Get the free illinois ui ha 2020 - ides illinois

Show details

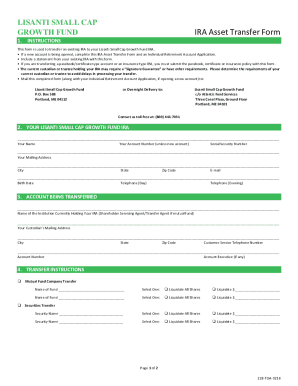

UI-HA Report for Household Employers Instructions You may file on-line at https://taxnet.ides.state.il.us Line 15 Step 1 Line 1a Enter your 7-digit Illinois Unemployment Insurance Account Number.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign illinois ui ha 2020

Edit your illinois ui ha 2020 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your illinois ui ha 2020 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing illinois ui ha 2020 online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit illinois ui ha 2020. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out illinois ui ha 2020

How to fill out illinois ui ha 2020:

01

Gather all necessary information: Before starting the Illinois UI HA 2020 application, make sure to collect important personal details, such as your social security number, contact information, employment history, and any relevant documentation regarding your previous job termination.

02

Visit the Illinois Department of Employment Security (IDES) website: Access the official IDES website through a reliable internet connection and locate the section dedicated to filing for unemployment insurance benefits.

03

Create an account: Follow the instructions provided on the IDES website to create an account if you are a new user. Provide accurate and up-to-date information during the registration process.

04

Complete the application form: Once logged in, access the UI HA 2020 application form. Carefully fill out each section, ensuring that all information is accurate and truthful. Be prepared to answer questions regarding your employment status, reason for seeking unemployment benefits, and any additional circumstances that may impact your eligibility.

05

Review and submit the application: After completing each section of the application, carefully review all entered information for accuracy. Double-check that all required fields have been filled out. Once satisfied, submit your application electronically through the IDES website.

06

Keep track of your application: After submitting your application, you should receive a confirmation message or email from IDES. Make a note of any reference numbers or confirmation details provided. Be sure to keep a thorough record of your application and any communications with IDES for future reference.

Who needs Illinois UI HA 2020?

01

Individuals who have lost their job: Illinois UI HA 2020 is designed to assist individuals who have become unemployed due to circumstances beyond their control, such as layoffs or company closures. If you have recently lost your job, you may be eligible for unemployment insurance benefits provided by the Illinois government.

02

Individuals whose employment has been significantly reduced: If your work hours or wages have been significantly reduced, you may be eligible to receive partial unemployment benefits through Illinois UI HA 2020. This program aims to support individuals who are experiencing financial hardship due to reduced work opportunities.

03

Individuals who meet the eligibility criteria: To determine who is eligible for Illinois UI HA 2020, various factors are considered, including your past employment history, earnings, and the reason for your job separation. It is crucial to review the specific eligibility requirements outlined by IDES to determine if you qualify for unemployment insurance benefits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send illinois ui ha 2020 to be eSigned by others?

To distribute your illinois ui ha 2020, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I execute illinois ui ha 2020 online?

pdfFiller has made filling out and eSigning illinois ui ha 2020 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit illinois ui ha 2020 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share illinois ui ha 2020 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is illinois ui ha?

Illinois UI HA stands for Illinois Unemployment Insurance - Health and Annual. It is a report filed by Illinois employers to report their annual wages and contributions for the purpose of calculating unemployment insurance taxes.

Who is required to file illinois ui ha?

All Illinois employers who are subject to the state's unemployment insurance laws are required to file Illinois UI HA.

How to fill out illinois ui ha?

Illinois UI HA can be filled out online through the Illinois Department of Employment Security (IDES) website. Employers need to report their employees' wages, contributions, and other relevant information for the calendar year.

What is the purpose of illinois ui ha?

The purpose of Illinois UI HA is to determine the amount of unemployment insurance taxes that an employer owes to the state.

What information must be reported on illinois ui ha?

Employers must report their employees' wages, contributions, the total amount of taxable wages, and any other relevant information requested on the Illinois UI HA form.

Fill out your illinois ui ha 2020 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Illinois Ui Ha 2020 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.