Get the free D-499

Show details

This application is required for taxpayers in North Carolina who wish to claim a tax credit for investments made in qualified business ventures. It includes important deadlines, eligibility requirements,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign d-499

Edit your d-499 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your d-499 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit d-499 online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit d-499. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

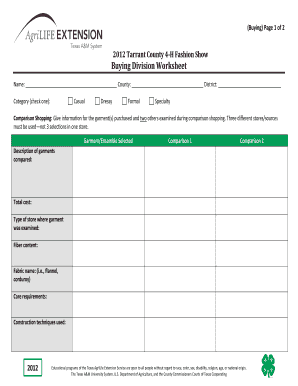

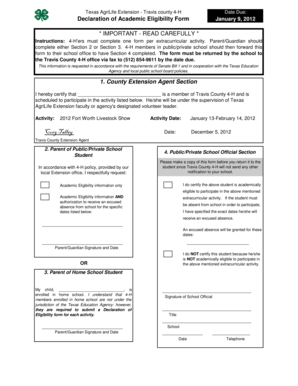

How to fill out d-499

How to fill out D-499

01

Obtain the D-499 form from the appropriate regulatory agency or their website.

02

Fill in your personal information, including name, address, and contact details.

03

Provide any required identification numbers, such as Social Security Number or Tax ID.

04

Complete the sections regarding your financial information, ensuring that all figures are accurate.

05

Review the form for any additional documentation requirements that need to be attached.

06

Sign and date the form at the bottom.

07

Submit the completed form to the designated office, either by mail or electronically, as instructed.

Who needs D-499?

01

Individuals applying for certain types of financial assistance or benefits.

02

Businesses seeking grants or loans that require this specific form.

03

Taxpayers needing to report specific financial information to the government.

04

Organizations that need to provide documentation related to compliance or regulatory requirements.

Fill

form

: Try Risk Free

People Also Ask about

What was the holding in Terry, V. Ohio?

Hodari D., 499 U.S. 621 (1991), was a United States Supreme Court case where the Court held that a fleeing suspect is not "seized" under the terms of the Fourth Amendment unless the pursuing officers apply physical force to the suspect or the suspect submits to officers' demands to halt.

What did Terry v. Ohio hold that officers may conduct?

In this case, the Court concluded that the Fourth Amendment did not prohibit police from stopping a person they have reasonable suspicion to believe had committed a crime, and frisking that person if they reasonably believe that person to be armed.

What was the holding of Terry v. Ohio?

In June 1968, the United States Supreme Court affirmed the conviction and set a precedent that allows police officers to interrogate and frisk suspicious individuals without probable cause for an arrest, providing that the officer can articulate a reasonable basis for the stop and frisk.

What was the defense of Terry v. Ohio?

Terry was charged with carrying a concealed weapon, and he moved to suppress the weapon as evidence. The motion was denied by the trial judge, who upheld the officer's actions on a stop and frisk theory. The Ohio Court of Appeals affirmed, and the Ohio Supreme Court dismissed Terry's appeal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is D-499?

D-499 is a tax form used by businesses to report certain financial information to the tax authorities.

Who is required to file D-499?

Businesses that meet specific criteria related to income, expenses, or tax obligations are required to file D-499.

How to fill out D-499?

To fill out D-499, gather the necessary financial documents and information, complete the form by entering the required details, and ensure accuracy before submission.

What is the purpose of D-499?

The purpose of D-499 is to provide the tax authorities with a comprehensive overview of a business's financial status for tax assessment and compliance.

What information must be reported on D-499?

The information that must be reported on D-499 includes income, expenses, deductions, and any other relevant financial data pertinent to the tax obligations.

Fill out your d-499 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

D-499 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.