Get the free Net Pay Calculation - Oregon.gov - oregon

Show details

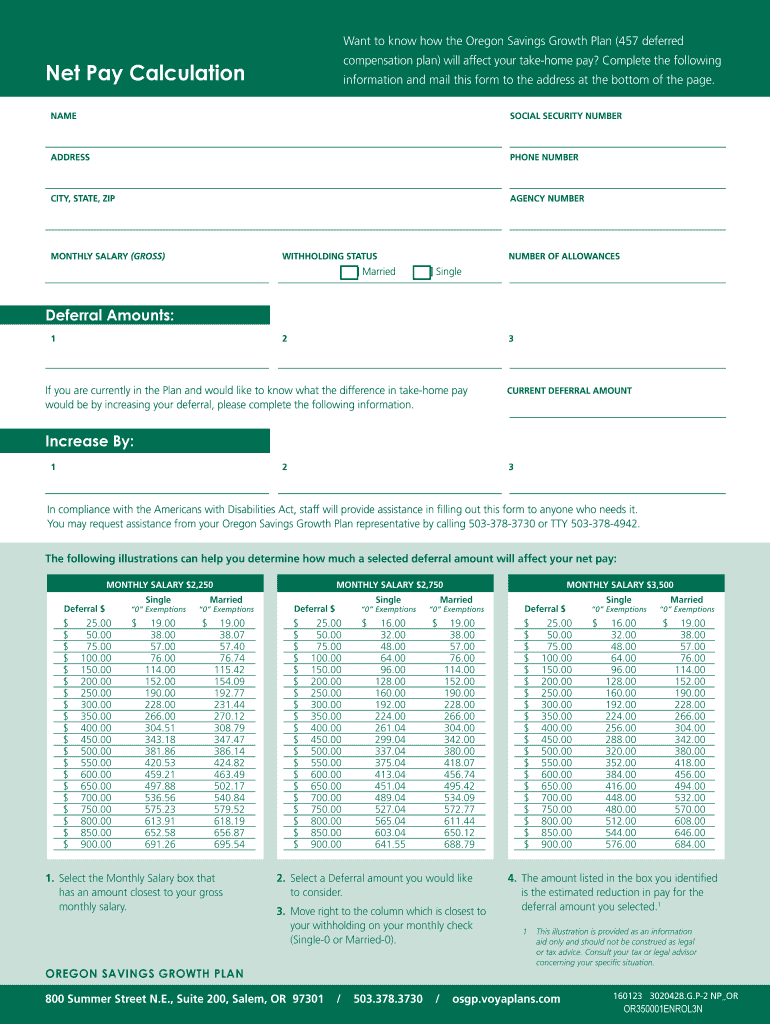

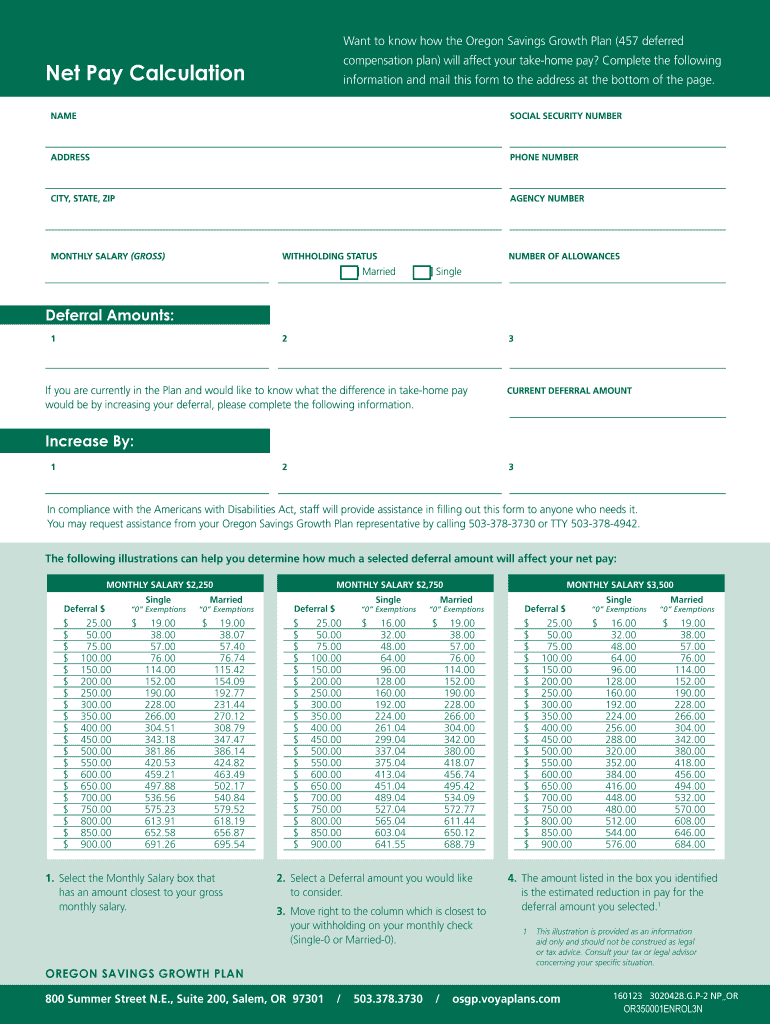

Want to know how the Oregon Savings Growth Plan (457 deferred compensation plan) will affect your take-home pay? Complete the following Net Pay Calculation information and mail this form to the address

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign net pay calculation

Edit your net pay calculation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your net pay calculation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing net pay calculation online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit net pay calculation. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out net pay calculation

How to Fill Out Net Pay Calculation:

01

Determine gross income: Start by calculating the total amount earned before any deductions or taxes are taken out. This includes regular wages, overtime pay, bonuses, and commissions.

02

Subtract pre-tax deductions: Next, subtract any pre-tax deductions from the gross income. This may include contributions to retirement plans, health insurance premiums, and flexible spending accounts.

03

Calculate taxable income: Once the pre-tax deductions have been subtracted, you will arrive at the taxable income. This is the amount of income that is subject to federal, state, and local taxes.

04

Determine and deduct federal taxes: Use the appropriate tax tables or tax brackets to calculate the federal income tax withholding. This amount will vary depending on the employee's filing status, number of allowances claimed, and the current tax rates.

05

Subtract state and local taxes: If applicable, calculate and deduct state and local income taxes from the taxable income. These rates and deductions may vary depending on the employee's location.

06

Subtract FICA taxes: FICA taxes, also known as Social Security and Medicare taxes, must be deducted from the net pay calculation. The current rates for Social Security and Medicare are a fixed percentage of the taxable income.

07

Subtract post-tax deductions: After deducting all required taxes, subtract any post-tax deductions, such as contributions to health savings accounts, union dues, or wage garnishments.

08

Calculate net pay: Finally, subtract all the deductions from the taxable income to determine the net pay. This is the amount that the employee will receive on their paycheck.

Who Needs Net Pay Calculation?

01

Employers: Employers need net pay calculations to accurately determine how much money to withhold from employee wages for taxes and other deductions. This ensures compliance with tax laws and proper payroll management.

02

Employees: Employees benefit from net pay calculations as it provides them with a clear understanding of how much money they will actually take home. It helps them budget their expenses and plan accordingly.

03

Financial Institutions: Financial institutions may require net pay calculations when individuals apply for loans or mortgages. This information helps determine the borrower's ability to repay the loan and manage their finances responsibly.

04

Tax Authorities: Tax authorities rely on net pay calculations to ensure accurate reporting and collection of taxes. It helps them verify that employers are withholding and remitting the correct amount of income taxes on behalf of their employees.

05

Accountants and HR Professionals: Accountants and HR professionals use net pay calculations to accurately record and report payroll expenses. This information guides financial planning, tax reporting, and compliance with labor laws.

Overall, net pay calculation is essential for both employers and employees to determine the accurate amount of wages after all deductions and taxes. It plays a crucial role in financial management, budgeting, tax compliance, and payroll administration.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute net pay calculation online?

pdfFiller has made it simple to fill out and eSign net pay calculation. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit net pay calculation online?

The editing procedure is simple with pdfFiller. Open your net pay calculation in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an eSignature for the net pay calculation in Gmail?

Create your eSignature using pdfFiller and then eSign your net pay calculation immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is net pay calculation?

Net pay calculation is the process of determining an employee's take-home pay after deductions for taxes, benefits, and other withholdings.

Who is required to file net pay calculation?

Employers are required to file net pay calculations for each of their employees.

How to fill out net pay calculation?

Net pay calculations are filled out by inputting an employee's gross pay and subtracting taxes, benefits, and other deductions to arrive at the net pay.

What is the purpose of net pay calculation?

The purpose of net pay calculation is to accurately determine how much an employee will receive in their paycheck after all deductions.

What information must be reported on net pay calculation?

Net pay calculations typically include information on gross pay, taxes withheld, benefits deducted, and net pay received.

Fill out your net pay calculation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Net Pay Calculation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.