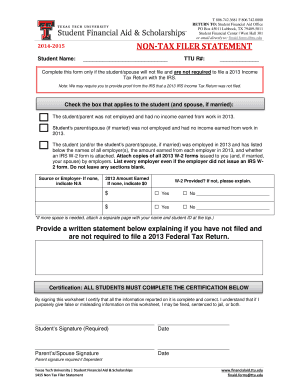

MS Non-Tax Filers Statement free printable template

Get, Create, Make and Sign student statement form

Editing ms non tax filers online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ms non tax filers

How to fill out MS Non-Tax Filers Statement

Who needs MS Non-Tax Filers Statement?

Video instructions and help with filling out and completing ms non tax filers blank

Instructions and Help about ms non tax filers

Hi I'm mark for attacks calm the IRS form 1098-t tuition statement is sent to students who pay tuition at a qualifying college or similar higher education institutions the form 1098-t lists expenses related to education and can help determine the student's eligibility for deductions and tax credits related to tuition and education if the student is categorized as a dependent then the parents are guardians of the student may be granted eligibility for the credits and deductions there are two methods for reporting expenses a student incurred the school can opt to report the amount a student actually paid by listing the total in box 1 of the form, or they can report how much they build a student as evident in box 2 if a school is adjusted the qualifying expenses from a previous year's 1098 — t it will be reported in box for students who receive grants or scholarships to help offset expenses will show an amount in box 5 the amount may reduce the total qualifying expenses that can be used towards a credit or deduction any amounts listed in box 6 relate to adjustments made by the school to scholarship or grant reporting on a previous year 1098 — T box 7 of the 109—

People Also Ask about

What is self contradictory statement form?

What is a statement form?

What is a student statement form?

What is meant by statement form?

Can you type a written statement?

How do you form a statement?

What should you include in a statement?

What is the example of statement form?

What does a written statement mean?

How do you write a statement of documentation?

How do you write a written statement example?

Whats writing a statement?

How do you write a statement form?

How do you start a statement letter?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ms non tax filers online?

How do I fill out the ms non tax filers form on my smartphone?

How do I complete ms non tax filers on an iOS device?

What is MS Non-Tax Filers Statement?

Who is required to file MS Non-Tax Filers Statement?

How to fill out MS Non-Tax Filers Statement?

What is the purpose of MS Non-Tax Filers Statement?

What information must be reported on MS Non-Tax Filers Statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.