Get the free Request to Rescind Homeowner’s Principal Residence Exemption

Show details

This form allows property owners to rescind their principal residence exemption when they no longer occupy the property as their main residence or if the property has been converted to a rental or

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request to rescind homeowners

Edit your request to rescind homeowners form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request to rescind homeowners form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing request to rescind homeowners online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit request to rescind homeowners. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request to rescind homeowners

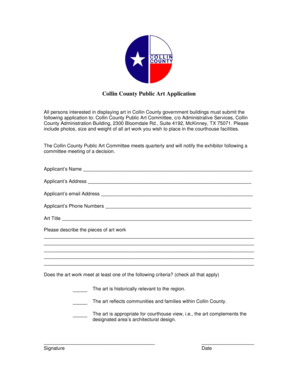

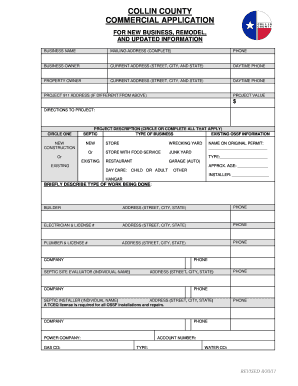

How to fill out Request to Rescind Homeowner’s Principal Residence Exemption

01

Obtain the form: Download or request the Request to Rescind Homeowner’s Principal Residence Exemption form from your local assessor's office or the official state website.

02

Provide property information: Fill out the property details including the address, parcel number, and owner's name.

03

Indicate exemption details: Clearly specify the reasons for rescinding the exemption, such as changes in occupancy or ownership.

04

Sign and date the form: Ensure the form is signed and dated by the homeowner or authorized representative.

05

Submit the form: Return the completed form to your local assessor's office by mail or in person within the specified timeframe.

Who needs Request to Rescind Homeowner’s Principal Residence Exemption?

01

Homeowners whose principal residence exemption is no longer valid due to changes in occupancy, property ownership, or other qualifying reasons.

Fill

form

: Try Risk Free

People Also Ask about

Is Michigan Homestead credit refundable?

The Homestead Property Tax Credit is a refundable credit avail- able to eligible Michigan residents who pay high property taxes or rent in relation to their income.

How to remove homestead exemption in Michigan?

Complete the Michigan Form 2602 The form you use to remove this exemption is a State of Michigan form called the Request to Rescind Principal Residence Exemption (PRE). Make sure to file this form shortly after you sell your home.

How much does homestead exemption save you in Michigan?

Principal Residence Exemption (Homestead Exemption) This is usually an 18-mill reduction in calculated taxes. This means that a homeowner is usually going to pay $18 less per $1,000 of taxable value on a principal residence than if it was a cottage or second home.

What is principal residence exemption mean?

What Is the Tax Exemption for a Principal Residence? Individual owners of a home do not have to pay capital gains on the first $250,000 of value sold on a property. Married couples are exempt from capital gains tax on the first $500,000 in gains. Capital gains tax is owed for gains that exceed these numbers.

What is the homestead exemption law in Michigan?

Michigan's Homestead Exemption is a legal provision that allows homeowners in the state to protect the equity in their primary residence from being seized by creditors or used to pay off certain debts.

Where does a taxpayer appeal a denial of a principal residence exemption issued by the Michigan Department of Treasury?

For denials by the State, contact the State Treasury's PRE Unit. Denials by the local city/township assessor must be appealed to the Michigan Tax Tribunal within 35 days.

How to get out of paying property taxes in Michigan?

Property Tax Exemption An eligible person must own and occupy his/her home as a principal residence (homestead) and meet poverty income standards. The local Board of Review may interview the applicant in order to determine eligibility, ing to the local guidelines, and will review all applications.

What is the difference between homestead and non-homestead taxes in Michigan?

The difference between and homestead taxes and non homestead taxes is about 30%. So if you buy a investment property or second home you are going to be paying about 30% more than somebody that would be living in the property.

Can you use principal residence exemption on US property?

Most properties (home or cottage, for example) can be designated a principal residence—even those seasonal residences located outside of Canada, such as in the U.S. or Caribbean— as long as the owner or their family ordinarily inhabit it during each calendar year being claimed.

At what age do seniors stop paying property taxes in Michigan?

Long-term Resident Senior Exemption The property must qualify for a homestead exemption. At least one homeowner must be 65 years old as of January 1. Total 'Household Adjusted Gross Income' for everyone who lives on the property cannot exceed statutory limits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Request to Rescind Homeowner’s Principal Residence Exemption?

The Request to Rescind Homeowner’s Principal Residence Exemption is a formal application submitted to rescind or revoke the property tax exemption that is granted to homeowners for their primary residence.

Who is required to file Request to Rescind Homeowner’s Principal Residence Exemption?

Any homeowner who no longer qualifies for the Principal Residence Exemption or has sold their property must file the Request to Rescind.

How to fill out Request to Rescind Homeowner’s Principal Residence Exemption?

To fill out the Request to Rescind form, homeowners should provide property details such as address, parcel number, and their information, along with the date the exemption should be rescinded.

What is the purpose of Request to Rescind Homeowner’s Principal Residence Exemption?

The purpose is to notify the tax authority that the homeowner no longer qualifies for the tax exemption, ensuring accurate property tax assessments.

What information must be reported on Request to Rescind Homeowner’s Principal Residence Exemption?

The form must include the homeowner's name, address, parcel number, the reason for rescinding the exemption, and the effective date of the change.

Fill out your request to rescind homeowners online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request To Rescind Homeowners is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.