Get the free 500 UET Exception

Show details

Print Georgia Form 500(Rev. 9 /14) Fiscal Year Beginning Individual Income Tax Return Georgia Department of Revenue 2014 (Approved web version) AFFIX LABEL HERE DEL 1. Clear Please print your numbers

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 500 uet exception

Edit your 500 uet exception form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 500 uet exception form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 500 uet exception online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 500 uet exception. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 500 uet exception

How to fill out 500 uet exception:

01

Gather all necessary information: Before filling out the 500 uet exception, make sure you have all the required details. This may include your personal information, the reason for requesting the exception, and any supporting documents or evidence.

02

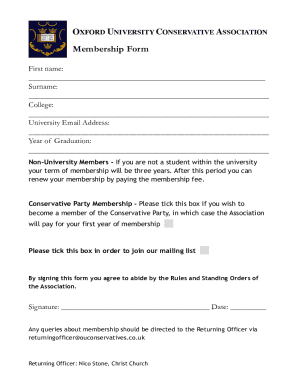

Access the appropriate form: Visit the official website or platform where the 500 uet exception form is available. It may be in an online format or a printable document. Download or access the form accordingly.

03

Fill in your personal information: Start by providing your complete name, address, contact details, and any other required personal information as specified on the form. Double-check for accuracy to avoid any mistakes or delays in processing.

04

Explain the reason for the exception: Clearly state the reason why you need a 500 uet exception. It could be due to certain circumstances or events that have made it necessary for you to request this exception. Be honest and provide all relevant details to support your request.

05

Attach supporting documents: If there are any documents, certificates, or evidence that support your need for a 500 uet exception, make sure to attach them to your application. This could include medical reports, legal documents, or any other relevant paperwork that strengthens your case.

06

Review and submit: Before submitting your application, carefully review all the information you have provided. Check for any errors or missing details that may impact the processing of your request. Once you are satisfied, submit your application through the designated channel or method specified.

Who needs 500 uet exception?

01

Individuals facing extreme financial difficulties: People who are struggling with severe financial challenges, such as large debts or sudden income loss, may need to request a 500 uet exception. It can provide temporary relief or assistance during difficult times.

02

Students with exceptional circumstances: Students who experience unforeseen circumstances that affect their ability to pay tuition fees or associated costs may require a 500 uet exception. This could include medical emergencies, family crises, or unexpected financial burdens.

03

Individuals under unique legal circumstances: Those who find themselves in special legal situations, such as pending lawsuits or court orders, may need a 500 uet exception. It can help alleviate some financial strain and prevent further complications during challenging periods.

04

People affected by natural disasters or emergencies: In the aftermath of a natural disaster or emergency, individuals who face significant financial hardships may be eligible for a 500 uet exception. It can provide temporary relief and support in rebuilding their lives.

05

Any individual meeting the criteria: Depending on the specific guidelines and regulations, the 500 uet exception may be available to anyone who meets the eligibility criteria. It is important to thoroughly review the requirements and ensure that you qualify before applying.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 500 uet exception?

500 UET exception is a specific provision in the tax code that allows certain taxpayers to claim an exception from the requirement to pay the Unincorporated Business Tax (UET) on their income.

Who is required to file 500 uet exception?

Taxpayers who meet the criteria set forth in the tax code and qualify for the exception are required to file the 500 UET exception.

How to fill out 500 uet exception?

To fill out the 500 UET exception, taxpayers must accurately report their income and follow the instructions provided by the tax authority.

What is the purpose of 500 uet exception?

The purpose of the 500 UET exception is to provide relief to certain taxpayers who qualify for the exception and may be burdened by the UET requirement.

What information must be reported on 500 uet exception?

Taxpayers must report their income, expenses, and any other relevant financial information required by the tax authority on the 500 UET exception form.

How can I manage my 500 uet exception directly from Gmail?

500 uet exception and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I fill out the 500 uet exception form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign 500 uet exception and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I complete 500 uet exception on an Android device?

Use the pdfFiller mobile app to complete your 500 uet exception on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your 500 uet exception online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

500 Uet Exception is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.