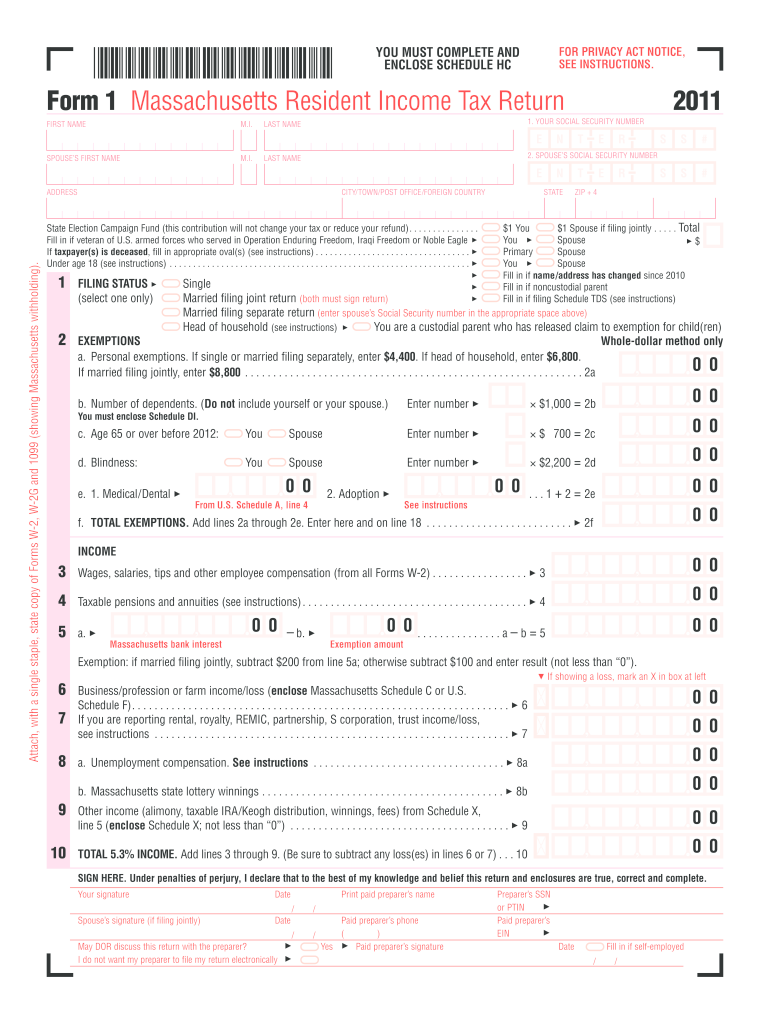

MA Form 1 2011 free printable template

Instructions and Help about MA Form 1

How to edit MA Form 1

How to fill out MA Form 1

About MA Form 1 2011 previous version

What is MA Form 1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about MA Form 1

What should I do if I discover an error on my submitted 2011mass schedule hc form?

If you find an error on your submitted 2011mass schedule hc form, you can submit an amended form to correct the mistake. It’s essential to indicate clearly that it is a correction and provide the correct information. Make sure to keep records of both the original submission and the amended version for your records.

How can I verify the status of my 2011mass schedule hc form after submission?

To verify the status of your submitted 2011mass schedule hc form, you can check the state’s filing portal or contact their support directly. Keep in mind that you may need to provide details such as your submission date and other identification information to get accurate updates.

Are e-signatures accepted for the 2011mass schedule hc form?

Yes, e-signatures are accepted for the 2011mass schedule hc form as long as the submission meets the technical requirements stipulated by the filing authority. Ensure that your e-signature complies with relevant regulations and maintains the integrity of the document.

What common errors should I avoid when submitting the 2011mass schedule hc form?

Common errors to avoid when submitting the 2011mass schedule hc form include incorrect payee information and data entry mistakes. Double-check all entries before submission, as these errors can lead to rejections or processing delays.

What should I do if my submission of the 2011mass schedule hc form is rejected?

If your submission of the 2011mass schedule hc form is rejected, you should carefully review the rejection notice for the reason and correct any issues. Once the errors are addressed, you can resubmit the form following the appropriate filing guidelines to avoid further complications.

See what our users say