Get the free pdffiller

Instructions and Help about form 104cr individual credit

How to edit form 104cr individual credit

How to fill out form 104cr individual credit

Latest updates to form 104cr individual credit

All You Need to Know About form 104cr individual credit

What is form 104cr individual credit?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about pdffiller form

What should I do if I notice an error after filing my form 104cr individual credit?

If you've identified an error on your submitted form 104cr individual credit, you can amend it using Form 1040-X. This allows you to correct any mistakes and ensures that your tax records reflect accurate information. Remember to include a clear explanation of the changes made when submitting the amendment.

How can I track the status of my form 104cr individual credit after submission?

To verify the receipt and processing of your form 104cr individual credit, you can utilize the IRS 'Where's My Refund?' tool if expecting a refund. Additionally, keep an eye out for any communication from the IRS regarding your submission status. If your form was e-filed and rejected, common error codes can help identify the issue.

What should I do if I receive an audit notice related to my form 104cr individual credit?

Receiving an audit notice concerning your form 104cr individual credit can be unsettling. It’s essential to carefully review the notice and gather all necessary documentation to support the entries on your form. Responding promptly and thoroughly will facilitate the process and help clarify any discrepancies.

Are e-signatures acceptable when filing the form 104cr individual credit?

E-signatures are generally acceptable for the form 104cr individual credit when filing electronically. However, ensure that the software you are using complies with IRS guidelines for electronic signatures to avoid complications. Confirming this can help streamline the filing process.

What common errors should I watch out for when filing my form 104cr individual credit?

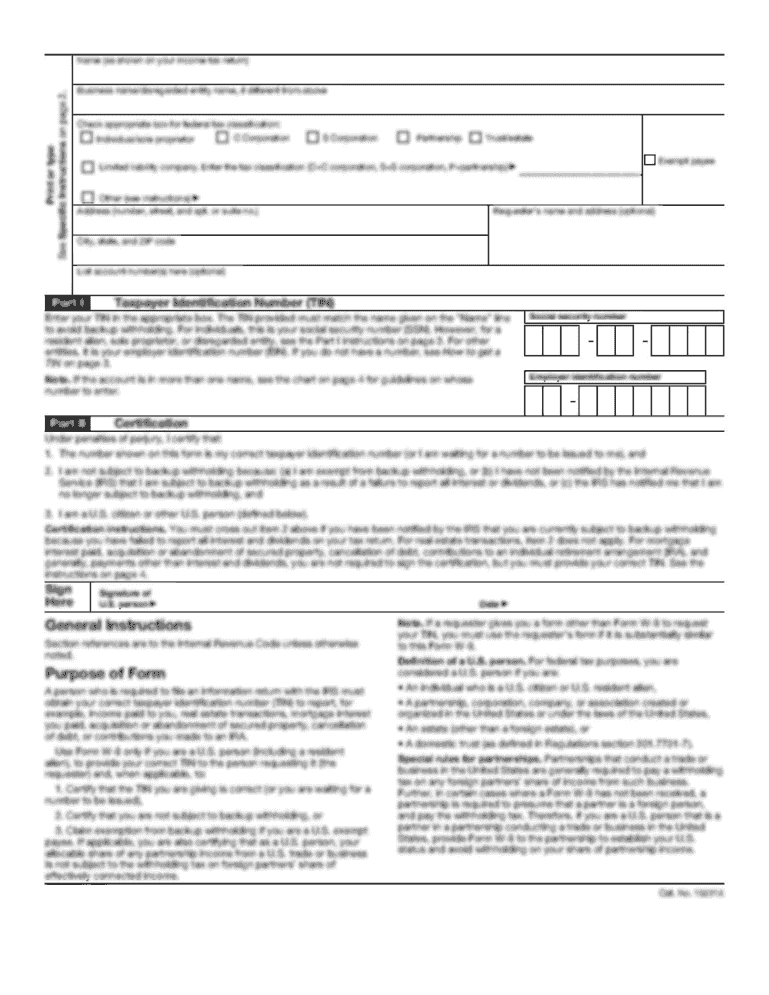

When filing the form 104cr individual credit, be vigilant for common errors such as incorrect Social Security numbers or tax identification numbers, mismatches with reported income, and missing signatures. Ensuring accuracy in these areas can help prevent delays or rejections during the processing of your form.