PH BIR Form 1706 2018-2025 free printable template

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

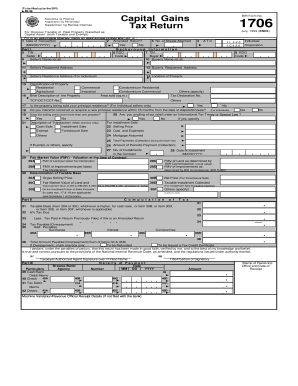

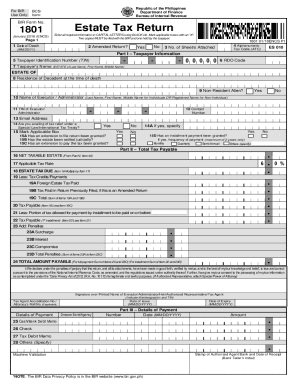

Understanding the PH BIR Form 1706

What is the PH BIR Form 1706?

The PH BIR Form 1706 is a tax form used for reporting capital gains from the sale of real property classified as a capital asset. This form is essential for taxpayers in the Philippines to declare the tax due on the sale and ensure compliance with the Bureau of Internal Revenue (BIR) regulations.

Who Needs the PH BIR Form 1706?

Individuals and corporations that engage in the sale of real property classified as a capital asset must use the PH BIR Form 1706. It is particularly relevant for sellers looking to report capital gains for taxation purposes, ensuring they fulfill their legal responsibilities.

When to Use the PH BIR Form 1706

This form should be used whenever a taxpayer sells real property that is considered a capital asset. It is crucial to complete this form in a timely manner to avoid penalties and interest that can accrue for late filing or payment.

Required Documents and Information

When filling out the PH BIR Form 1706, individuals must include specific documentation and information, such as the seller's name, Taxpayer Identification Number (TIN), description of the property, selling price, and details of any potential tax relief or exemptions applicable to the property sale.

How to Fill the PH BIR Form 1706

To fill out the PH BIR Form 1706 correctly, one should use black ink and capital letters. It's important to follow the prescribed format and ensure all relevant fields are completed accurately. Incorrect or incomplete forms may delay processing and lead to additional scrutiny from the BIR.

Best Practices for Accurate Completion

Accuracy is vital when completing the PH BIR Form 1706. Taxpayers should double-check all entries and ensure that all required documents are attached. Maintaining clear records of the transaction can help verify the accuracy of reported information.

Common Errors and Troubleshooting

Common mistakes when filling out the PH BIR Form 1706 include missing information, incorrect TINs, and errors in the selling price. Taxpayers should be vigilant in reviewing their forms to avoid these issues, as they can lead to delays in processing or additional fees.

Frequently Asked Questions about bir form 1706 download

What happens if I don't file the PH BIR Form 1706 on time?

Failure to file the PH BIR Form 1706 on time may result in penalties and interest charges. It is advisable to submit the form promptly to avoid such consequences.

Can I amend my PH BIR Form 1706 after submission?

Yes, if there are any errors or changes after submission, taxpayers can file an amended return with the correct information.

pdfFiller scores top ratings on review platforms