Get the free (Also, involuntary conversions and - ftb ca

Show details

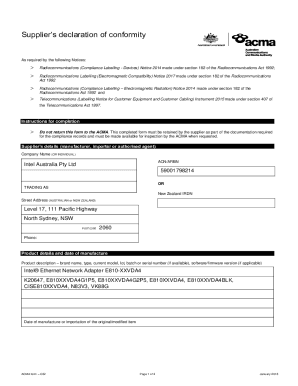

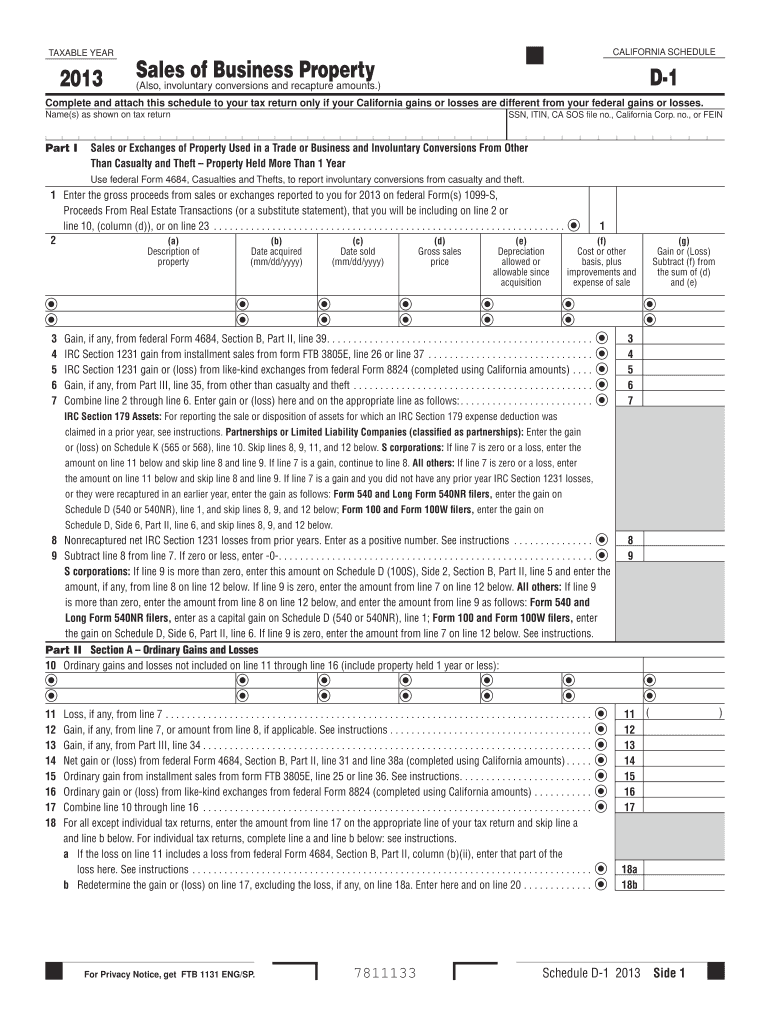

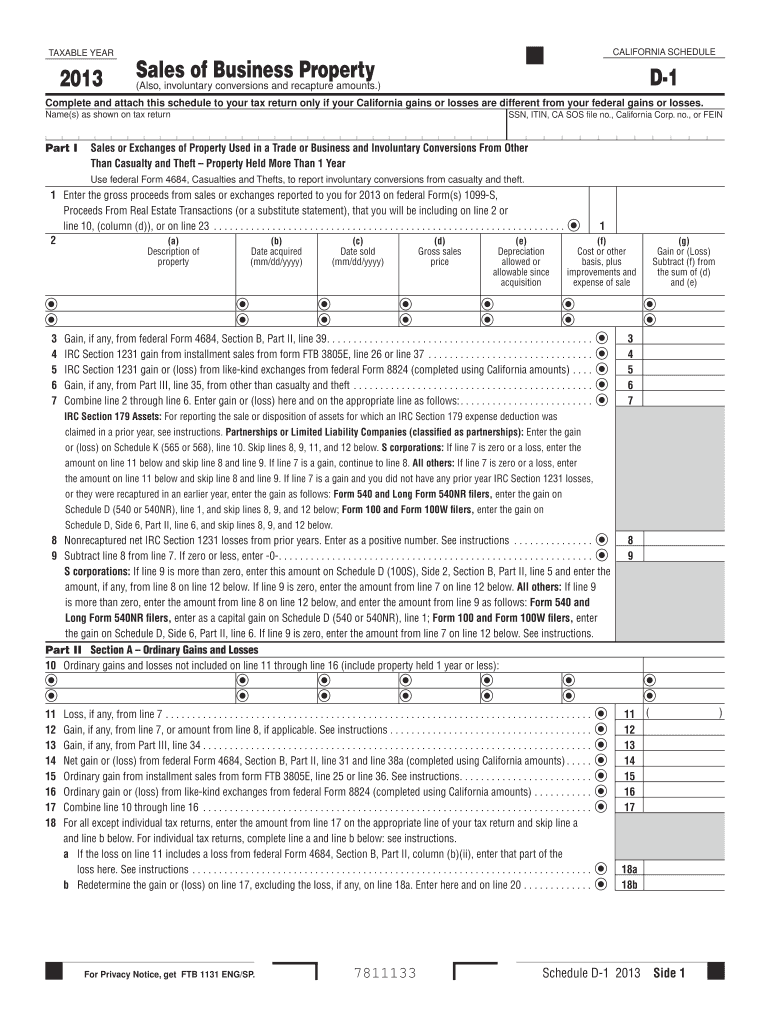

18 Dec 2013 ... 2013. SSN, ITIN, CA SOS file no., California Corp. no., or VEIN ... 4 IRC Section 1231 gain from installment sales from form FT 3805E, line 26 ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign also involuntary conversions and

Edit your also involuntary conversions and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your also involuntary conversions and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit also involuntary conversions and online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit also involuntary conversions and. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out also involuntary conversions and

How to fill out also involuntary conversions and:

01

Begin by gathering all the necessary documentation related to the involuntary conversion. This may include any relevant forms, invoices, receipts, and other supporting documents.

02

Fill out the basic information section of the form, ensuring that all required fields are completed accurately. This may include details such as your name, address, taxpayer identification number, and the tax year pertaining to the conversion.

03

Provide a detailed description of the property that was involuntarily converted. Include information about the type of property, its original cost, and any depreciation claimed in previous years.

04

Indicate the date and circumstances surrounding the involuntary conversion. This could involve a natural disaster, theft, or condemnation of the property. Include any pertinent details relating to insurance claims or reimbursements received.

05

Calculate the gain or loss from the conversion by subtracting the property's adjusted basis from the amount realized. Ensure that all relevant adjustments and deductions are accounted for correctly.

06

Report any gain on a separate part of the form, and follow the instructions provided to determine how to report the gain. Consult with a tax professional if you are unsure about the specific reporting requirements for your situation.

Who needs also involuntary conversions and:

01

Taxpayers who have experienced an involuntary conversion of property, such as through a natural disaster, theft, or condemnation, may need to fill out the relevant forms to report the conversion and any resulting gain or loss.

02

Individuals or businesses who have received insurance reimbursements or other compensation related to the involuntary conversion may need to report this information on their tax returns.

03

Taxpayers who have deducted depreciation expenses relating to the property prior to the conversion will need to account for this when filling out the forms.

It is important to note that the specific requirements for reporting involuntary conversions may vary depending on the jurisdiction and individual circumstances. It is advisable to consult with a tax professional or refer to the applicable tax guidelines for accurate and up-to-date information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send also involuntary conversions and for eSignature?

When you're ready to share your also involuntary conversions and, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make changes in also involuntary conversions and?

The editing procedure is simple with pdfFiller. Open your also involuntary conversions and in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I fill out also involuntary conversions and on an Android device?

On Android, use the pdfFiller mobile app to finish your also involuntary conversions and. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is also involuntary conversions and?

Involuntary conversions refer to the exchange or sale of property that occurs due to circumstances beyond the owner's control, such as theft, destruction, or condemnation.

Who is required to file also involuntary conversions and?

Taxpayers who experience an involuntary conversion and realize a gain from the transaction are required to report it on their tax return.

How to fill out also involuntary conversions and?

The involuntary conversion should be reported on IRS Form 4684, Casualties and Thefts, and included as part of the taxpayer's overall income tax return.

What is the purpose of also involuntary conversions and?

The purpose of reporting involuntary conversions is to accurately reflect any gains or losses resulting from the transaction and ensure compliance with tax laws.

What information must be reported on also involuntary conversions and?

Taxpayers must report details of the involuntary conversion, including the date of the event, the nature of the property, the amount received, and any resulting gain or loss.

Fill out your also involuntary conversions and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Also Involuntary Conversions And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.