IRS 8891 2012 free printable template

Show details

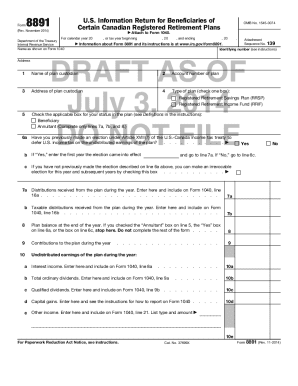

Form 8891 U.S. Information Return for Beneficiaries of Certain Canadian Registered Retirement Plans (Rev. December 2012) ? For calendar year 20 Department of the Treasury Internal Revenue Service

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8891

Edit your IRS 8891 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8891 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8891 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8891

How to fill out IRS 8891

01

Obtain IRS Form 8891 from the IRS website or your tax preparation software.

02

Fill in your name, address, and taxpayer identification number at the top of the form.

03

Indicate the tax year for which you are filing the form.

04

Declare the type of foreign trust or bank accounts involved.

05

Report the income earned from the foreign entities, including interests, dividends, and capital gains.

06

Complete any additional sections that pertain to distributions from the foreign account or changes in the trust status.

07

Sign and date the form to certify that the information is accurate and complete.

08

Attach the form to your annual tax return if required.

Who needs IRS 8891?

01

U.S. citizens or residents who have an interest in a foreign trust or receive distributions from a foreign trust.

02

Individuals who hold specified foreign financial assets over the reporting threshold.

03

Taxpayers who file with respect to foreign trust rules and need to disclose these interests to the IRS.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IRS 8891?

IRS Form 8891 is a tax form used by certain U.S. citizens and residents to report their interest in Canadian registered retirement savings plans (RRSPs) or registered retirement income funds (RRIFs).

Who is required to file IRS 8891?

U.S. citizens or residents who have a financial interest in a Canadian RRSP or RRIF and who wish to defer income tax on that income must file Form 8891.

How to fill out IRS 8891?

To fill out IRS Form 8891, taxpayers must provide information about their RRSPs and RRIFs, including account numbers, contributions, and details about distributions. Instructions provided with the form should be followed carefully.

What is the purpose of IRS 8891?

The purpose of IRS Form 8891 is to allow U.S. citizens and residents to report their interest in Canadian retirement accounts and to elect to defer U.S. income tax on income earned within those accounts.

What information must be reported on IRS 8891?

Information required on IRS Form 8891 includes the taxpayer's identifying information, details of the Canadian retirement accounts, such as account numbers, contributions, distributions, and any elections made regarding tax treatment.

Fill out your IRS 8891 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8891 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.