Get the free Tax Filing Status and Confirmation of Income - Student 2012-2013 - csusm

Show details

This form is required for students applying for financial aid to verify their income for the 2012-2013 academic year. It includes sections for both tax filers and non-tax filers, with instructions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax filing status and

Edit your tax filing status and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax filing status and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax filing status and online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax filing status and. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax filing status and

How to fill out Tax Filing Status and Confirmation of Income - Student 2012-2013

01

Gather all necessary documents, including your personal identification, income slips, and any relevant tax forms.

02

Locate the section for Tax Filing Status on the form.

03

Choose the appropriate filing status that best describes your situation (e.g., dependent, independent, etc.).

04

Fill in your income details accurately based on the information from your income slips.

05

Double-check all information for accuracy to ensure there are no mistakes.

06

Review any additional sections that may require your signature or further disclosures.

07

Submit the completed form according to the instructions provided, ensuring it is sent to the correct authority.

Who needs Tax Filing Status and Confirmation of Income - Student 2012-2013?

01

Students who are required to report their income for tax purposes.

02

Individuals who are applying for financial aid and need to provide proof of income.

03

Any student who has earned income during the tax year and needs to declare it.

04

Those who may need to verify their filing status for scholarships or government assistance programs.

Fill

form

: Try Risk Free

People Also Ask about

How do I know if I am a full-time or part-time student?

To be considered a full-time student, you must take at least 12 credits per semester. Generally, one class will be 3 or 4 credits. However, some elective classes or labs may only be 1 or 2 credits. A full-time schedule would usually mean taking three to five classes per semester.

How to file a 2013 tax return?

No e-file for 2013: The IRS shuts down its e-file portal in mid-October. Individual tax returns submitted after that date can easily be prepared online with Priortax but must be downloaded, printed, signed, and mailed to the IRS. The same applies to late state tax return.

Why did I get an ives request for tax information?

The Income Verification Express Service (IVES) program lets participants, mortgage lenders, banks, credit unions and others, request taxpayer authorization for the IRS to provide tax transcripts and wage statements in the loan application process.

What qualifies a dependent as a student?

Age: Be under age 19 or under 24 if a full-time student, or any age if permanently and totally disabled. Residency: Live with you for more than half the year, with some exceptions. Support: Get more than half their financial support from you.

What does it mean when the IRS has to verify your income?

Why is my return being reviewed? We select some returns to review so we can determine whether income, expenses, and credits are reported correctly. This doesn't mean you made an error or were dishonest.

What can I report on my taxes as a student?

If you have student loans or pay education costs for yourself, you may be eligible to claim education deductions and credits on your tax return, such as loan interest deductions, qualified tuition programs (529 plans) and Coverdell Education Savings Accounts. For more information, see tax benefits for education.

What qualifies as a student when filing taxes?

Student defined. A full-time student at a school that has a regular teaching staff, course of study, and a regularly enrolled student body at the school; or. A student taking a full-time, on-farm training course given by a school described in (1), or by a state, county, or local government agency.

What qualifies as a student?

any person who is enrolled in a full-time course of education at a prescribed educational establishment. a person under the age of 20 undertaking a qualifying course of education.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

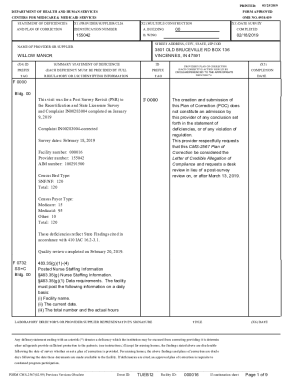

What is Tax Filing Status and Confirmation of Income - Student 2012-2013?

Tax Filing Status and Confirmation of Income - Student 2012-2013 is a document used to determine the tax filing status of a student for the tax year 2012-2013, including the verification of their income for financial aid or tax purposes.

Who is required to file Tax Filing Status and Confirmation of Income - Student 2012-2013?

Students who are applying for financial aid, scholarships, or any programs that require verification of financial situations for the tax year 2012-2013 must file this document.

How to fill out Tax Filing Status and Confirmation of Income - Student 2012-2013?

To fill out the form, students must provide their personal information, including their name, Social Security number, and financial details such as income sources and amounts for the specified tax year. Instructions are typically included with the form.

What is the purpose of Tax Filing Status and Confirmation of Income - Student 2012-2013?

The purpose of this document is to assess a student's financial need for assistance, ensure eligibility for aid programs, and confirm their tax filing status during the specified tax year.

What information must be reported on Tax Filing Status and Confirmation of Income - Student 2012-2013?

Students must report their total income, including wages, scholarships, grants, and any other earnings, as well as information regarding their dependent status and household size for the 2012-2013 tax year.

Fill out your tax filing status and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Filing Status And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.