TIAA F11040 2013 free printable template

Show details

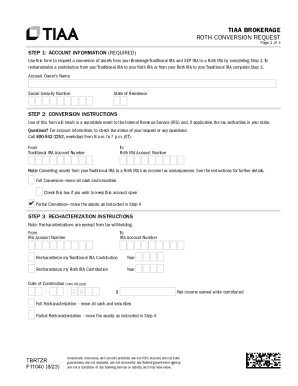

TIAA-CREF BROKERAGE SERVICES ROTH CONVERSION/RECHARACTERIZATION REQUEST INSTRUCTIONS QUESTIONS Call 800 927-3059 Monday to Friday from 8 a.m. to 7 p.m. ET. The IRA custodian TIAA-CREF Trust Company FSB is required by law to report to the Internal Revenue Service IRS the Roth conversion from your Traditional IRA to your Roth IRA. Consult with a tax professional to determine if you are eligible for a Roth conversion and your personal income tax lia...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TIAA F11040

Edit your TIAA F11040 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TIAA F11040 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TIAA F11040 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit TIAA F11040. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TIAA F11040 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TIAA F11040

How to fill out tiaa cref recharacterization form:

01

Begin by downloading the tiaa cref recharacterization form from the official website or obtain a physical copy from a nearby tiaa cref branch.

02

Carefully read the instructions provided on the form to ensure you understand the purpose and requirements of the recharacterization process.

03

Start by entering your personal information, including your full name, contact details, and social security number, as requested on the form.

04

Next, provide details about the specific investment or account that you wish to recharacterize. This may include the account number, fund name, and other relevant information.

05

Specify the type of recharacterization you are requesting, such as a partial or full recharacterization, and indicate the reason for the request.

06

If applicable, provide any additional documentation or evidence to support your recharacterization request. This may include receipts, statements, or other relevant financial records.

07

Review the completed form to ensure all information is accurate and complete. Make any necessary corrections or additions before submitting it.

08

Once you are satisfied with the form, sign and date it in the designated spaces to certify the accuracy of the provided information.

09

Make a copy of the completed form for your records.

10

Finally, submit the form to tiaa cref through the recommended method, such as mailing it to the provided address or delivering it in person. Remember to attach any necessary supporting documents as instructed.

Who needs tiaa cref recharacterization form:

01

Individuals who have made contributions to a tiaa cref account and wish to change the classification of those contributions.

02

Customers who have mistakenly made contributions to the wrong type of account and need to correct the error.

03

Those who want to adjust their investment strategy by recharacterizing funds from one tiaa cref account to another.

04

Individuals who have experienced a change in their financial circumstances and need to modify their investment or retirement plans through recharacterization.

05

Customers who have received professional advice or guidance to recharacterize their tiaa cref investments for better financial planning or tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

Can you still do an IRA recharacterization?

The Tax Cuts and Jobs Act prohibits Roth IRA conversion recharacterizations, but you can still recharacterize an IRA contribution from one type of IRA to another.

How do I report recharacterization of my IRA?

Report the nondeductible traditional IRA portion of the recharacterized contribution, if any, on Form 8606, Part I. Don't report the Roth IRA contribution (whether or not you recharacterized all or part of it) on Form 8606. Attach a statement to your return explaining the recharacterization.

Is Roth recharacterization no longer allowed?

The Tax Cuts and Jobs Act prohibits Roth IRA conversion recharacterizations, but you can still recharacterize an IRA contribution from one type of IRA to another. An individual retirement account (IRA) is a long-term savings plan with tax advantages that taxpayers can use to plan for retirement.

What is the Roth recharacterization limit?

For the 2022 tax year, you can contribute up to $6,000 to Roth and traditional IRAs, plus a $1,000 catch-up contribution if you're age 50 or older. 22 That is the combined maximum for all of your IRAs.

What is the deadline for recharacterization?

Roth IRA Recharacterization Rules from the IRS If your recharacterization is for the 2022 tax year, for example, then you have until October 15, 2023 (with extended filing) to make the recharacterization before filing your taxes.

How do I Recharacterize my retirement account?

To recharacterize a regular IRA contribution, you tell the trustee of the financial institution holding your IRA to transfer the amount of the contribution plus earnings to a different type of IRA (either a Roth or traditional) in a trustee-to-trustee transfer or to a different type of IRA with the same trustee.

How do I Recharacterize my IRA contributions?

To recharacterize a regular IRA contribution, you tell the trustee of the financial institution holding your IRA to transfer the amount of the contribution plus earnings to a different type of IRA (either a Roth or traditional) in a trustee-to-trustee transfer or to a different type of IRA with the same trustee.

Can you recharacterize a Roth contribution and then convert to Roth?

This has been true for the last few years because of a change instituted by the Tax Cuts and Jobs Act (TCJA). As if life and taxes weren't confusing enough, even though you can no longer recharacterize a Roth conversion, you are still allowed to recharacterize a contribution to a Roth IRA.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify TIAA F11040 without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like TIAA F11040, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Where do I find TIAA F11040?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific TIAA F11040 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How can I edit TIAA F11040 on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing TIAA F11040 right away.

What is tiaa cref recharacterization form?

The TIAA CREF recharacterization form is a document that allows individuals to undo or change a previous contribution to an individual retirement account (IRA) or other qualified retirement plan.

Who is required to file tiaa cref recharacterization form?

Any individual who wishes to recharacterize a previous contribution to an IRA or qualified retirement plan through TIAA CREF must file the recharacterization form.

How to fill out tiaa cref recharacterization form?

To fill out the TIAA CREF recharacterization form, provide your personal information, details of the original contribution, and the desired changes you would like to make. Make sure to follow the instructions provided on the form and provide all necessary documentation.

What is the purpose of tiaa cref recharacterization form?

The purpose of the TIAA CREF recharacterization form is to allow individuals to change or undo a previous contribution to an IRA or qualified retirement plan. This can help individuals correct mistakes, optimize their retirement savings strategies, or take advantage of new opportunities.

What information must be reported on tiaa cref recharacterization form?

The TIAA CREF recharacterization form typically requires you to report your personal information, including your name, address, and social security number. You will also need to provide details about the original contribution you wish to recharacterize, such as the amount, date, and type of contribution.

Fill out your TIAA F11040 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TIAA f11040 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.