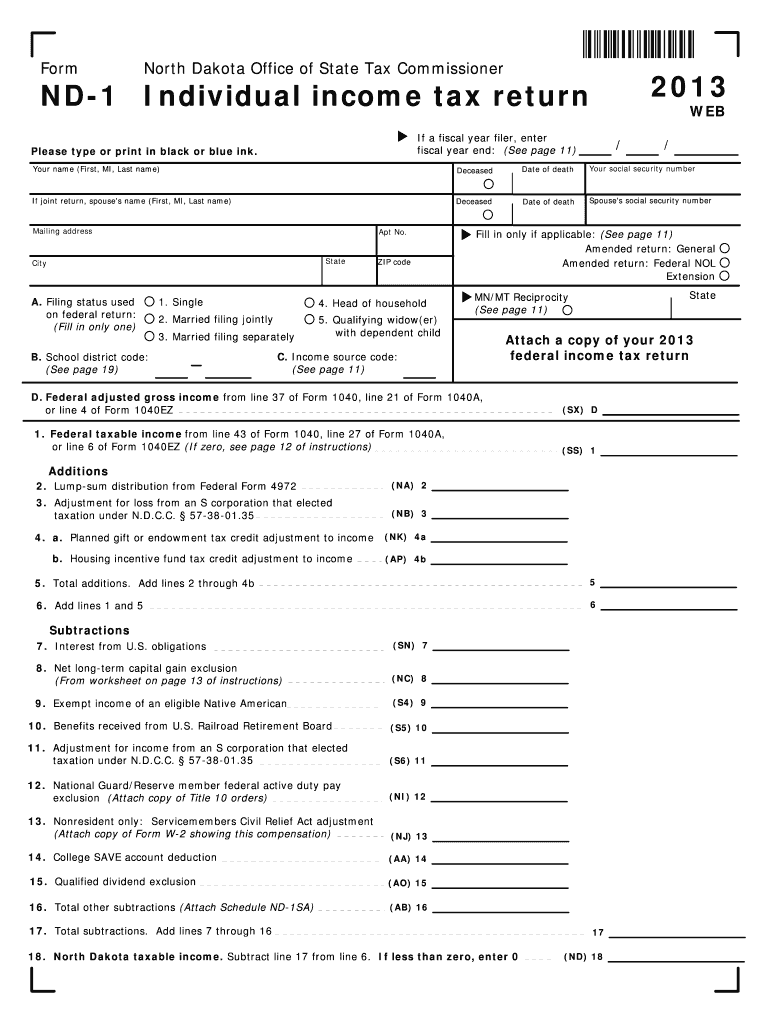

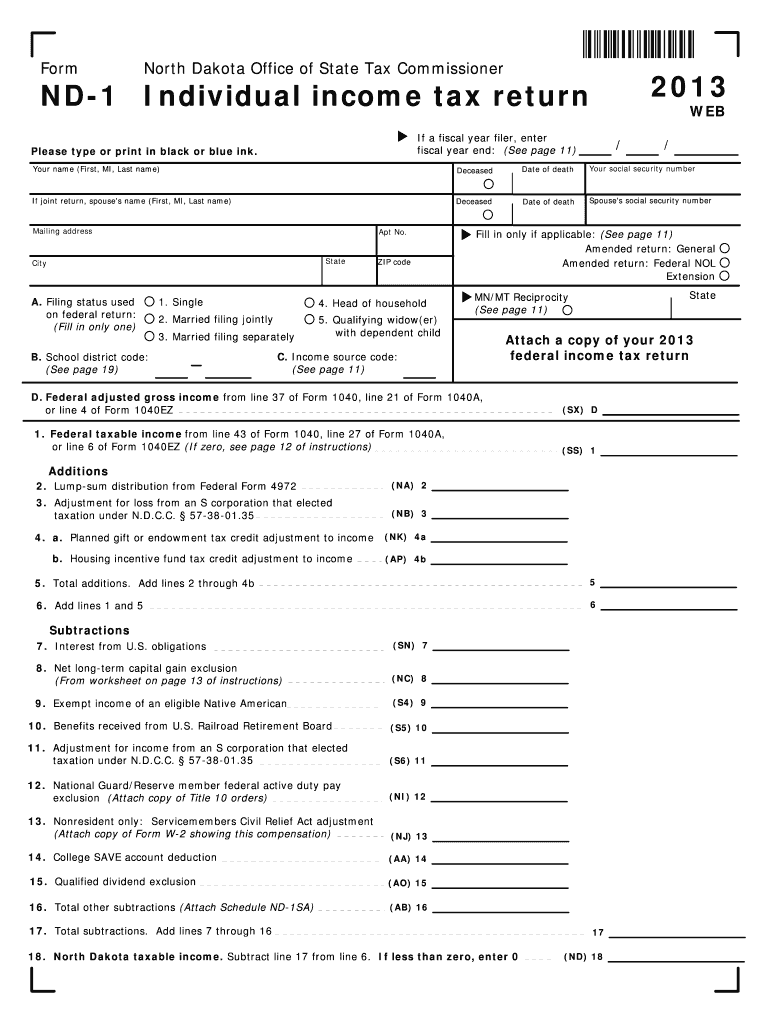

North Dakota Office of State Tax Commissioner. ND-1 Individual income tax return. 2013. 13. Nonresident only: Service members Civil Relief Act adjustment.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fiscal year end see

Edit your fiscal year end see form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fiscal year end see form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fiscal year end see online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fiscal year end see. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fiscal year end see

How to fill out fiscal year end see:

01

Begin by gathering all the necessary financial documentation, including income statements, balance sheets, and cash flow statements. These records should accurately reflect your company's financial activities throughout the fiscal year.

02

Review the financial records and ensure that all transactions are accurately recorded and classified. This step is crucial to ensure the integrity of your financial statements.

03

Calculate and record any necessary adjustments, such as depreciation or accruals, to accurately reflect the financial position of your company at the end of the fiscal year.

04

Prepare the income statement, which shows the revenue and expenses incurred during the fiscal year. Make sure to include all relevant revenue sources and correctly categorize expenses.

05

Compose the balance sheet, which provides a snapshot of your company's assets, liabilities, and equity at the end of the fiscal year. Double-check that all assets and liabilities are properly accounted for and classified.

06

Generate the cash flow statement, which details the cash inflows and outflows during the fiscal year. This statement is crucial in assessing your company's ability to generate cash and meet its financial obligations.

07

Perform a thorough review of all the financial statements to ensure accuracy and completeness. Look for any discrepancies or errors that might require correction.

08

Once you are confident in the accuracy of the financial statements, finalize them by organizing and presenting them in a professional manner. This includes ensuring that all necessary disclosures are provided.

Who needs fiscal year end see:

01

Businesses of all sizes and types require fiscal year end see. It is a critical process for accounting and financial reporting purposes.

02

Government agencies and non-profit organizations also need to complete fiscal year end see to fulfill their regulatory requirements and demonstrate transparency in their financial operations.

03

Investors and shareholders rely on fiscal year end see to assess the financial performance and stability of a company. These reports provide valuable insights into the company's profitability, liquidity, and overall financial health.

In summary, properly filling out the fiscal year end see involves gathering, reviewing, adjusting, and compiling all relevant financial information. This process is important for businesses, government agencies, non-profit organizations, and stakeholders who rely on accurate and comprehensive financial statements to make informed decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit fiscal year end see from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including fiscal year end see, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I create an electronic signature for signing my fiscal year end see in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your fiscal year end see right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out fiscal year end see on an Android device?

Use the pdfFiller mobile app to complete your fiscal year end see on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is fiscal year end see?

The fiscal year end see is the date on which a company's financial year ends, it is usually the last day of a specific month.

Who is required to file fiscal year end see?

All companies and organizations are required to file a fiscal year end see in order to report their financial performance for the year.

How to fill out fiscal year end see?

To fill out a fiscal year end see, companies must gather all financial data and information for the entire year and prepare financial statements such as income statement, balance sheet, and cash flow statement.

What is the purpose of fiscal year end see?

The purpose of fiscal year end see is to provide stakeholders with a comprehensive overview of the company's financial performance and position for the year.

What information must be reported on fiscal year end see?

On fiscal year end see, companies must report their revenue, expenses, net income, assets, liabilities, and shareholders' equity.

Fill out your fiscal year end see online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fiscal Year End See is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.