Get the free RI-1040H

Show details

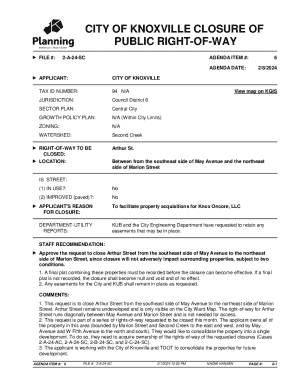

This form is used by Rhode Island residents to claim a property tax relief credit for the year 2011. It requires information regarding household income, residency status, and current property tax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ri-1040h

Edit your ri-1040h form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ri-1040h form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ri-1040h online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ri-1040h. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

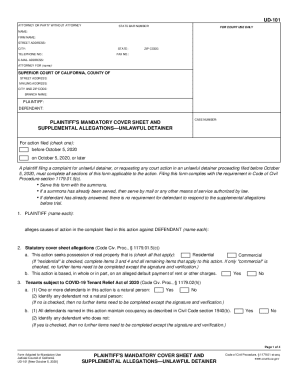

How to fill out ri-1040h

How to fill out RI-1040H

01

Download the RI-1040H form from the Rhode Island Division of Taxation website.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Indicate your filing status by selecting the appropriate box.

04

Provide details of your income sources and their amounts in the designated sections.

05

Deductions: Enter any deductions you are eligible for, such as property tax or rent rebates.

06

Calculate your total income, tax due, and any credits you may qualify for.

07

Review all entries for accuracy before signing and dating the form.

08

Mail the completed RI-1040H form to the address provided in the instructions.

Who needs RI-1040H?

01

Residents of Rhode Island who are eligible for property tax relief or rent rebates.

02

Individuals filing for tax relief based on their income and housing costs.

03

Taxpayers seeking to claim eligibility for the Rhode Island Property Tax Relief Credit.

Fill

form

: Try Risk Free

People Also Ask about

Do seniors pay property taxes in Rhode Island?

Property Tax-Aide features Property Tax Relief for Elderly and Disabled Homeowners and Renters in Rhode Island. Local governments may also provide additional relief, primarily to homeowners. The local programs, generally exemptions, vary, at local options, as to age, property tenure, and income eligibilities.

What age do you stop paying taxes?

When can I stop filing tax returns? Regardless of your age, you'll be required to keep filing a tax return and paying tax as long as you meet the gross income requirements. However, if you are over the age of 65, the gross income limits are a bit higher.

What is RI 1040H?

The 2022 Form RI-1040H allows Rhode Island residents to claim property tax relief. This form is specifically for those aged 65 or older and disabled individuals. Proper completion is essential for timely benefits.

Is there an age where you don't have to pay property taxes anymore?

Instead, property tax relief for seniors varies significantly depending on where you live. Most states and many local jurisdictions offer some form of property tax exemption, deferral, or credit program specifically designed for older residents, typically starting between the ages of 65 and 75.

What is a RI 1040 form?

The RI-1040 Resident booklet contains returns and instructions for filing the 2024 Rhode Island Resident Individual Income Tax Return.

What is the property tax relief credit in Rhode Island?

Program provides state-funded tax credit to senior and disabled homeowners and renters whose property taxes exceed between 3% and 6% of their household income. For renters, property tax is calculated at 20% of annual rent. The maximum credit is $675 for tax year 2024.

At what age do you stop paying property taxes in Rhode Island?

Senior Over 65 Exemption Application.

Is there a personal property tax exemption in RI?

NEW FOR 2024 - The State of RI has mandated a $50,000 exemption. This exemption has been applied to all business personal property accounts. If you reported less than $50,000 in assets for the period ending 12/31/2023, you WILL NOT receive a 2024 bill.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is RI-1040H?

RI-1040H is the Rhode Island Personal Income Tax Return form designed for residents who qualify for the state-established income tax credit.

Who is required to file RI-1040H?

Residents of Rhode Island who have a certain level of income and want to claim the property tax relief credit must file RI-1040H.

How to fill out RI-1040H?

To fill out RI-1040H, taxpayers need to provide personal identification information, income details, and claim any applicable credits. Step-by-step instructions can be found in the form's guidelines.

What is the purpose of RI-1040H?

The purpose of RI-1040H is to allow eligible Rhode Island residents to claim a credit against their personal income tax based on property tax paid.

What information must be reported on RI-1040H?

Taxpayers must report personal identification details, income, property taxes paid, and any other relevant deductions or credits on the RI-1040H.

Fill out your ri-1040h online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ri-1040h is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.