Get the free Guidelines for Use of Foundation Funds - oufoundation

Show details

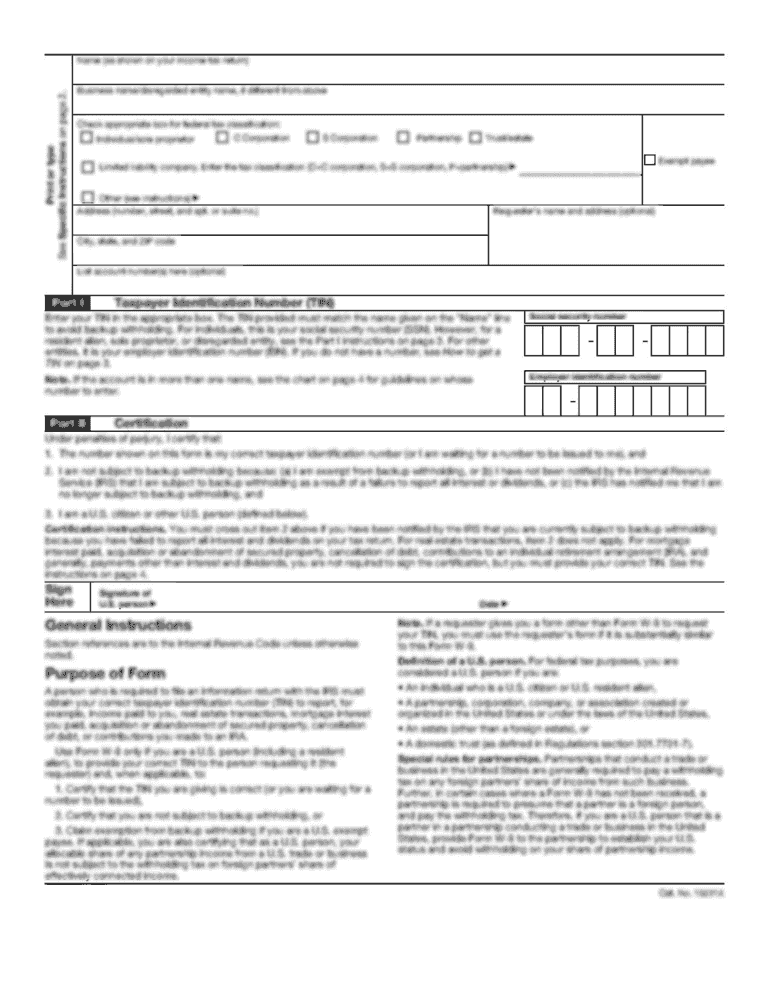

This document provides comprehensive guidelines for the use and management of foundation funds at the University of Oklahoma, detailing fund types, disbursement policies, and proper documentation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign guidelines for use of

Edit your guidelines for use of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guidelines for use of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing guidelines for use of online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit guidelines for use of. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out guidelines for use of

How to fill out Guidelines for Use of Foundation Funds

01

Read the Foundation's mission and purpose to understand the context.

02

Review the funding categories and eligibility criteria specified in the guidelines.

03

Gather all necessary documentation, including project proposals and budget estimates.

04

Complete the application form, ensuring to fill in all required fields accurately.

05

Provide detailed descriptions of how the funds will be used, aligning with the Foundation's priorities.

06

Include timelines and measurable outcomes for accountability.

07

Seek feedback from peers or mentors on your application before submission.

08

Submit the application by the specified deadline, following all submission instructions.

Who needs Guidelines for Use of Foundation Funds?

01

Non-profit organizations seeking funding for their projects.

02

Individuals applying for grants to support community initiatives.

03

Educational institutions aiming to fund research or programs.

04

Community organizations working to improve local services or outreach.

05

Any entity that intends to responsibly manage and implement foundation funds.

Fill

form

: Try Risk Free

People Also Ask about

How much does a foundation have to pay out each year?

The basic rule can be stated simply, but its calculation is complex: Each year every private foundation must make eligible charitable expenditures that equal or exceed approximately 5 percent of the value of its endowment.

What are the rules for a foundation?

Each private foundation is required by the IRS to distribute a minimum of 5% of its average net investments each year. This is true even in years where the foundation experiences no additional income or investment return.

What is the 33% rule for nonprofits?

If your organization receives more than 10 percent but less than 33-1/3 percent of its support from the general public or a governmental unit, it can qualify as a public charity if it can establish that, under all the facts and circumstances, it normally receives a substantial part of its support from governmental

What is the 5% rule for foundations?

As a general rule, a private foundation should make a charitable “payout”—in grants and qualifying operating expenses (explained further below)—totaling at least 5% of total assets annually to remain in compliance with federal and state tax codes.

What is the 5 rule for foundations?

In short, the U.S. government expects foundations to use their assets to benefit society and it enforces this through section 4942 of the Internal Revenue Code, which requires private foundations to distribute 5% of the fair market value of their endowment each year for charitable purposes.

What is the 5 percent rule for nonprofits?

One of the important differences between a public charity and a private foundation is the 5% rule which requires the foundation to spend at least 5% annually of non-charitable use assets acquired during the previous year.

What are the rules of a foundation?

requirements that the foundation annually distribute income for charitable purposes; limits on their holdings in private businesses; provisions that investments must not jeopardize the carrying out of exempt purposes; and. provisions to assure that expenditures further exempt purposes.

What can a private foundation spend money on?

What can a private foundation spend money on while maintaining compliance with IRS rules and regulations? Charitable Purposes. Reasonable and Necessary Expenses. Operating Costs for Direct Charitable Activities. Administrative Expenses. Investment Expenses. Program-Related Investments (PRIs) Advocacy and Education.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Guidelines for Use of Foundation Funds?

Guidelines for Use of Foundation Funds are rules and procedures established to determine how foundation funds can be allocated and utilized in accordance with the foundation's mission and objectives.

Who is required to file Guidelines for Use of Foundation Funds?

Individuals or organizations seeking to access or utilize foundation funds are required to file Guidelines for Use of Foundation Funds.

How to fill out Guidelines for Use of Foundation Funds?

To fill out Guidelines for Use of Foundation Funds, applicants typically need to provide detailed information about their project, budget estimates, expected outcomes, and how the funds will be used in alignment with the foundation's goals.

What is the purpose of Guidelines for Use of Foundation Funds?

The purpose of Guidelines for Use of Foundation Funds is to ensure that funds are used appropriately and effectively to support initiatives that align with the foundation's mission, promoting transparency and accountability.

What information must be reported on Guidelines for Use of Foundation Funds?

Information that must be reported includes project descriptions, objectives, detailed budgets, timelines, and anticipated impacts, as well as any relevant financial records and outcomes after funding is used.

Fill out your guidelines for use of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Guidelines For Use Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.