Get the free Self-Insured Section - lni wa

Show details

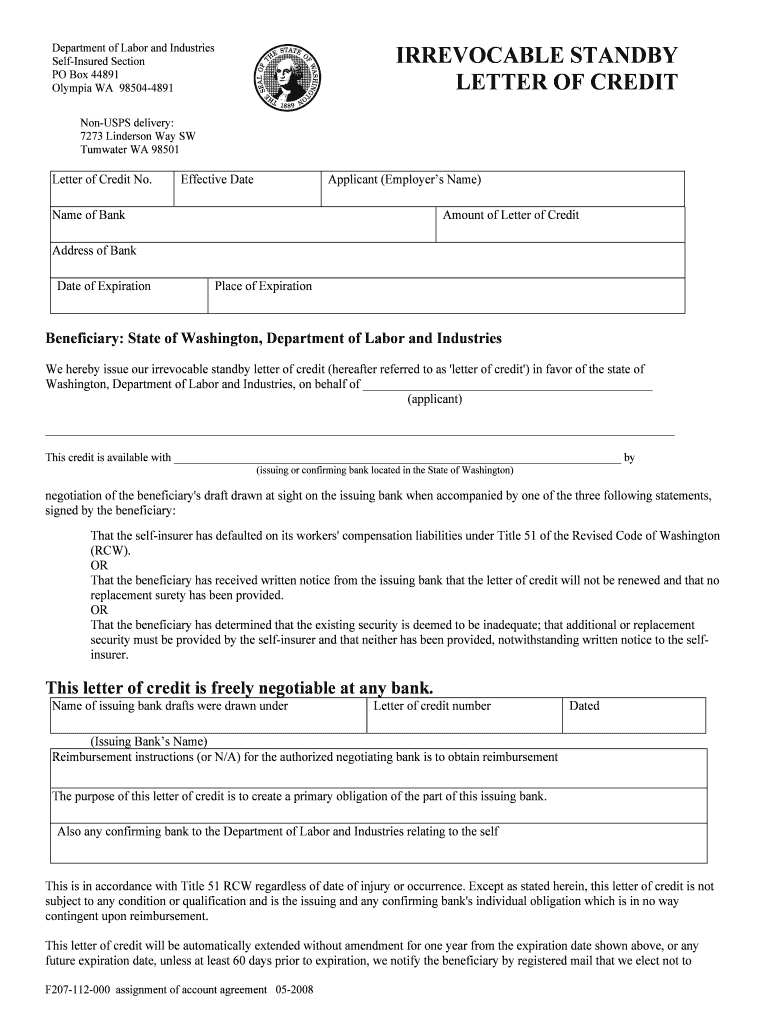

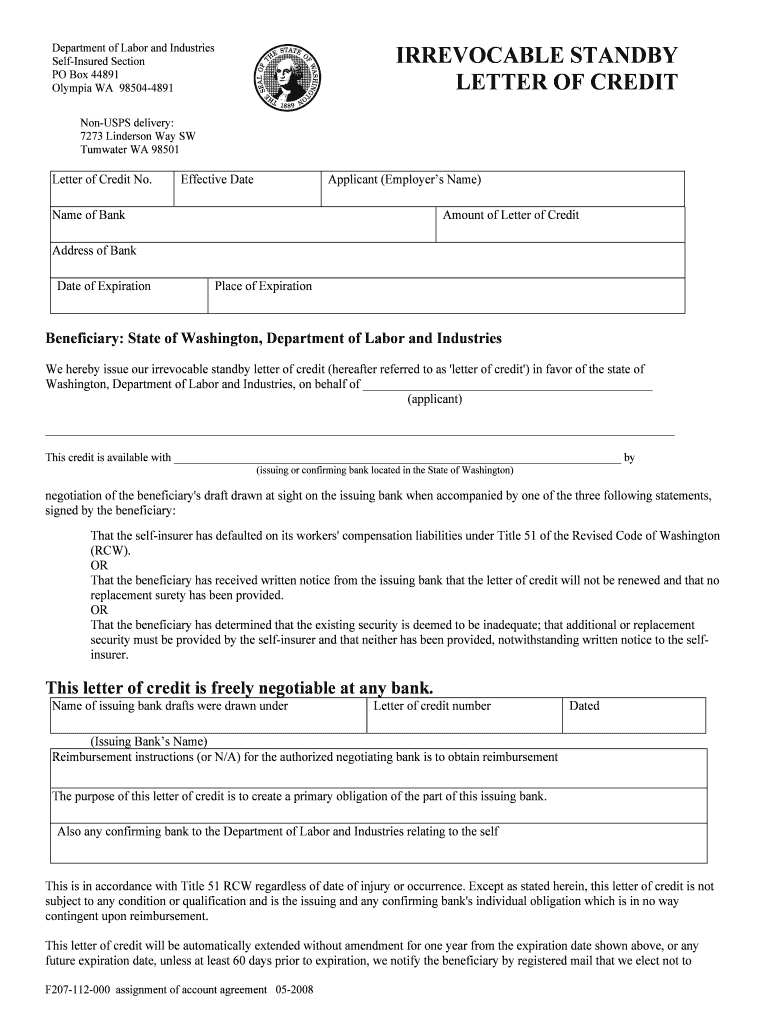

Department of Labor and Industries Self-Insured Section PO Box 44891 Olympia WA 98504-4891 IRREVOCABLE STANDBY LETTER OF CREDIT Non-USPS delivery: 7273 Anderson Way SW Tum water WA 98501 Letter of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign self-insured section - lni

Edit your self-insured section - lni form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self-insured section - lni form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing self-insured section - lni online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit self-insured section - lni. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out self-insured section - lni

How to fill out self-insured section?

01

Start by providing your business information: Write the name and address of your company, along with any other relevant contact details.

02

Identify the purpose of self-insurance: Clearly state the reasons why you have chosen to be self-insured. This could include factors like cost savings, greater control over insurance policies, or specific coverage needs.

03

Outline the types of insurance coverage you are self-insuring: Specify the categories of insurance that you will handle yourself, such as general liability, property, workers' compensation, or any other applicable types.

04

State the financial capacity to self-insure: Share details about your financial stability and ability to cover potential losses or claims without relying on external insurance providers. This may include information about your company's financial statements or proof of reserves set aside for self-insurance purposes.

05

Mention the claims management process: Describe how you will handle and resolve claims that arise under your self-insurance program. This could involve appointing a claims administrator, establishing a dedicated claims department, or following a specific protocol for claim reporting and processing.

06

Provide evidence of compliance with legal requirements: Include any applicable state or federal regulations that you have fulfilled to operate as a self-insured entity. This may involve obtaining necessary licenses, meeting minimum financial thresholds, or adhering to specific reporting and record-keeping obligations.

Who needs self-insured section?

01

Large corporations: Companies with substantial financial resources and risk management capabilities often opt for self-insurance to have more control over their insurance programs and potentially reduce costs.

02

Government entities: Some government agencies or municipalities choose self-insurance to handle certain types of risks, such as workers' compensation or liability claims.

03

Associations or groups: Professional associations, trade organizations, or consortiums occasionally establish self-insurance programs to collectively manage risks and pool resources.

04

Small businesses: While less common, some small businesses may decide to self-insure specific risks if the cost of traditional insurance is prohibitively high or if they have specialized coverage needs that are not readily available from insurance providers.

05

Non-profit organizations: Non-profits may choose self-insurance as a way to have greater control over their insurance program and potentially achieve cost savings, enabling them to direct more funding towards their core mission.

Remember, the decision to self-insure should be carefully evaluated based on your organization's unique circumstances and risk profile. Consulting with insurance professionals or legal advisors can provide valuable insights before pursuing self-insurance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit self-insured section - lni online?

The editing procedure is simple with pdfFiller. Open your self-insured section - lni in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I edit self-insured section - lni on an iOS device?

You certainly can. You can quickly edit, distribute, and sign self-insured section - lni on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Can I edit self-insured section - lni on an Android device?

With the pdfFiller Android app, you can edit, sign, and share self-insured section - lni on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is self-insured section?

Self-insured section refers to a section of a form or document where an entity declares that they are providing their own insurance coverage.

Who is required to file self-insured section?

Entities or individuals who choose to self-insure or provide their own insurance coverage are required to file a self-insured section.

How to fill out self-insured section?

To fill out the self-insured section, the entity must provide details about their self-insurance coverage, including the type of coverage, coverage limits, and any other relevant information.

What is the purpose of self-insured section?

The purpose of the self-insured section is to declare and provide information about self-insurance coverage to relevant parties or authorities.

What information must be reported on self-insured section?

The self-insured section must include details about the type of coverage, coverage limits, and any other relevant information about the self-insurance coverage.

Fill out your self-insured section - lni online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self-Insured Section - Lni is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.