Get the free Competent Authority Agreement - irs

Show details

This Agreement outlines the types of pension plans established in the United States and Belgium that will be recognized for tax purposes in the other Contracting State as stipulated in the treaty

We are not affiliated with any brand or entity on this form

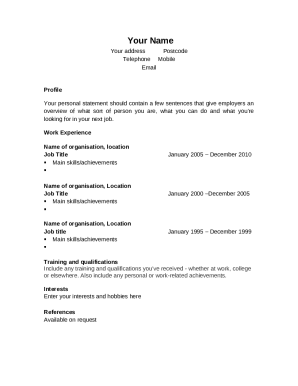

Get, Create, Make and Sign competent authority agreement

Edit your competent authority agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your competent authority agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing competent authority agreement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit competent authority agreement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out competent authority agreement

How to fill out Competent Authority Agreement

01

Obtain the official template for the Competent Authority Agreement from the relevant authority.

02

Review the purpose and terms of the agreement outlined in the template.

03

Fill in the names and contact information of all parties involved.

04

Clearly outline the responsibilities and obligations of each party.

05

Specify the duration of the agreement and any provisions for amendment or termination.

06

Ensure all required signatures are obtained from authorized representatives.

07

Keep a copy of the completed agreement for your records.

Who needs Competent Authority Agreement?

01

Individuals or organizations involved in international tax matters.

02

Entities seeking clarification on tax liabilities in different jurisdictions.

03

Companies with cross-border transactions requiring assessment by multiple tax authorities.

Fill

form

: Try Risk Free

People Also Ask about

Who are the competent authorities?

Competent Authorities are bodies that approve against the criteria in the regulations and monitor the continued compliance of approved ADR bodies.

What is a competent authority in English?

A competent authority is any person or organization that has the legally delegated or invested authority, capacity, or power to perform a designated function. Similarly, once an authority is delegated to perform a certain act, only the competent authority is entitled to take accounts therefrom and no one else.

What is an example of a tax authority?

There are many examples of administrative tax authority. The most well-known ones are: Treasury regulations, as published in the Federal Register and Internal Revenue Bulletin. Treasury regulations can be either legislative or interpretative.

What is an example of a competent authority?

Examples of competent authorities include health departments in the healthcare sector, environmental protection agencies, and financial regulatory bodies. Each of these entities has specific responsibilities and powers within their respective fields.

What is a competent authority example?

Examples of competent authorities include health departments in the healthcare sector, environmental protection agencies, and financial regulatory bodies. Each of these entities has specific responsibilities and powers within their respective fields.

What is qualifying competent authority agreements?

The term “Qualifying Competent Authority Agreement” means an agreement that is between authorised representatives of an EU Member State and a non-Union jurisdiction that are parties to an International Agreement and that requires the automatic exchange of country-by-country reports between the party jurisdictions.

What is the meaning of competence authority?

A competent authority is any person or organization that has the legally delegated or invested authority, capacity, or power to perform a designated function.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Competent Authority Agreement?

A Competent Authority Agreement is a formal arrangement between tax authorities of two or more jurisdictions that facilitates the resolution of transfer pricing and other tax-related issues to ensure that taxes are not imposed on the same income by different countries.

Who is required to file Competent Authority Agreement?

Businesses that engage in cross-border transactions and are subject to transfer pricing regulations are typically required to file a Competent Authority Agreement if they seek relief from double taxation or wish to clarify tax obligations with international tax authorities.

How to fill out Competent Authority Agreement?

To fill out a Competent Authority Agreement, taxpayers must provide detailed information on the involved entities, the nature of the transactions, pricing methods used, and documentation that supports the pricing arrangements. Completion often involves collaboration with tax advisors and legal counsel.

What is the purpose of Competent Authority Agreement?

The purpose of a Competent Authority Agreement is to prevent double taxation, resolve disputes regarding transfer pricing, align tax treatment across jurisdictions, and ensure compliance with international tax standards for multinational enterprises.

What information must be reported on Competent Authority Agreement?

The information that must be reported generally includes the identity of the entities involved, details of the intercompany transactions, the applicable transfer pricing methods, supporting financial data, and any previous correspondence with tax authorities regarding the agreement.

Fill out your competent authority agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Competent Authority Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.