CO Sales Tax Return - City free printable template

Show details

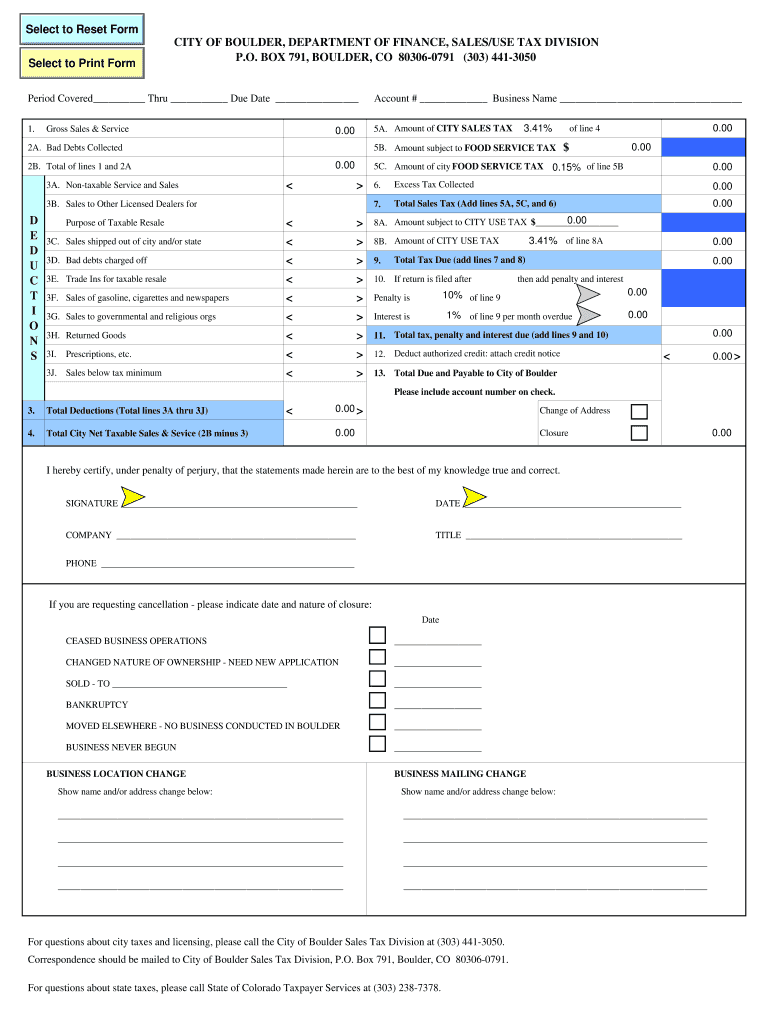

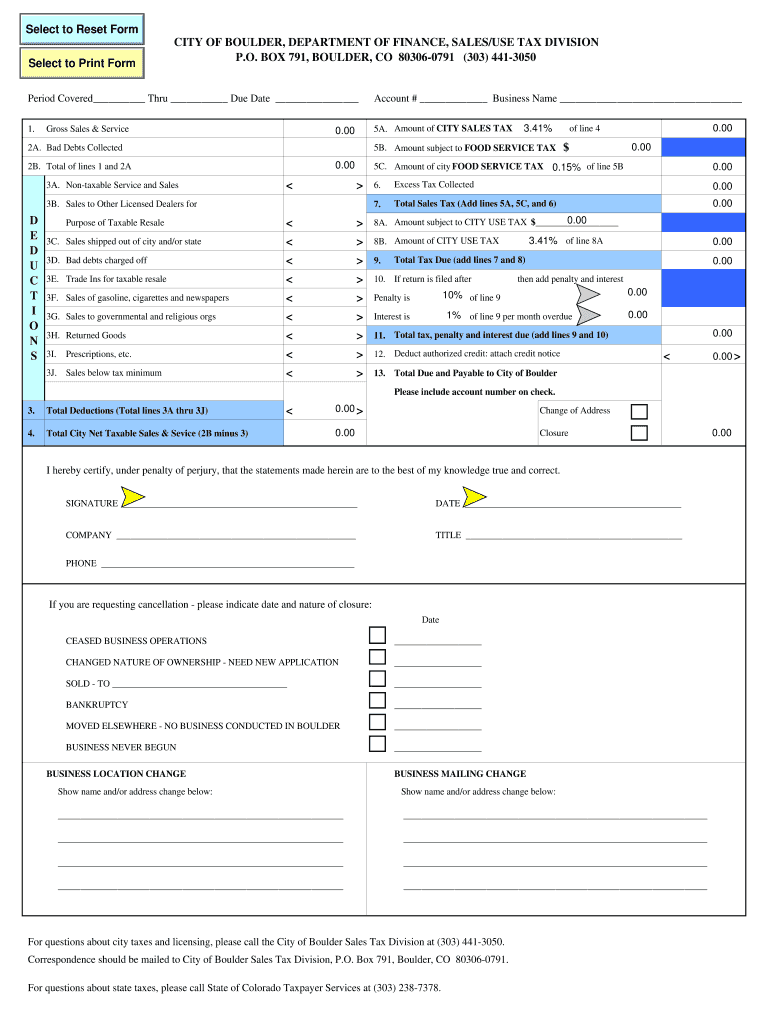

Sales Tax Return. Instructions. Sales & Revenue: 1. Enter your business#39; gross sales. 2A Enter any bad debts that had been written off, but recently collected.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CO Sales Tax Return - City

Edit your CO Sales Tax Return - City form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CO Sales Tax Return - City form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CO Sales Tax Return - City online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CO Sales Tax Return - City. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out CO Sales Tax Return - City

How to fill out CO Sales Tax Return - City of Boulder

01

Gather all necessary sales records for the reporting period.

02

Obtain the CO Sales Tax Return form specific to the City of Boulder.

03

Input the total sales amount in the appropriate section.

04

Calculate the sales tax collected based on the city's tax rate.

05

Deduct any allowable exemptions or credits.

06

Sum up the total tax due.

07

Complete all required sections of the form, including business information.

08

Review the form for accuracy.

09

Submit the completed return by the deadline, either online or by mail.

Who needs CO Sales Tax Return - City of Boulder?

01

Any business operating within the City of Boulder that collects sales tax.

02

Retailers and service providers who are obligated to report sales tax.

03

Businesses seeking to comply with local tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is City of Boulder retail tax?

The city use tax rate is the same as the sales tax rate: 3.86%. With proof of payment, sales tax paid to another tax jurisdiction may be credited against consumer use tax due for a particular item.

What is the City use tax in Boulder?

Check invoices and receipts for tax rates If only County, RTD and State taxes (4.985%) were collected, then the City use tax rate of 3.86% is due and payable to the City of Boulder.

Does Colorado collect sales tax on out of state sales?

Colorado businesses must collect and remit the full sales tax rate in effect at the location of the consumer — the destination of the sale — when taxable goods are delivered to a Colorado address. Destination sourcing also applies to out-of-state sellers.

What is Colorado sales tax on online services?

The Colorado state sales tax rate is 2.9%.

Do you pay local sales tax online?

Generally speaking, if an online retailer maintains a physical presence in a state that charges a sales tax on most purchases, then that online retailer must charge sales tax on any items that are sold to customers within the home state.

Does Colorado collect online sales tax?

The requirement to collect tax applies regardless of whether the sale is made at a retailer's location in Colorado or delivered to the customer at a location in Colorado. A retailer may be required to collect tax even if it has no physical presence in Colorado.

What is the sales tax in Boulder City 2023?

What is the sales tax rate in Boulder, Colorado? The minimum combined 2023 sales tax rate for Boulder, Colorado is 9.05%. This is the total of state, county and city sales tax rates.

What is the sales tax rate for 2023 Colorado?

Local Rates StateState Tax RateAvg. Local Tax Rate (a)Arizona5.60%2.77%Arkansas6.50%2.96%California7.25%1.57%Colorado2.90%4.88%42 more rows • Feb 7, 2023

What is the sales tax rate in Boulder County 2023?

*Boulder County rates changed from 0.985% to 1.185% as of January 1, 2023.

How do I pay my Colorado state sales tax?

If you have a sales tax bill, you should use the payment voucher that comes with the "Statement of Account." The payment and voucher should be mailed to the address on the "Statement of Account." The only method of paying tax bills is by check or money order with the voucher.

What is the city use tax in Boulder?

Check invoices and receipts for tax rates If only County, RTD and State taxes (4.985%) were collected, then the City use tax rate of 3.86% is due and payable to the City of Boulder.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete CO Sales Tax Return - City online?

pdfFiller has made it simple to fill out and eSign CO Sales Tax Return - City. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How can I edit CO Sales Tax Return - City on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing CO Sales Tax Return - City.

How do I fill out CO Sales Tax Return - City using my mobile device?

Use the pdfFiller mobile app to complete and sign CO Sales Tax Return - City on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is CO Sales Tax Return - City of Boulder?

The CO Sales Tax Return - City of Boulder is a form that businesses in Boulder must file to report and pay sales tax collected on sales of goods and services within the city.

Who is required to file CO Sales Tax Return - City of Boulder?

All businesses selling taxable goods or services within the City of Boulder are required to file the CO Sales Tax Return, regardless of their revenue level.

How to fill out CO Sales Tax Return - City of Boulder?

To fill out the CO Sales Tax Return, businesses need to include their business information, report the total sales, calculate the sales tax due, and provide any applicable deductions or exemptions before submitting the form with payment.

What is the purpose of CO Sales Tax Return - City of Boulder?

The purpose of the CO Sales Tax Return is to collect the sales tax revenue that funds local services and infrastructure in Boulder, ensuring compliance with the city's tax regulations.

What information must be reported on CO Sales Tax Return - City of Boulder?

Businesses must report their total sales, total taxable sales, sales tax collected, any exemptions applied, and the total amount due on the CO Sales Tax Return.

Fill out your CO Sales Tax Return - City online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CO Sales Tax Return - City is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.