Get the free FORM 1040XN Amended Nebraska Individual Income Tax Return

Instructions and Help about form 1040xn amended nebraska

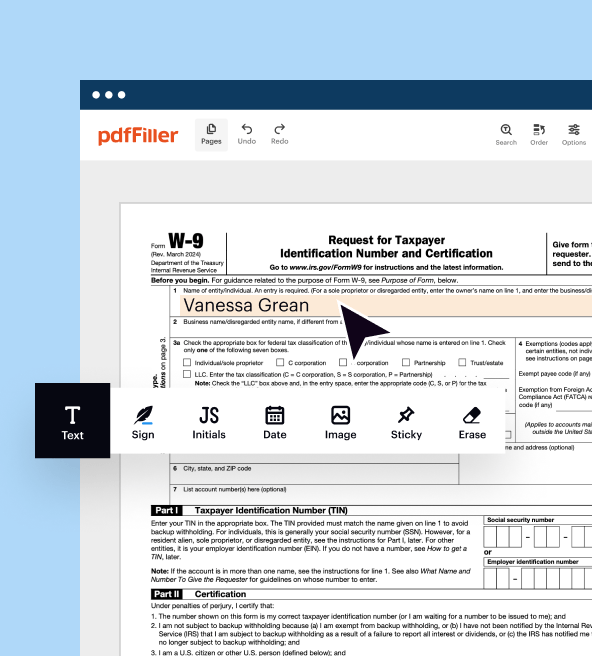

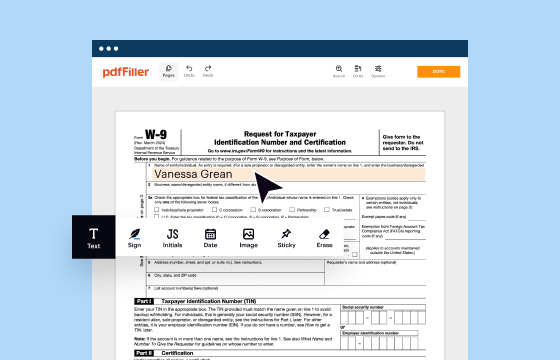

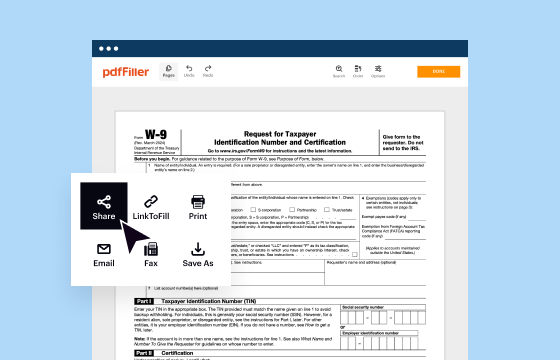

How to edit form 1040xn amended nebraska

How to fill out form 1040xn amended nebraska

Latest updates to form 1040xn amended nebraska

All You Need to Know About form 1040xn amended nebraska

What is form 1040xn amended nebraska?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

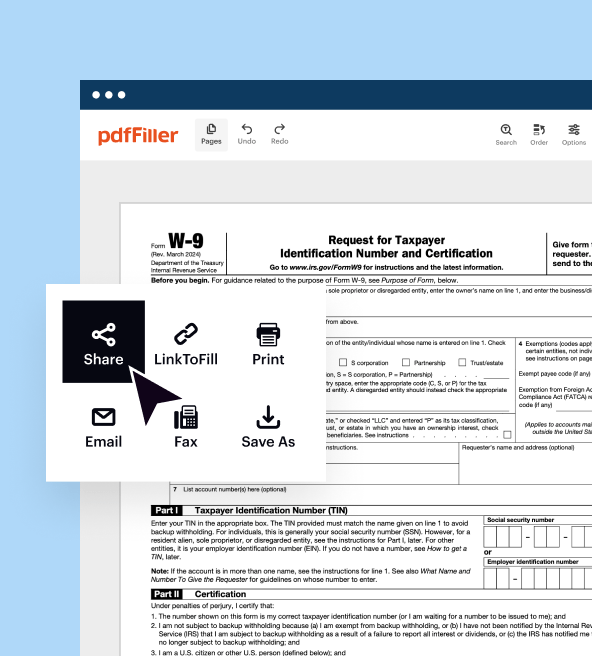

Where do I send the form?

FAQ about form 1040xn amended nebraska

What should I do if I realize I've made a mistake after submitting form 1040xn amended nebraska?

If you've discovered an error after filing your form 1040xn amended nebraska, you can file another amended return to correct the mistakes. Ensure you clearly indicate which sections were incorrect and provide the correct information. It's crucial to keep documentation of both versions of the form for your records.

How can I check the status of my submitted form 1040xn amended nebraska?

To track the status of your form 1040xn amended nebraska, you can contact the Nebraska Department of Revenue directly or check their online portal if available. Provide your details such as Social Security number and filing year for efficient tracking.

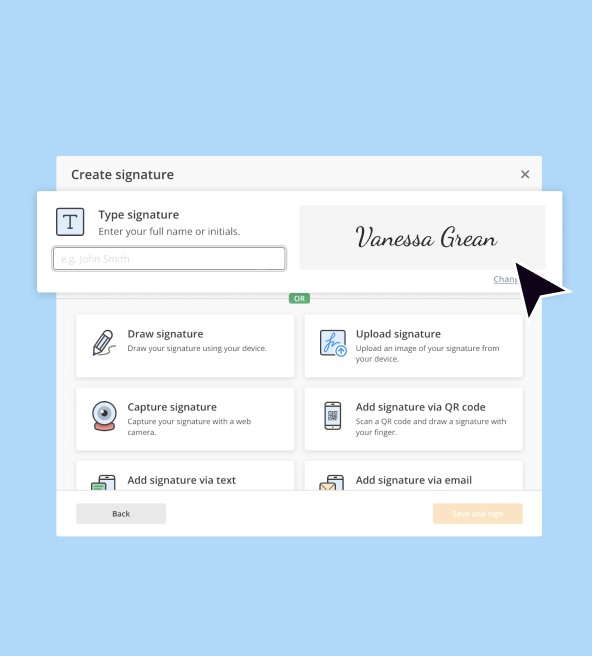

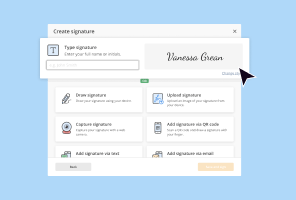

What should I remember regarding electronic signatures when submitting form 1040xn amended nebraska?

When e-filing your form 1040xn amended nebraska, ensure your electronic signature meets the Nebraska Department of Revenue's requirements. Using a reliable e-filing software helps maintain compliance with signature regulations to authenticate your submission.

Are there specific common errors I should look out for when filing form 1040xn amended nebraska?

Common errors for form 1040xn amended nebraska include incorrect calculation of tax owed or refund and failing to include all necessary supporting documentation. Double-check all figures and ensure all amended items are thoroughly addressed to avoid processing issues.

What actions should I take if I receive a notice regarding my form 1040xn amended nebraska?

If you receive a notice related to your form 1040xn amended nebraska, carefully read the details provided. Respond promptly with any requested documentation and clarify any misunderstandings regarding your filing to resolve the issue efficiently.