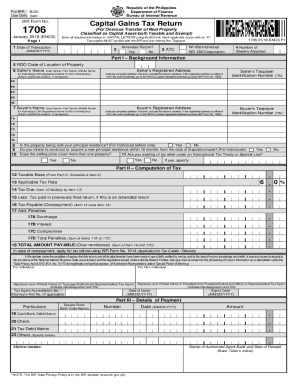

PH BIR Form 1706 1999 free printable template

Get, Create, Make and Sign

Editing bir form 1706 online

PH BIR Form 1706 Form Versions

How to fill out bir form 1706 1999

How to fill out bir form 1706?

Who needs bir form 1706?

Video instructions and help with filling out and completing bir form 1706

Instructions and Help about bir form 1706 pdf

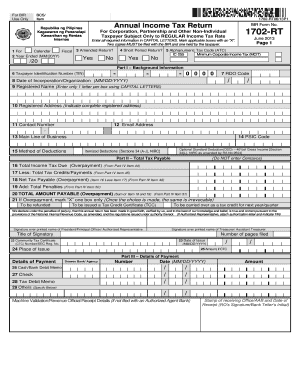

The applicable tax return for an individual earning purely compensation income is the VAR form one seven zero the latest version of which was released only in January the revised form now has four pages and divided into five parts 1 2 3 are on page 1 this provides an overview about yourself and your tax liability for the year part 1 is all about you and your spouse please note that there are certain critical information that you need to provide on this page but which you may not readily have first is your Philippine tax identification number or your tin which can be found on your tin card second is the revenue district office code or the DO code this can be found in your application for registration otherwise this can be verified directly with a VAR taxpayer assistance division part 2 is a summary of your final tax liability and tax credits for the year the entries for this portion should be lifted from the computation of your tax liability and part 4 thus ideally you need to accomplish part for first before you complete part 2 part 3 details your tax payment that is the amount of X that you need to pay upon filing of your return and the mode by which you intend to settle the same part 4 is on page 2 and details the computation of your tax payable therefore you need to summarize all your earnings during the calendar year you would normally you're 30 or based obscure these items want to Ford provide a summary of your grass compensation income for the year and corresponding axis withheld by your employer icons 528 provide a detailed computation of your tax liability make sure that you take advantage of the allowable deductions and exclusions for employees such as the following 30 thousand pesos exception 413 c'mon pay bonuses and other benefits mandatory contributions as it s fill help and cut a bit de minimis benefits the same of these items check applicable to you should be indicated I inquire further as an individual taxpayer you are eligible to claim of basic personal exceptions with these action specials and if you have qualified dependent children an additional extension of 25,000 pesos for each of your dependent children up to a maximum of four the clickable image should be indicated I am tonight for your tax credits you have to refer to your VAR form to be 1/6 that will be issued to you by your local employer this amount will reduce your total 13 income tax liability and any difference between your capacity abilities in here withholding taxes is your meaning fax paper bar 5 is on page three innocent and fifteen source passive income such as interest dividend scatter they're subjected by Elton sent a scotch this portion is for information purposes only and no addition of back liability as expected service under this section the supplemental information was intended to be mandatory when it was first introduced in 2011 however the VA r has since then made compliance optional page four is an extension of part five on this page you can indicate...

Fill bir 1706 : Try Risk Free

People Also Ask about bir form 1706

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your bir form 1706 1999 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.