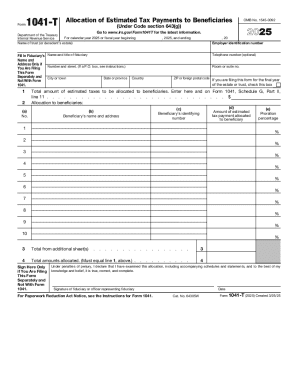

IRS 1041-T 2012 free printable template

Instructions and Help about IRS 1041-T

How to edit IRS 1041-T

How to fill out IRS 1041-T

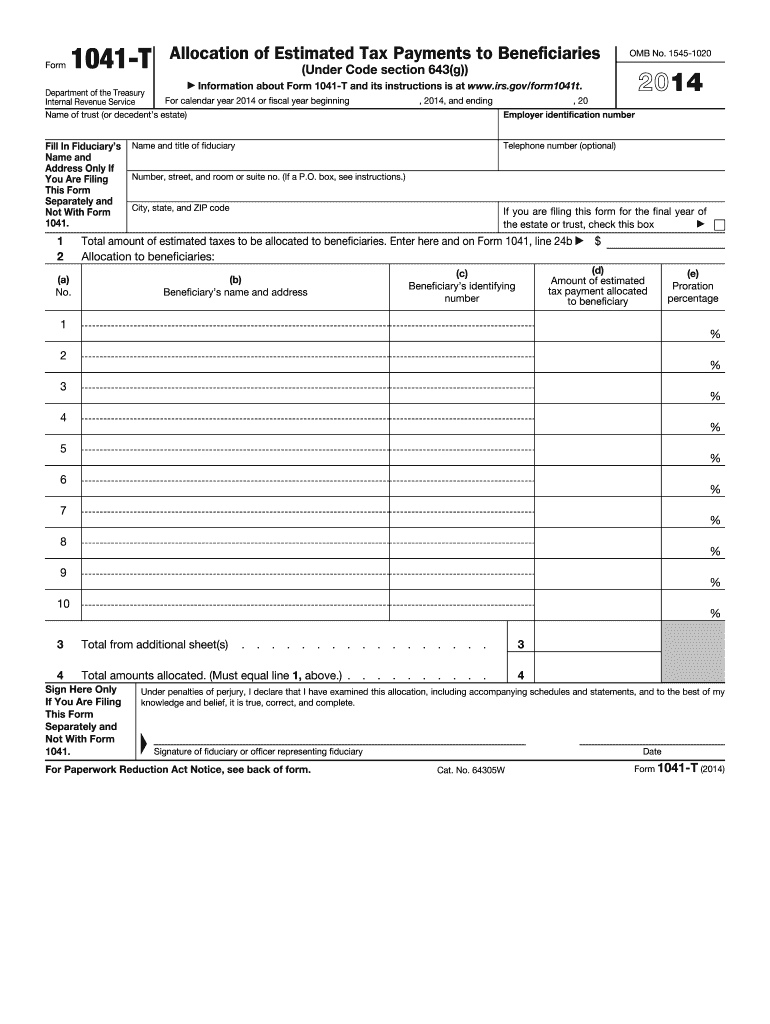

About IRS 1041-T 2012 previous version

What is IRS 1041-T?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

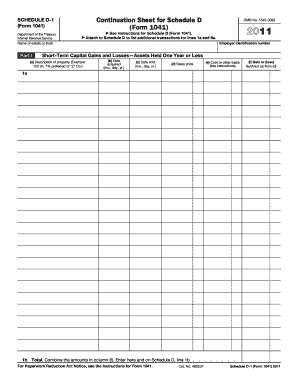

Is the form accompanied by other forms?

FAQ about IRS 1041-T

What should I do if I realize I made a mistake after filing my fill in fiduciarys?

If you discover an error after submitting your fill in fiduciarys, you can file an amended form to correct the mistake. It's important to do this as soon as possible to ensure accurate records and compliance with tax regulations. Be sure to follow the guidelines for submitting an amended return to avoid delays.

How can I verify if my fill in fiduciarys has been processed?

To verify the status of your fill in fiduciarys, you can check the official website of the tax authority where you submitted your form, as they often provide tracking tools. You may also contact their customer service for assistance if you encounter any issues while checking the status.

What should I consider regarding data security when submitting my fill in fiduciarys online?

When submitting your fill in fiduciarys online, ensure that the website utilizes encryption and secure protocols to protect your personal information. It's also advisable to use trusted software that complies with data security standards to safeguard your sensitive data during transmission.

Can I have someone else file my fill in fiduciarys on my behalf?

Yes, you can authorize a representative, such as a tax professional or power of attorney, to file your fill in fiduciarys on your behalf. Make sure to provide them with the necessary documents and information to ensure compliance, and clarify any permissions they might have.