Get the free T-19 - wmich

Show details

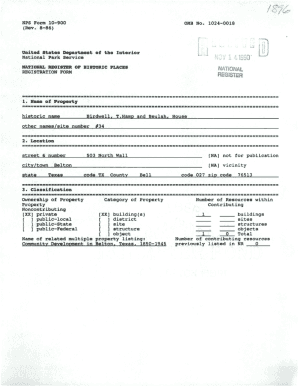

This form is required for students selected for verification to report income information for those who do not file a tax return. It includes sections for student and parent income, a signature certification,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign t-19 - wmich

Edit your t-19 - wmich form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t-19 - wmich form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit t-19 - wmich online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit t-19 - wmich. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out t-19 - wmich

How to fill out T-19

01

Gather all necessary documents required for T-19.

02

Begin with the top section of the form, entering your personal details accurately.

03

Fill out the required financial information in the appropriate sections.

04

Provide any supporting documentation as required by the form.

05

Review all entered information to ensure accuracy and completeness.

06

Sign and date the form at the designated area.

07

Submit the completed T-19 form to the appropriate agency or department.

Who needs T-19?

01

Individuals applying for specific tax credits.

02

Businesses needing to report financial information for compliance.

03

Anyone who has received income subject to reporting requirements.

04

Tax professionals assisting clients with specific claims.

Fill

form

: Try Risk Free

People Also Ask about

What is a T19 form used for?

It's designed to certify that a designated individual has the legal right to execute title documents on behalf of the entity they represent, specifically concerning vehicle ownership.

What is a T19 endorsement for Texas?

T-19 Guideline - TX Restrictions, Encroachments, Minerals Endorsement. Explanation: This endorsement to the Loan policy insures against violations of restrictions, encroachments over easements, building lines or property lines, and damage by reason of mineral or other subsurface substance development.

What is a T 16 form?

The Form T-16 certifies the repossession of a motor vehicle due to the owner's failure to meet lien obligations.

What is a T 11 form?

The T-11 Affidavit of Correction is used to correct errors in vehicle documentation such as titles and registration forms. This can include typographical mistakes, incorrect Vehicle Identification Numbers (VINs), and inaccuracies in owner details.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is T-19?

T-19 is a tax form used to report specific financial information related to certain transactions or activities.

Who is required to file T-19?

Entities or individuals engaged in transactions that fall under the requirements set by the taxing authority are required to file T-19.

How to fill out T-19?

To fill out T-19, gather the necessary financial documents and follow the instructions provided on the form, ensuring all required fields are completed accurately.

What is the purpose of T-19?

The purpose of T-19 is to provide the taxing authority with necessary financial information to ensure compliance with tax regulations and to assess tax liability.

What information must be reported on T-19?

T-19 must report details such as transaction amounts, dates, involved parties, and any other information specified by the taxing authority relevant to the reporting requirements.

Fill out your t-19 - wmich online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

T-19 - Wmich is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.